Robo advisors utilize algorithms and artificial intelligence to provide automated, low-cost investment management tailored to individual risk profiles. Human financial advisors offer personalized financial planning and expert guidance, often including emotional support during market fluctuations. Explore the differences between robo advisors and human financial advisors to choose the best fit for your financial goals.

Why it is important

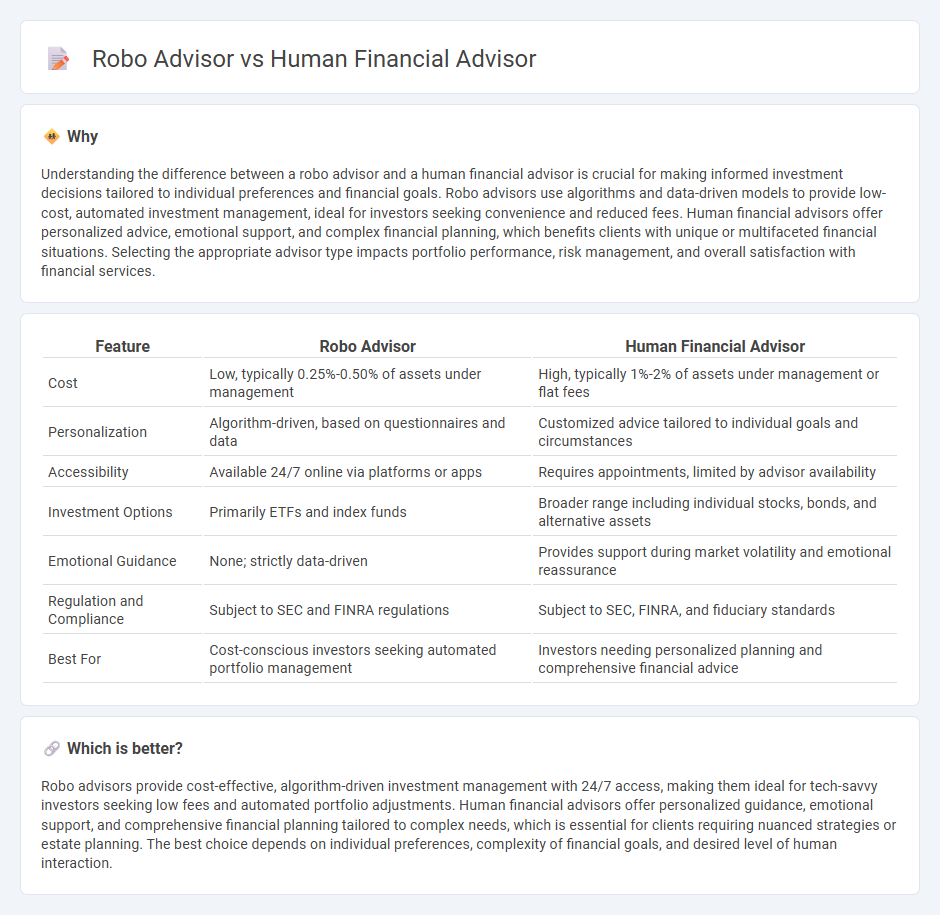

Understanding the difference between a robo advisor and a human financial advisor is crucial for making informed investment decisions tailored to individual preferences and financial goals. Robo advisors use algorithms and data-driven models to provide low-cost, automated investment management, ideal for investors seeking convenience and reduced fees. Human financial advisors offer personalized advice, emotional support, and complex financial planning, which benefits clients with unique or multifaceted financial situations. Selecting the appropriate advisor type impacts portfolio performance, risk management, and overall satisfaction with financial services.

Comparison Table

| Feature | Robo Advisor | Human Financial Advisor |

|---|---|---|

| Cost | Low, typically 0.25%-0.50% of assets under management | High, typically 1%-2% of assets under management or flat fees |

| Personalization | Algorithm-driven, based on questionnaires and data | Customized advice tailored to individual goals and circumstances |

| Accessibility | Available 24/7 online via platforms or apps | Requires appointments, limited by advisor availability |

| Investment Options | Primarily ETFs and index funds | Broader range including individual stocks, bonds, and alternative assets |

| Emotional Guidance | None; strictly data-driven | Provides support during market volatility and emotional reassurance |

| Regulation and Compliance | Subject to SEC and FINRA regulations | Subject to SEC, FINRA, and fiduciary standards |

| Best For | Cost-conscious investors seeking automated portfolio management | Investors needing personalized planning and comprehensive financial advice |

Which is better?

Robo advisors provide cost-effective, algorithm-driven investment management with 24/7 access, making them ideal for tech-savvy investors seeking low fees and automated portfolio adjustments. Human financial advisors offer personalized guidance, emotional support, and comprehensive financial planning tailored to complex needs, which is essential for clients requiring nuanced strategies or estate planning. The best choice depends on individual preferences, complexity of financial goals, and desired level of human interaction.

Connection

Robo advisors and human financial advisors complement each other by integrating algorithm-driven portfolio management with personalized financial planning expertise. Robo advisors analyze large datasets using artificial intelligence to provide cost-effective investment strategies, while human advisors address complex financial situations and offer emotional insights. Combining these tools enhances client experience through efficient decision-making and tailored advice in banking services.

Key Terms

Personalization

Human financial advisors offer highly personalized strategies by analyzing clients' unique financial goals, risk tolerance, and life circumstances through direct interaction. Robo advisors use algorithms and data inputs to provide customized portfolios but may lack the nuanced understanding of individual preferences and emotional responses. Explore more about how personalized financial planning differs between human and robo advisors.

Automation

Robo advisors leverage advanced algorithms and automation to provide cost-effective, personalized investment strategies with minimal human intervention. Human financial advisors offer tailored guidance by understanding clients' emotional and complex financial needs that machines may overlook. Discover how automation can enhance your investment experience by exploring key differences between these advisory options.

Fiduciary Duty

Human financial advisors are legally bound by fiduciary duty to act in their clients' best interests, ensuring personalized and ethical investment recommendations. Robo advisors, while efficient and cost-effective, may not always uphold the same fiduciary standards, as their algorithms prioritize automated portfolio management and scalability. Explore the key differences in fiduciary responsibilities between human and robo advisors to make an informed decision.

Source and External Links

Robo-Advisors vs. Financial Advisors: Which One Fits ... - Bankrate - A human financial advisor offers comprehensive, personalized financial planning and expert advice on complex topics such as estate planning, allowing for responsive adjustments to your financial strategy over time.

Robo-Advisors vs. Human Financial Advisors: Which Is Right for You? - Human financial advisors provide tailored, relationship-driven guidance that can address nuanced financial challenges and detailed retirement and estate planning, often resulting in more personalized support than robo-advisors.

Despite robo hype, human financial advisors continue providing the ... - Human financial advisors offer empathetic, high-quality guidance through life's uncertainties, and when combined with technology, they deliver powerful, personalized financial management that adapts to clients' evolving needs.

dowidth.com

dowidth.com