Account aggregation consolidates financial data from multiple accounts into a single platform, enhancing visibility and management of assets. Risk assessment evaluates creditworthiness and potential financial threats by analyzing transaction patterns and behavioral data. Discover how these tools transform banking efficiency and security.

Why it is important

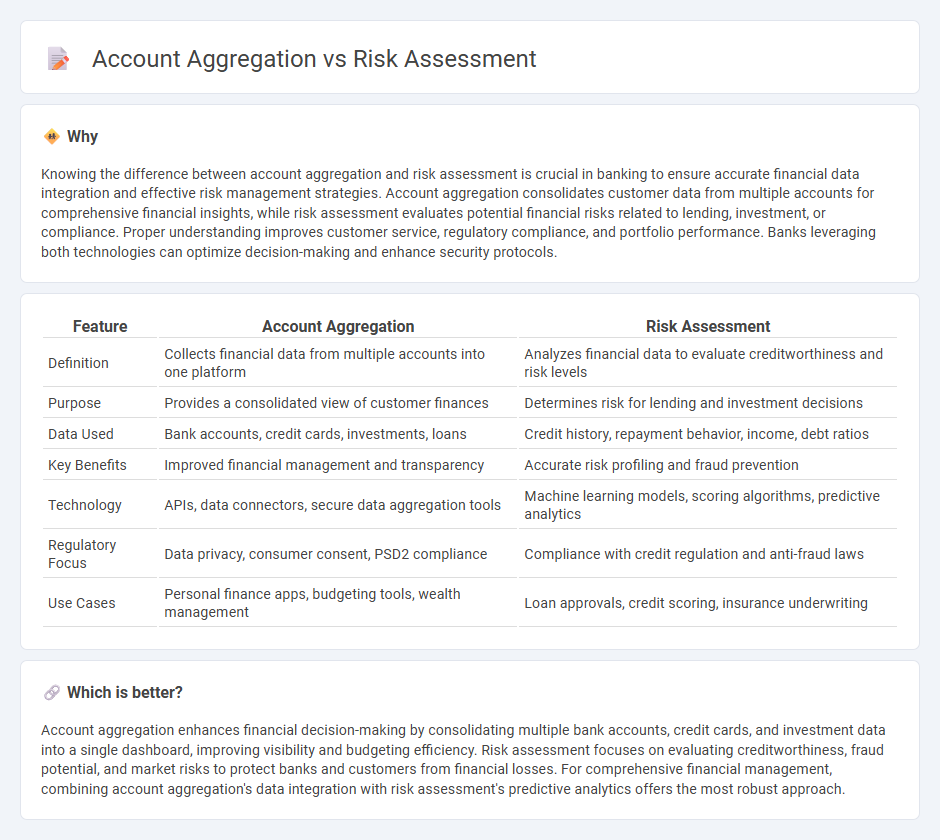

Knowing the difference between account aggregation and risk assessment is crucial in banking to ensure accurate financial data integration and effective risk management strategies. Account aggregation consolidates customer data from multiple accounts for comprehensive financial insights, while risk assessment evaluates potential financial risks related to lending, investment, or compliance. Proper understanding improves customer service, regulatory compliance, and portfolio performance. Banks leveraging both technologies can optimize decision-making and enhance security protocols.

Comparison Table

| Feature | Account Aggregation | Risk Assessment |

|---|---|---|

| Definition | Collects financial data from multiple accounts into one platform | Analyzes financial data to evaluate creditworthiness and risk levels |

| Purpose | Provides a consolidated view of customer finances | Determines risk for lending and investment decisions |

| Data Used | Bank accounts, credit cards, investments, loans | Credit history, repayment behavior, income, debt ratios |

| Key Benefits | Improved financial management and transparency | Accurate risk profiling and fraud prevention |

| Technology | APIs, data connectors, secure data aggregation tools | Machine learning models, scoring algorithms, predictive analytics |

| Regulatory Focus | Data privacy, consumer consent, PSD2 compliance | Compliance with credit regulation and anti-fraud laws |

| Use Cases | Personal finance apps, budgeting tools, wealth management | Loan approvals, credit scoring, insurance underwriting |

Which is better?

Account aggregation enhances financial decision-making by consolidating multiple bank accounts, credit cards, and investment data into a single dashboard, improving visibility and budgeting efficiency. Risk assessment focuses on evaluating creditworthiness, fraud potential, and market risks to protect banks and customers from financial losses. For comprehensive financial management, combining account aggregation's data integration with risk assessment's predictive analytics offers the most robust approach.

Connection

Account aggregation consolidates financial data from multiple sources, providing a comprehensive view critical for accurate risk assessment in banking. By analyzing aggregated data, banks can identify patterns and potential risks more effectively, improving credit scoring and fraud detection. Enhanced data integration supports better decision-making in loan approvals and portfolio management.

Key Terms

**Risk Assessment:**

Risk assessment evaluates potential financial, operational, and security risks by analyzing data patterns, transaction histories, and user behavior to predict vulnerabilities and prevent fraud. It uses advanced analytics, machine learning models, and regulatory compliance checks to ensure robust decision-making and risk mitigation. Explore how risk assessment enhances financial security and operational efficiency.

Credit Score

Risk assessment analyzes borrower credit scores to determine loan eligibility and potential default risk, using credit bureau data and predictive models. Account aggregation consolidates financial accounts, providing a comprehensive view of an individual's financial health, which can enhance the accuracy of credit score evaluations. Explore how integrating both tools can optimize credit decision-making processes.

Probability of Default

Risk assessment evaluates the Probability of Default (PD) by analyzing credit history, financial behavior, and external factors to estimate the likelihood of a borrower failing to repay a loan. Account aggregation compiles comprehensive financial data from multiple accounts, enhancing PD models by providing a holistic view of an individual's cash flow and liabilities. Explore how integrating account aggregation can refine risk assessment and improve default predictions.

Source and External Links

Risk assessment - Risk assessment is the process of identifying hazards, evaluating their likelihood and consequences, and determining actions to mitigate negative impacts on individuals, assets, and the environment as part of a broader risk management strategy.

Risk Assessment: Process, Tools, & Techniques - A risk assessment systematically identifies potential hazards and analyzes their impacts to prioritize and implement controls, ensuring workplace safety and regulatory compliance such as OSHA requirements.

Risk assessment: An overview - Risk assessment involves identifying, analyzing, and evaluating risks using methods like risk matrices or quantitative assessments to prioritize risks based on likelihood and impact for effective management.

dowidth.com

dowidth.com