Predictive analytics in banking focuses on analyzing historical data to forecast future financial trends, customer behavior, and credit risks, enhancing decision-making accuracy. Sentiment analysis interprets customer feedback and social media interactions to gauge public opinion and satisfaction, helping banks tailor services and detect potential issues. Explore how integrating predictive analytics and sentiment analysis can revolutionize banking strategies and customer engagement.

Why it is important

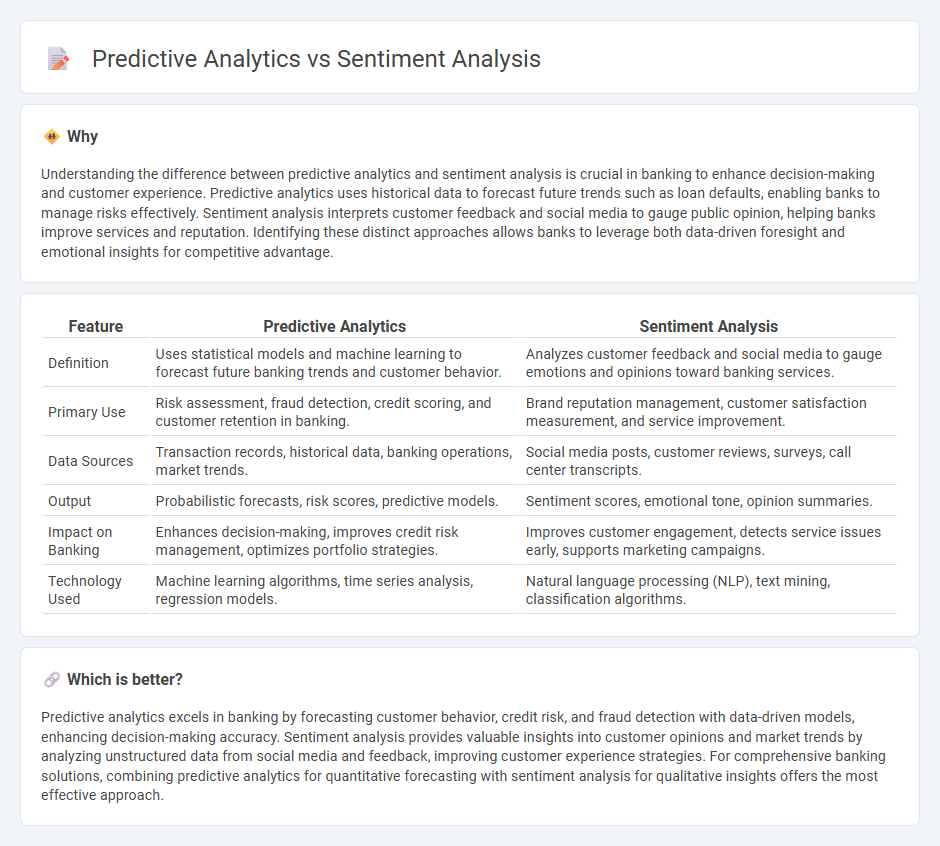

Understanding the difference between predictive analytics and sentiment analysis is crucial in banking to enhance decision-making and customer experience. Predictive analytics uses historical data to forecast future trends such as loan defaults, enabling banks to manage risks effectively. Sentiment analysis interprets customer feedback and social media to gauge public opinion, helping banks improve services and reputation. Identifying these distinct approaches allows banks to leverage both data-driven foresight and emotional insights for competitive advantage.

Comparison Table

| Feature | Predictive Analytics | Sentiment Analysis |

|---|---|---|

| Definition | Uses statistical models and machine learning to forecast future banking trends and customer behavior. | Analyzes customer feedback and social media to gauge emotions and opinions toward banking services. |

| Primary Use | Risk assessment, fraud detection, credit scoring, and customer retention in banking. | Brand reputation management, customer satisfaction measurement, and service improvement. |

| Data Sources | Transaction records, historical data, banking operations, market trends. | Social media posts, customer reviews, surveys, call center transcripts. |

| Output | Probabilistic forecasts, risk scores, predictive models. | Sentiment scores, emotional tone, opinion summaries. |

| Impact on Banking | Enhances decision-making, improves credit risk management, optimizes portfolio strategies. | Improves customer engagement, detects service issues early, supports marketing campaigns. |

| Technology Used | Machine learning algorithms, time series analysis, regression models. | Natural language processing (NLP), text mining, classification algorithms. |

Which is better?

Predictive analytics excels in banking by forecasting customer behavior, credit risk, and fraud detection with data-driven models, enhancing decision-making accuracy. Sentiment analysis provides valuable insights into customer opinions and market trends by analyzing unstructured data from social media and feedback, improving customer experience strategies. For comprehensive banking solutions, combining predictive analytics for quantitative forecasting with sentiment analysis for qualitative insights offers the most effective approach.

Connection

Predictive analytics in banking leverages historical financial data and customer behavior to forecast credit risks, fraud detection, and market trends, while sentiment analysis processes customer feedback and social media data to gauge client satisfaction and brand reputation. Integrating sentiment analysis enhances predictive models by incorporating emotional and subjective data, improving the accuracy of customer churn predictions and personalized marketing strategies. This connection enables banks to make data-driven decisions that optimize risk management, customer engagement, and service innovation.

Key Terms

Customer Feedback (sentiment analysis)

Sentiment analysis uses natural language processing to interpret customer emotions and opinions from feedback, enabling businesses to identify satisfaction levels and areas for improvement. Predictive analytics leverages historical and transactional data to forecast future customer behaviors, such as purchasing trends and churn risk, guiding proactive decision-making. Explore how integrating these methods enhances customer experience and business strategy.

Risk Scoring (predictive analytics)

Risk scoring in predictive analytics uses historical data and machine learning algorithms to estimate the likelihood of future adverse events, enabling more accurate risk management decisions. Sentiment analysis, while valuable for gauging public opinion and consumer emotions, primarily processes textual data to understand mood rather than quantifying risk probabilities. Explore how integrating risk scoring models can enhance your predictive insights for more effective risk assessment.

Text Mining (shared technique)

Sentiment analysis and predictive analytics both utilize text mining to extract valuable insights from unstructured data, with sentiment analysis focusing on interpreting emotions and opinions expressed in textual content, while predictive analytics aims to forecast future trends and behaviors based on historical data patterns. Text mining techniques such as natural language processing (NLP), tokenization, and feature extraction are essential for transforming raw text into analyzable datasets in both approaches. Explore deeper applications and methodologies to understand how text mining drives innovation in sentiment analysis and predictive analytics.

Source and External Links

Sentiment Analysis and How to Leverage It - This article discusses the four main types of sentiment analysis: fine-grained, aspect-based, intent-based, and their applications in understanding customer reactions.

What is Sentiment Analysis? - Sentiment analysis is a method used in natural language processing to identify and categorize opinions in text, helping organizations understand customer sentiment and brand reputation.

What Is Sentiment Analysis? - Sentiment analysis involves analyzing large volumes of text to determine whether the sentiment is positive, negative, or neutral, aiding companies in improving customer experiences and brand reputation.

dowidth.com

dowidth.com