Blockchain remittance leverages decentralized ledgers to enable fast, secure, and cost-effective cross-border money transfers without intermediaries, while SEPA facilitates standardized euro transactions across European countries with regulated bank networks ensuring compliance and reliability. Blockchain offers transparency and reduced transaction times compared to SEPA's typically slower processing tied to traditional banking hours. Explore the differences between blockchain remittance and SEPA to understand which suits your payment needs best.

Why it is important

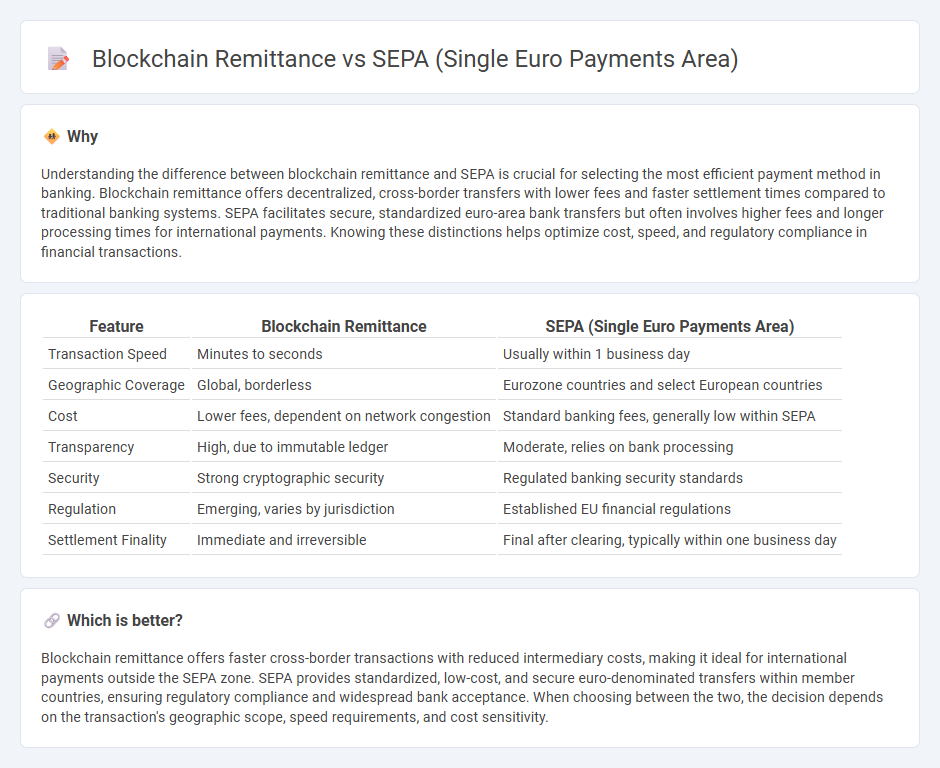

Understanding the difference between blockchain remittance and SEPA is crucial for selecting the most efficient payment method in banking. Blockchain remittance offers decentralized, cross-border transfers with lower fees and faster settlement times compared to traditional banking systems. SEPA facilitates secure, standardized euro-area bank transfers but often involves higher fees and longer processing times for international payments. Knowing these distinctions helps optimize cost, speed, and regulatory compliance in financial transactions.

Comparison Table

| Feature | Blockchain Remittance | SEPA (Single Euro Payments Area) |

|---|---|---|

| Transaction Speed | Minutes to seconds | Usually within 1 business day |

| Geographic Coverage | Global, borderless | Eurozone countries and select European countries |

| Cost | Lower fees, dependent on network congestion | Standard banking fees, generally low within SEPA |

| Transparency | High, due to immutable ledger | Moderate, relies on bank processing |

| Security | Strong cryptographic security | Regulated banking security standards |

| Regulation | Emerging, varies by jurisdiction | Established EU financial regulations |

| Settlement Finality | Immediate and irreversible | Final after clearing, typically within one business day |

Which is better?

Blockchain remittance offers faster cross-border transactions with reduced intermediary costs, making it ideal for international payments outside the SEPA zone. SEPA provides standardized, low-cost, and secure euro-denominated transfers within member countries, ensuring regulatory compliance and widespread bank acceptance. When choosing between the two, the decision depends on the transaction's geographic scope, speed requirements, and cost sensitivity.

Connection

Blockchain remittance enhances SEPA (Single Euro Payments Area) by enabling faster, more secure cross-border euro transfers through decentralized ledger technology. This integration reduces transaction costs and settlement times compared to traditional SEPA credit transfers, improving liquidity and transparency for European banks. The combination supports real-time payment processing while maintaining compliance with SEPA's regulatory framework and interoperability standards.

Key Terms

Interoperability

SEPA enables seamless electronic euro payments across 36 European countries through standardized protocols, ensuring interoperability within traditional banking networks. Blockchain remittance offers cross-border transaction transparency and faster settlement times by utilizing decentralized digital ledgers, but faces challenges in integration with existing financial infrastructure. Explore how both systems address interoperability to transform cross-border payments.

Settlement speed

SEPA facilitates euro transactions across 36 European countries, typically settling payments within one business day, leveraging centralized banking infrastructure for reliability and compliance. Blockchain remittance offers near-instant settlement by validating transactions across a decentralized ledger, reducing delays often caused by traditional banking hours and intermediaries. Explore detailed comparisons to understand how settlement speed impacts cross-border payment efficiency.

Transaction transparency

SEPA transactions provide high transparency by enabling standardized payment processing across 36 European countries, with clear traceability and regulatory oversight governed by the European Central Bank. Blockchain remittance offers enhanced transaction transparency through real-time, immutable ledger records that allow end-to-end tracking without intermediaries, increasing security and reducing fraud risks. Discover how each payment solution impacts your transaction visibility and compliance by exploring detailed comparisons and use cases.

Source and External Links

SEPA Payments - Explains the SEPA payment method, which facilitates fast and inexpensive cross-border euro payments.

Single Euro Payments Area (SEPA) - Describes how SEPA harmonizes cross-border euro payments for consumers, businesses, and public administrations.

Single Euro Payments Area (SEPA) - European Central Bank - Discusses how SEPA enhances efficiency in European payments by standardizing credit transfers and direct debits.

dowidth.com

dowidth.com