Wealthtech platforms leverage advanced algorithms and data analytics to offer personalized investment management and automated wealth advisory services, targeting high-net-worth individuals and sophisticated investors. Crowdfunding platforms enable startups and small businesses to raise capital directly from a broad base of individual investors, often through equity, rewards, or donation-based models, democratizing access to funding. Explore the key differences and advantages of wealthtech and crowdfunding platforms to understand which suits your financial goals best.

Why it is important

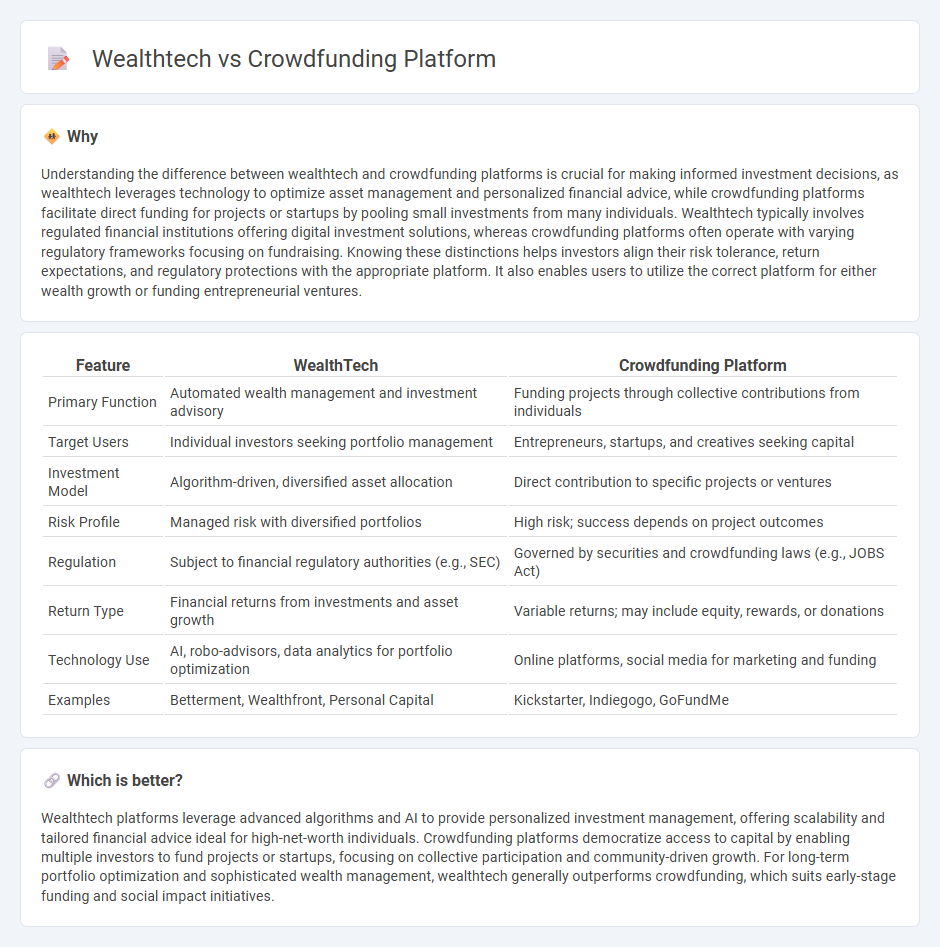

Understanding the difference between wealthtech and crowdfunding platforms is crucial for making informed investment decisions, as wealthtech leverages technology to optimize asset management and personalized financial advice, while crowdfunding platforms facilitate direct funding for projects or startups by pooling small investments from many individuals. Wealthtech typically involves regulated financial institutions offering digital investment solutions, whereas crowdfunding platforms often operate with varying regulatory frameworks focusing on fundraising. Knowing these distinctions helps investors align their risk tolerance, return expectations, and regulatory protections with the appropriate platform. It also enables users to utilize the correct platform for either wealth growth or funding entrepreneurial ventures.

Comparison Table

| Feature | WealthTech | Crowdfunding Platform |

|---|---|---|

| Primary Function | Automated wealth management and investment advisory | Funding projects through collective contributions from individuals |

| Target Users | Individual investors seeking portfolio management | Entrepreneurs, startups, and creatives seeking capital |

| Investment Model | Algorithm-driven, diversified asset allocation | Direct contribution to specific projects or ventures |

| Risk Profile | Managed risk with diversified portfolios | High risk; success depends on project outcomes |

| Regulation | Subject to financial regulatory authorities (e.g., SEC) | Governed by securities and crowdfunding laws (e.g., JOBS Act) |

| Return Type | Financial returns from investments and asset growth | Variable returns; may include equity, rewards, or donations |

| Technology Use | AI, robo-advisors, data analytics for portfolio optimization | Online platforms, social media for marketing and funding |

| Examples | Betterment, Wealthfront, Personal Capital | Kickstarter, Indiegogo, GoFundMe |

Which is better?

Wealthtech platforms leverage advanced algorithms and AI to provide personalized investment management, offering scalability and tailored financial advice ideal for high-net-worth individuals. Crowdfunding platforms democratize access to capital by enabling multiple investors to fund projects or startups, focusing on collective participation and community-driven growth. For long-term portfolio optimization and sophisticated wealth management, wealthtech generally outperforms crowdfunding, which suits early-stage funding and social impact initiatives.

Connection

Wealthtech platforms leverage advanced technology to provide automated investment solutions, which increasingly integrate crowdfunding platforms to democratize access to diverse investment opportunities. Crowdfunding enables individuals to pool resources and invest in startups or projects, while wealthtech tools optimize portfolio management and risk assessment for these collective investments. This synergy enhances financial inclusion by combining scalable technology with community-driven funding models in banking.

Key Terms

Crowdfunding Platform:

Crowdfunding platforms facilitate capital raising by connecting a broad base of individual investors with startups, nonprofits, or projects seeking funding through online portals. These platforms democratize investment opportunities, enabling users to contribute small amounts towards equity, debt, or reward-based campaigns, enhancing financial inclusion. Explore how crowdfunding platforms transform traditional fundraising and empower diverse projects by discovering key features and benefits.

Peer-to-peer (P2P) lending

Peer-to-peer (P2P) lending on crowdfunding platforms enables direct loan transactions between individual borrowers and investors, bypassing traditional banks and offering greater accessibility and competitive interest rates. Wealthtech integrates P2P lending within sophisticated financial technology ecosystems, utilizing AI-driven credit assessments and personalized investment strategies to enhance risk management and returns. Explore how these innovations reshape financing options and investment opportunities.

Equity crowdfunding

Equity crowdfunding platforms enable startups and growing companies to raise capital from a large pool of investors by offering ownership stakes, blending traditional fundraising with innovative digital access. Wealthtech, in contrast, incorporates technology-driven solutions for wealth management, focusing on personalized investment strategies, robo-advisory, and portfolio optimization rather than direct equity investments. Explore how equity crowdfunding revolutionizes capital access and investor engagement in the evolving wealthtech landscape.

Source and External Links

GoFundMe - A leading global crowdfunding platform for personal, medical, and charitable causes, with easy setup, no startup fees, and tools to help share your fundraiser widely.

Kickstarter - The world's largest reward-based crowdfunding platform for creative projects, using an all-or-nothing funding model and charging a 5% commission on successful campaigns.

Indiegogo - A flexible crowdfunding platform for businesses, artists, and nonprofits, offering both fixed and flexible funding options and charging a 5% fee plus transaction costs.

dowidth.com

dowidth.com