Hyperpersonalization in banking leverages advanced data analytics and AI to tailor financial products and services to individual customer preferences, increasing engagement and satisfaction. Cross-selling focuses on promoting complementary products based on existing customer portfolios to enhance revenue streams and deepen customer relationships. Discover how these strategies can transform banking experiences and drive growth.

Why it is important

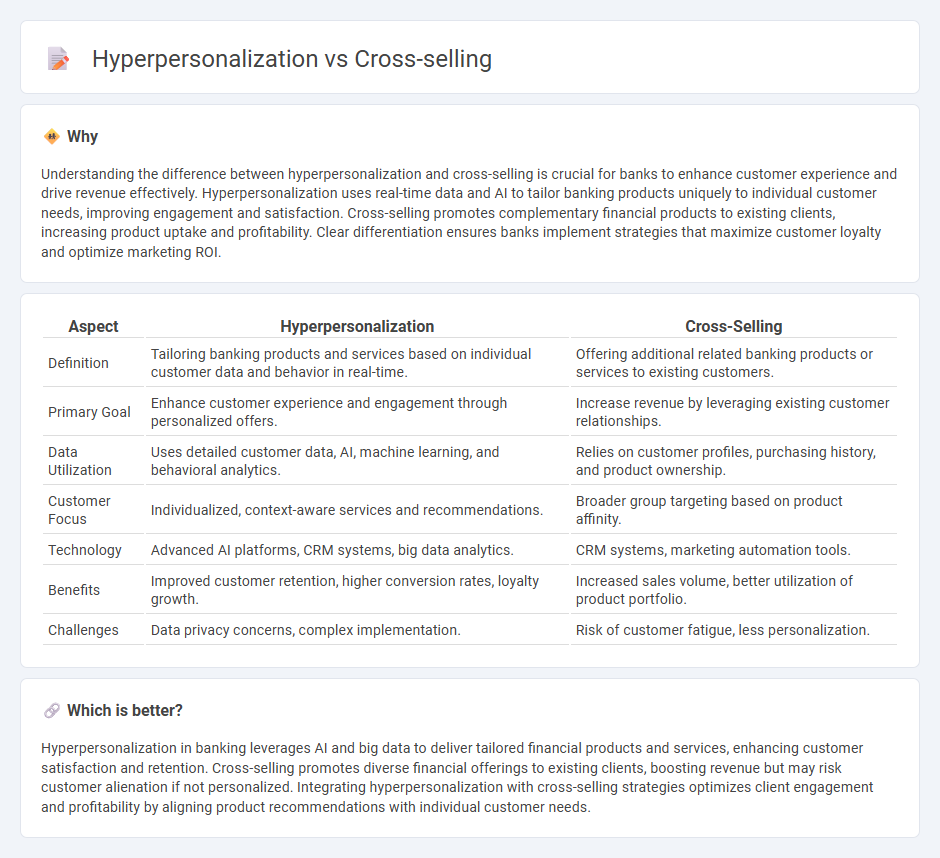

Understanding the difference between hyperpersonalization and cross-selling is crucial for banks to enhance customer experience and drive revenue effectively. Hyperpersonalization uses real-time data and AI to tailor banking products uniquely to individual customer needs, improving engagement and satisfaction. Cross-selling promotes complementary financial products to existing clients, increasing product uptake and profitability. Clear differentiation ensures banks implement strategies that maximize customer loyalty and optimize marketing ROI.

Comparison Table

| Aspect | Hyperpersonalization | Cross-Selling |

|---|---|---|

| Definition | Tailoring banking products and services based on individual customer data and behavior in real-time. | Offering additional related banking products or services to existing customers. |

| Primary Goal | Enhance customer experience and engagement through personalized offers. | Increase revenue by leveraging existing customer relationships. |

| Data Utilization | Uses detailed customer data, AI, machine learning, and behavioral analytics. | Relies on customer profiles, purchasing history, and product ownership. |

| Customer Focus | Individualized, context-aware services and recommendations. | Broader group targeting based on product affinity. |

| Technology | Advanced AI platforms, CRM systems, big data analytics. | CRM systems, marketing automation tools. |

| Benefits | Improved customer retention, higher conversion rates, loyalty growth. | Increased sales volume, better utilization of product portfolio. |

| Challenges | Data privacy concerns, complex implementation. | Risk of customer fatigue, less personalization. |

Which is better?

Hyperpersonalization in banking leverages AI and big data to deliver tailored financial products and services, enhancing customer satisfaction and retention. Cross-selling promotes diverse financial offerings to existing clients, boosting revenue but may risk customer alienation if not personalized. Integrating hyperpersonalization with cross-selling strategies optimizes client engagement and profitability by aligning product recommendations with individual customer needs.

Connection

Hyperpersonalization in banking leverages real-time data analytics and AI to tailor financial products and services to individual customer preferences, creating a more engaging user experience. This deep customer insight enables effective cross-selling by identifying complementary products that meet specific needs, thereby increasing customer lifetime value. Banks using these strategies see higher conversion rates and stronger customer loyalty due to relevant, targeted offers.

Key Terms

Customer Segmentation

Cross-selling strategies leverage customer segmentation to identify related products that appeal to specific buyer groups, increasing average order value. Hyperpersonalization uses real-time data and machine learning to deliver highly tailored product recommendations and offers, refining segmentation down to individual preferences and behaviors. Explore how advanced customer segmentation enhances both techniques for maximum revenue impact.

Product Bundling

Product bundling strategically combines complementary items to increase average transaction value and enhance customer satisfaction through tailored offers. Cross-selling emphasizes suggesting related products during the purchase process, while hyperpersonalization leverages advanced data analytics to curate highly individualized bundles based on unique customer behavior and preferences. Discover how leveraging hyperpersonalized product bundling can revolutionize your sales strategy and boost revenue.

Data Analytics

Cross-selling leverages data analytics by analyzing customer purchase histories and behavioral patterns to identify complementary products, enhancing revenue through targeted suggestions. Hyperpersonalization uses real-time data, AI, and advanced algorithms to deliver individualized experiences, dynamically adjusting offers based on detailed customer profiles and preferences. Explore how innovative data analytics tools can elevate your strategy by combining cross-selling techniques with hyperpersonalized approaches for maximum impact.

Source and External Links

What Is Cross-Selling? Intro, Steps, and Pro Tips [+Data] - Cross-selling is a sales technique offering customers additional products or services that complement their original purchase, such as adding fries and a drink to a burger order, and it differs from upselling by focusing on complementary rather than upgraded products.

Cross-Sell - Overview, How It Works, and Examples - Cross-selling involves selling an adjacent, related product or service to a customer's primary purchase, aiming to generate additional revenue and strengthen customer relationships if done with relevant complementary offers.

What is Cross-Selling? - Cross-selling helps increase sales revenue and customer loyalty by offering related supplementary products or services that enhance the customer's experience without replacing their original choice.

dowidth.com

dowidth.com