Alternative credit data includes non-traditional financial information such as utility payments, rental history, and social behavior metrics, offering a broader view of a borrower's creditworthiness beyond conventional credit scores. E-commerce transaction data captures online purchase patterns, payment frequency, and digital spending habits, providing real-time insights into consumer financial behavior. Explore how integrating these data sources can revolutionize credit risk assessment and lending decisions.

Why it is important

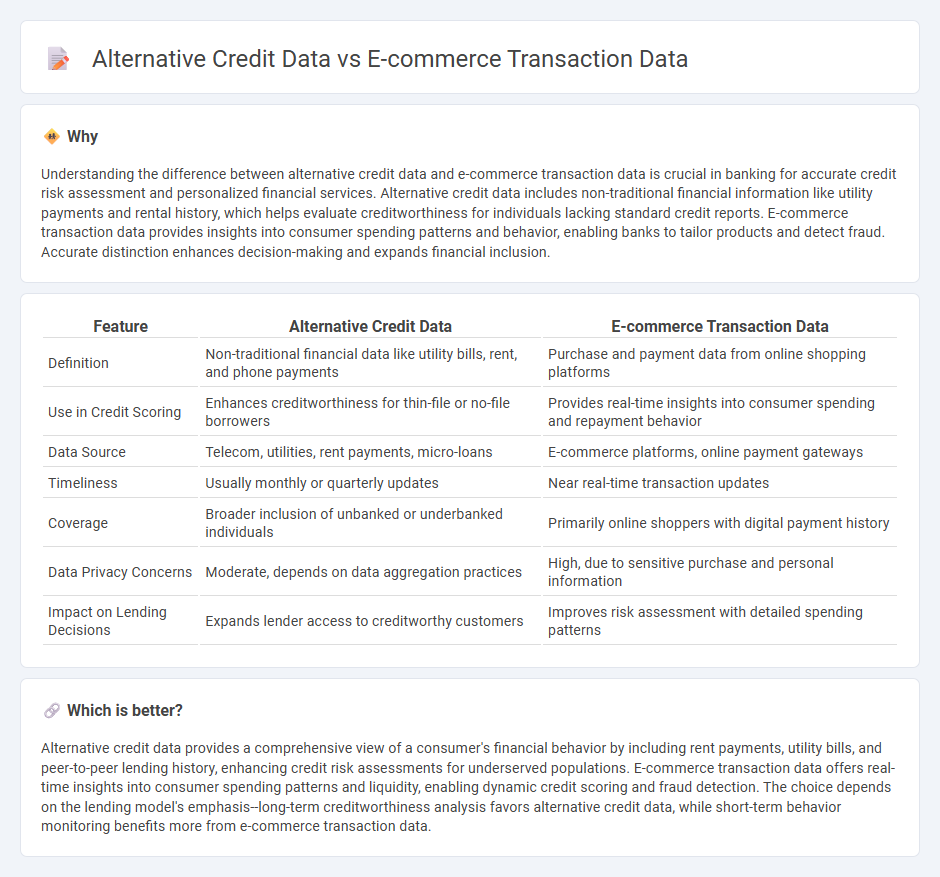

Understanding the difference between alternative credit data and e-commerce transaction data is crucial in banking for accurate credit risk assessment and personalized financial services. Alternative credit data includes non-traditional financial information like utility payments and rental history, which helps evaluate creditworthiness for individuals lacking standard credit reports. E-commerce transaction data provides insights into consumer spending patterns and behavior, enabling banks to tailor products and detect fraud. Accurate distinction enhances decision-making and expands financial inclusion.

Comparison Table

| Feature | Alternative Credit Data | E-commerce Transaction Data |

|---|---|---|

| Definition | Non-traditional financial data like utility bills, rent, and phone payments | Purchase and payment data from online shopping platforms |

| Use in Credit Scoring | Enhances creditworthiness for thin-file or no-file borrowers | Provides real-time insights into consumer spending and repayment behavior |

| Data Source | Telecom, utilities, rent payments, micro-loans | E-commerce platforms, online payment gateways |

| Timeliness | Usually monthly or quarterly updates | Near real-time transaction updates |

| Coverage | Broader inclusion of unbanked or underbanked individuals | Primarily online shoppers with digital payment history |

| Data Privacy Concerns | Moderate, depends on data aggregation practices | High, due to sensitive purchase and personal information |

| Impact on Lending Decisions | Expands lender access to creditworthy customers | Improves risk assessment with detailed spending patterns |

Which is better?

Alternative credit data provides a comprehensive view of a consumer's financial behavior by including rent payments, utility bills, and peer-to-peer lending history, enhancing credit risk assessments for underserved populations. E-commerce transaction data offers real-time insights into consumer spending patterns and liquidity, enabling dynamic credit scoring and fraud detection. The choice depends on the lending model's emphasis--long-term creditworthiness analysis favors alternative credit data, while short-term behavior monitoring benefits more from e-commerce transaction data.

Connection

Alternative credit data and e-commerce transaction data are interconnected through their ability to provide detailed insights into consumer financial behavior beyond traditional credit scores. E-commerce transaction data captures purchase patterns, payment timeliness, and spending habits, which serve as valuable indicators in alternative credit assessments to evaluate creditworthiness. Leveraging these diverse data sources enhances risk modeling accuracy and expands credit access for underserved populations.

Key Terms

Payment Gateway Data

Payment gateway data captures real-time e-commerce transaction details, including purchase amounts, frequency, and merchant categories, offering granular insights into consumer spending behavior not typically found in alternative credit data. Unlike traditional alternative credit data, which aggregates information from utilities, rent, and telecom payments, payment gateway data provides a direct link to transactional cash flow, enhancing credit risk models and underwriting accuracy. Explore how integrating payment gateway data can transform credit assessment frameworks and unlock new opportunities for financial inclusion.

Social Media Activity

E-commerce transaction data provides detailed insights into purchasing behavior, while social media activity offers unique indicators of creditworthiness through user engagement patterns and lifestyle signals. Analyzing social media activity as alternative credit data can uncover hidden financial behaviors not captured by traditional transaction records. Explore how leveraging social media metrics enhances credit scoring models for a more comprehensive risk assessment.

Utility Bill Records

Utility bill records provide crucial alternative credit data by capturing consistent payment behaviors often missing from traditional e-commerce transaction data, offering lenders a broader view of an individual's creditworthiness. Unlike e-commerce purchases that primarily reflect consumer spending patterns, utility bills demonstrate essential financial commitments, significantly enhancing credit risk assessments. Discover how integrating utility bill records with transaction data can revolutionize credit evaluation models.

Source and External Links

Ecommerce transactions: Definition, Formula & Examples - Ecommerce transaction data records each customer's purchase in an online store, providing insights on product variants, sales performance, and guiding inventory, marketing, and profitability decisions.

What is Ecommerce Data? Examples, Datasets and Providers in 2025 - Ecommerce transaction data includes sales data that tracks product sales performance over time, enabling pricing strategy optimization and stock management for online retailers.

E-Commerce Data - Kaggle - A commonly used e-commerce transaction dataset contains all the transactions of a UK-based online retail company from 2010 to 2011, useful for analysis such as time series and classification tasks.

dowidth.com

dowidth.com