Fraud orchestration integrates multiple detection tools and data sources to create a comprehensive defense against financial crimes, while identity verification focuses on confirming the legitimacy of a user's identity at the point of account access. Banks leverage advanced AI-driven fraud orchestration platforms to analyze behavioral patterns and transaction anomalies in real-time, reducing false positives and enhancing security. Explore how combining these strategies can fortify your institution's protection against evolving cyber threats.

Why it is important

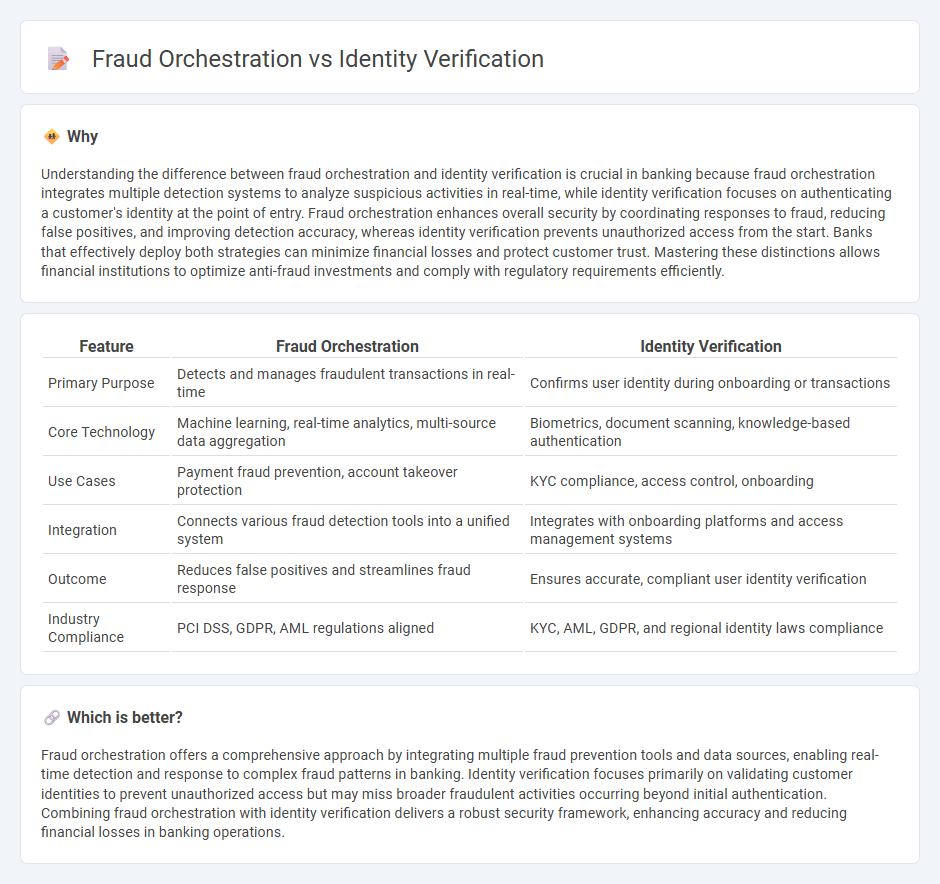

Understanding the difference between fraud orchestration and identity verification is crucial in banking because fraud orchestration integrates multiple detection systems to analyze suspicious activities in real-time, while identity verification focuses on authenticating a customer's identity at the point of entry. Fraud orchestration enhances overall security by coordinating responses to fraud, reducing false positives, and improving detection accuracy, whereas identity verification prevents unauthorized access from the start. Banks that effectively deploy both strategies can minimize financial losses and protect customer trust. Mastering these distinctions allows financial institutions to optimize anti-fraud investments and comply with regulatory requirements efficiently.

Comparison Table

| Feature | Fraud Orchestration | Identity Verification |

|---|---|---|

| Primary Purpose | Detects and manages fraudulent transactions in real-time | Confirms user identity during onboarding or transactions |

| Core Technology | Machine learning, real-time analytics, multi-source data aggregation | Biometrics, document scanning, knowledge-based authentication |

| Use Cases | Payment fraud prevention, account takeover protection | KYC compliance, access control, onboarding |

| Integration | Connects various fraud detection tools into a unified system | Integrates with onboarding platforms and access management systems |

| Outcome | Reduces false positives and streamlines fraud response | Ensures accurate, compliant user identity verification |

| Industry Compliance | PCI DSS, GDPR, AML regulations aligned | KYC, AML, GDPR, and regional identity laws compliance |

Which is better?

Fraud orchestration offers a comprehensive approach by integrating multiple fraud prevention tools and data sources, enabling real-time detection and response to complex fraud patterns in banking. Identity verification focuses primarily on validating customer identities to prevent unauthorized access but may miss broader fraudulent activities occurring beyond initial authentication. Combining fraud orchestration with identity verification delivers a robust security framework, enhancing accuracy and reducing financial losses in banking operations.

Connection

Fraud orchestration integrates real-time data from identity verification processes to detect and prevent fraudulent banking activities efficiently. Identity verification technologies, including biometrics and multi-factor authentication, provide critical data points that fraud orchestration platforms analyze for suspicious patterns. This synergy enhances security measures, reduces false positives, and ensures compliance with regulatory standards in banking transactions.

Key Terms

KYC (Know Your Customer)

Identity verification is a critical step in the KYC process, ensuring that customers are who they claim to be by validating government-issued IDs and biometric data. Fraud orchestration extends beyond verification by continuously monitoring and analyzing transactions and behaviors to detect and prevent fraudulent activities in real-time. Explore how integrating identity verification with fraud orchestration strengthens compliance and enhances security in KYC frameworks.

Synthetic Identity Fraud

Synthetic identity fraud involves creating fake identities by combining real and fabricated information to bypass identity verification systems. Fraud orchestration focuses on detecting and preventing these complex fraud schemes by analyzing patterns across multiple data sources in real time. Explore advanced techniques in synthetic identity fraud prevention to safeguard your business effectively.

Fraud Detection Platform

Identity verification ensures the authenticity of user identities by cross-referencing personal data with trusted databases, reducing the risk of fraudulent access at the entry point. Fraud orchestration integrates multiple detection tools and real-time analytics to identify and mitigate complex fraud patterns across various channels, enhancing the overall security framework of a Fraud Detection Platform. Explore the latest advancements in Fraud Detection Platforms to strengthen your defense against evolving fraud threats.

Source and External Links

Verify your identity - Login.gov - You prove your identity using a government-issued ID, Social Security Number, and additional personal information, with options for online or in-person verification depending on your resources.

Identity Verification Help - The NPDB - Identity verification is completed through ID.me by uploading photos of your ID, taking a live video selfie, and entering your Social Security Number for secure multi-factor authentication.

Identity verification service (Wikipedia) - Businesses use these services to confirm that a user's provided identity information matches real, authoritative data sources or documents.

dowidth.com

dowidth.com