Alternative data lending leverages non-traditional information such as social media activity, utility payments, and transaction histories to assess creditworthiness, enabling loans for individuals with limited credit scores. Crowdfunding pools small investments from a large number of people, allowing entrepreneurs or projects to raise capital without conventional bank loans. Explore the advantages and challenges of these innovative financing methods to understand their impact on modern banking.

Why it is important

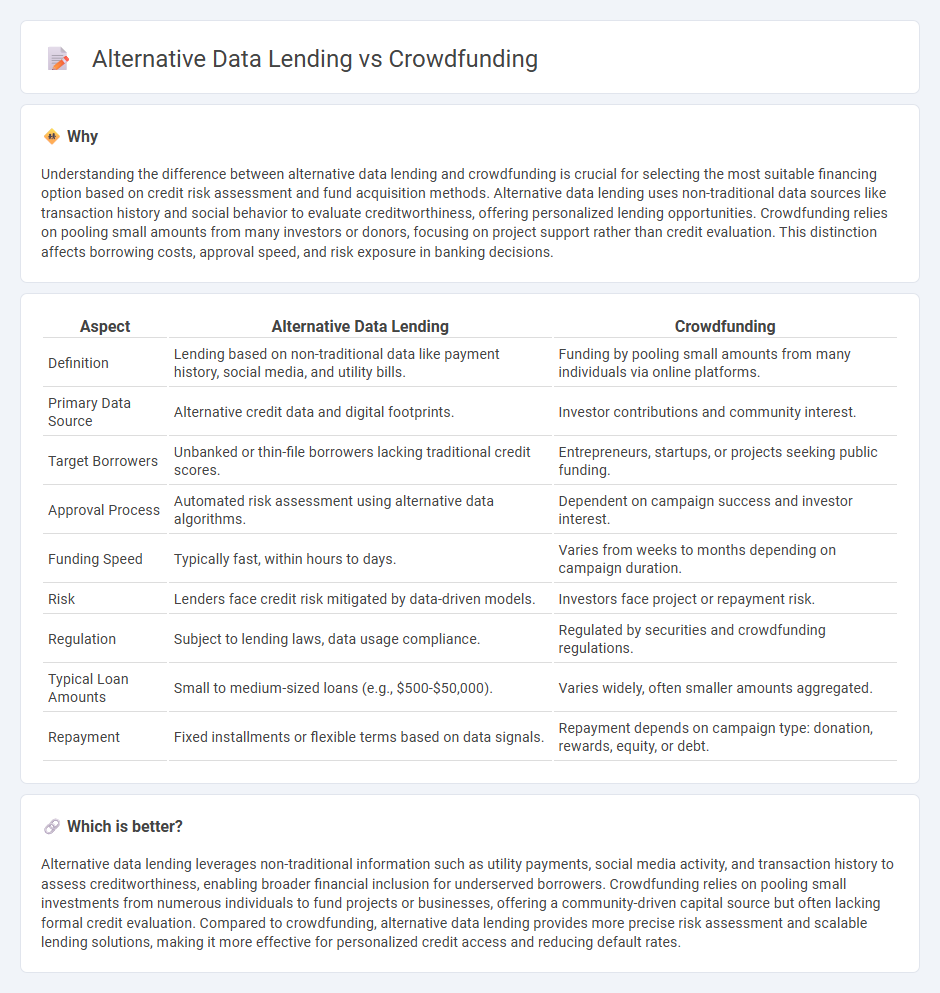

Understanding the difference between alternative data lending and crowdfunding is crucial for selecting the most suitable financing option based on credit risk assessment and fund acquisition methods. Alternative data lending uses non-traditional data sources like transaction history and social behavior to evaluate creditworthiness, offering personalized lending opportunities. Crowdfunding relies on pooling small amounts from many investors or donors, focusing on project support rather than credit evaluation. This distinction affects borrowing costs, approval speed, and risk exposure in banking decisions.

Comparison Table

| Aspect | Alternative Data Lending | Crowdfunding |

|---|---|---|

| Definition | Lending based on non-traditional data like payment history, social media, and utility bills. | Funding by pooling small amounts from many individuals via online platforms. |

| Primary Data Source | Alternative credit data and digital footprints. | Investor contributions and community interest. |

| Target Borrowers | Unbanked or thin-file borrowers lacking traditional credit scores. | Entrepreneurs, startups, or projects seeking public funding. |

| Approval Process | Automated risk assessment using alternative data algorithms. | Dependent on campaign success and investor interest. |

| Funding Speed | Typically fast, within hours to days. | Varies from weeks to months depending on campaign duration. |

| Risk | Lenders face credit risk mitigated by data-driven models. | Investors face project or repayment risk. |

| Regulation | Subject to lending laws, data usage compliance. | Regulated by securities and crowdfunding regulations. |

| Typical Loan Amounts | Small to medium-sized loans (e.g., $500-$50,000). | Varies widely, often smaller amounts aggregated. |

| Repayment | Fixed installments or flexible terms based on data signals. | Repayment depends on campaign type: donation, rewards, equity, or debt. |

Which is better?

Alternative data lending leverages non-traditional information such as utility payments, social media activity, and transaction history to assess creditworthiness, enabling broader financial inclusion for underserved borrowers. Crowdfunding relies on pooling small investments from numerous individuals to fund projects or businesses, offering a community-driven capital source but often lacking formal credit evaluation. Compared to crowdfunding, alternative data lending provides more precise risk assessment and scalable lending solutions, making it more effective for personalized credit access and reducing default rates.

Connection

Alternative data lending leverages non-traditional financial information such as social media activity, utility payments, and mobile phone usage to assess creditworthiness, enabling more inclusive lending practices. Crowdfunding platforms utilize insights from alternative data to identify potential borrowers and assess risk, facilitating peer-to-peer lending without relying solely on traditional credit scores. The integration of alternative data improves the accuracy of credit evaluation, fostering trust and efficiency between lenders and borrowers in crowdfunding ecosystems.

Key Terms

Peer-to-Peer (P2P) Platforms

Peer-to-peer (P2P) lending platforms leverage alternative data such as social media activity, transaction histories, and mobile usage patterns to assess borrower creditworthiness more accurately than traditional crowdfunding methods. Unlike crowdfunding that pools small contributions from numerous backers without stringent credit checks, P2P lending uses advanced algorithms and alternative datasets to reduce default risk and streamline loan approvals. Explore the advantages and evolving methodologies of P2P platforms to understand how alternative data reshapes lending landscapes.

Credit Scoring Models

Crowdfunding platforms leverage collective funding but often lack granular data, relying mostly on basic credit inputs for credit scoring models. Alternative data lending enhances credit assessments by incorporating unconventional data sources like social media activity, payment histories, and utility bills to predict borrower reliability more accurately. Explore how these innovative credit scoring models transform lending decisions and improve financial inclusivity.

Risk Assessment

Crowdfunding platforms typically rely on collective community support and basic credit checks to assess borrower risk, emphasizing social proof and project viability. Alternative data lending uses non-traditional datasets such as utility payments, social media behavior, and transaction histories to create a more nuanced risk profile, enabling access to credit for underserved populations. Explore how integrating alternative data enhances risk assessment beyond conventional crowdfunding methods.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, bypassing traditional financial intermediaries.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding allows entrepreneurs to raise money for projects or businesses through the collective effort of friends, family, customers, and individual investors, primarily using online platforms and social media.

Crowdfunding - Small Business Financing: A Resource Guide - Crowdfunding involves collecting small amounts of money from many individuals using an online platform, with common models including donation-based, rewards-based, and equity-based funding.

dowidth.com

dowidth.com