Wealthtech revolutionizes personal finance by leveraging AI and data analytics to optimize investment portfolios and enhance client advisory services. Regtech focuses on automating compliance processes using advanced technologies such as blockchain and machine learning to mitigate risks and streamline regulatory reporting. Explore how these innovations transform the banking industry and drive competitive advantage.

Why it is important

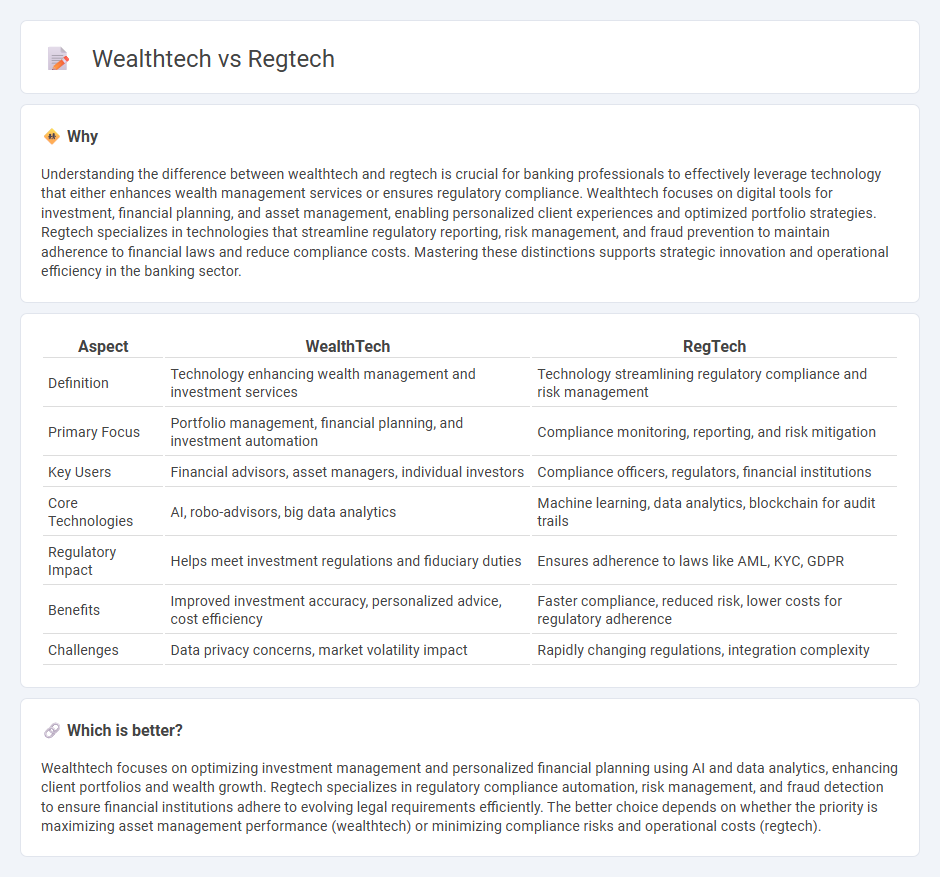

Understanding the difference between wealthtech and regtech is crucial for banking professionals to effectively leverage technology that either enhances wealth management services or ensures regulatory compliance. Wealthtech focuses on digital tools for investment, financial planning, and asset management, enabling personalized client experiences and optimized portfolio strategies. Regtech specializes in technologies that streamline regulatory reporting, risk management, and fraud prevention to maintain adherence to financial laws and reduce compliance costs. Mastering these distinctions supports strategic innovation and operational efficiency in the banking sector.

Comparison Table

| Aspect | WealthTech | RegTech |

|---|---|---|

| Definition | Technology enhancing wealth management and investment services | Technology streamlining regulatory compliance and risk management |

| Primary Focus | Portfolio management, financial planning, and investment automation | Compliance monitoring, reporting, and risk mitigation |

| Key Users | Financial advisors, asset managers, individual investors | Compliance officers, regulators, financial institutions |

| Core Technologies | AI, robo-advisors, big data analytics | Machine learning, data analytics, blockchain for audit trails |

| Regulatory Impact | Helps meet investment regulations and fiduciary duties | Ensures adherence to laws like AML, KYC, GDPR |

| Benefits | Improved investment accuracy, personalized advice, cost efficiency | Faster compliance, reduced risk, lower costs for regulatory adherence |

| Challenges | Data privacy concerns, market volatility impact | Rapidly changing regulations, integration complexity |

Which is better?

Wealthtech focuses on optimizing investment management and personalized financial planning using AI and data analytics, enhancing client portfolios and wealth growth. Regtech specializes in regulatory compliance automation, risk management, and fraud detection to ensure financial institutions adhere to evolving legal requirements efficiently. The better choice depends on whether the priority is maximizing asset management performance (wealthtech) or minimizing compliance risks and operational costs (regtech).

Connection

Wealthtech leverages advanced data analytics and artificial intelligence to enhance personalized investment strategies, while regtech focuses on automating regulatory compliance using similar technological frameworks. Both sectors utilize blockchain and machine learning to improve transparency, risk management, and operational efficiency within banking. The integration of wealthtech and regtech creates a seamless ecosystem that ensures secure, compliant, and optimized financial services for clients and institutions.

Key Terms

Regtech:

Regtech, or regulatory technology, leverages advanced software solutions and artificial intelligence to streamline compliance processes, reduce regulatory risks, and automate reporting for financial institutions. Key applications include real-time monitoring, fraud detection, anti-money laundering (AML), and know your customer (KYC) procedures, which significantly enhance efficiency and accuracy. Discover how Regtech innovations revolutionize regulatory adherence and risk management in the financial sector.

Regulatory Compliance

Regtech specializes in using advanced technologies such as AI and blockchain to streamline regulatory compliance processes, reduce risks, and ensure adherence to financial regulations across industries. Wealthtech focuses on improving wealth management services through digital platforms, offering personalized investment strategies and portfolio management while integrating compliance features to protect client assets. Discover more about how regtech and wealthtech are transforming regulatory compliance in the financial sector.

Risk Management

Regtech enhances risk management by leveraging AI-driven compliance monitoring, real-time data analytics, and automated reporting to reduce regulatory breaches and financial penalties. Wealthtech improves risk management through personalized portfolio optimization, predictive analytics, and stress-testing tools to mitigate investment risks and optimize asset allocation. Explore the latest innovations in regtech and wealthtech risk management solutions to safeguard your financial operations effectively.

Source and External Links

What is regtech? - Moody's - Regtech, or regulatory technology, consists of SaaS solutions that automate regulatory compliance processes, primarily in financial services, helping to combat financial crime like money laundering and terrorist financing while improving compliance efficiency for businesses.

What is RegTech (Regulatory Technology)? - Tipalti - Regtech utilizes technologies such as machine learning and big data to manage compliance and risk, enabling real-time monitoring of transactions and predicting regulatory risks to reduce financial crimes and costly compliance failures.

Regulatory technology - Wikipedia - RegTech applies information technology to improve regulatory and compliance processes in highly regulated sectors, aiming to increase transparency, standardize procedures, and deliver more efficient, lower-cost compliance solutions.

dowidth.com

dowidth.com