Personal financial management tools empower individuals to track expenses, budget effectively, and make informed financial decisions by aggregating account data and providing personalized insights. Loan origination systems streamline the application, approval, and disbursement processes for lenders, enhancing efficiency through automated credit scoring and compliance checks. Explore the differences and benefits of these banking technologies to optimize your financial management and lending experience.

Why it is important

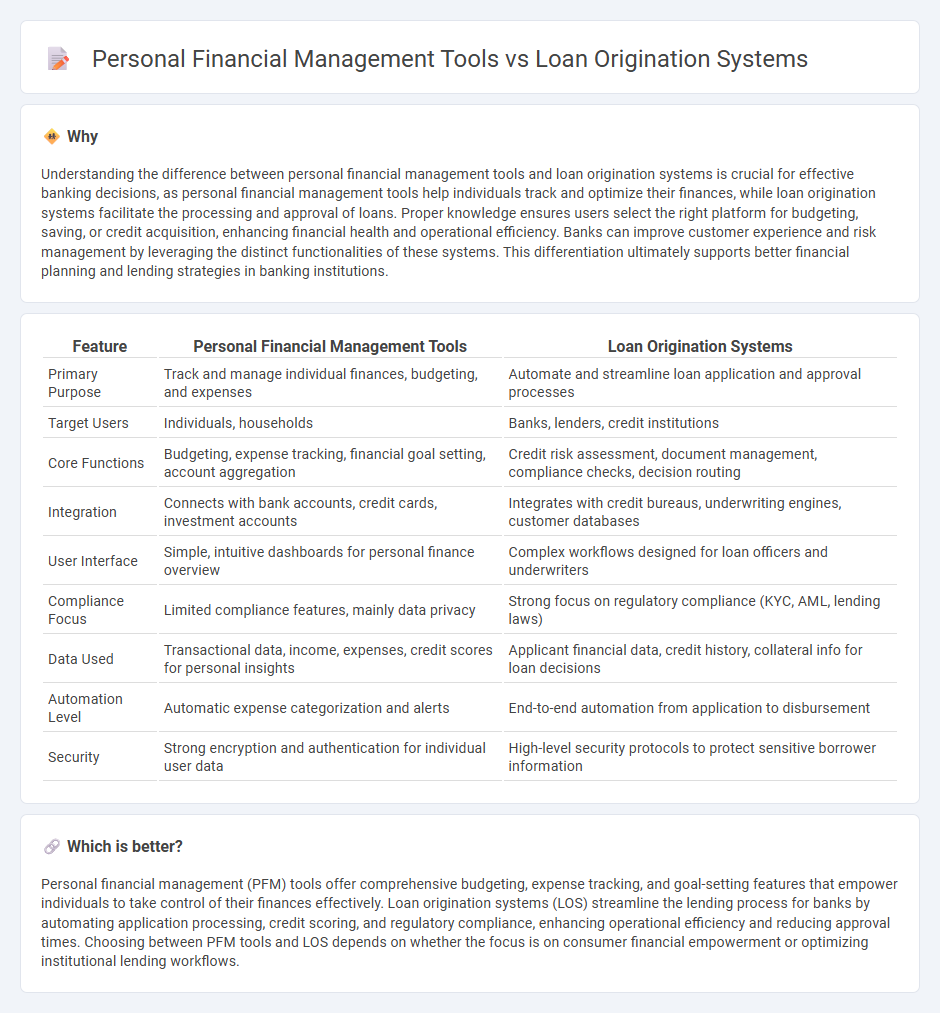

Understanding the difference between personal financial management tools and loan origination systems is crucial for effective banking decisions, as personal financial management tools help individuals track and optimize their finances, while loan origination systems facilitate the processing and approval of loans. Proper knowledge ensures users select the right platform for budgeting, saving, or credit acquisition, enhancing financial health and operational efficiency. Banks can improve customer experience and risk management by leveraging the distinct functionalities of these systems. This differentiation ultimately supports better financial planning and lending strategies in banking institutions.

Comparison Table

| Feature | Personal Financial Management Tools | Loan Origination Systems |

|---|---|---|

| Primary Purpose | Track and manage individual finances, budgeting, and expenses | Automate and streamline loan application and approval processes |

| Target Users | Individuals, households | Banks, lenders, credit institutions |

| Core Functions | Budgeting, expense tracking, financial goal setting, account aggregation | Credit risk assessment, document management, compliance checks, decision routing |

| Integration | Connects with bank accounts, credit cards, investment accounts | Integrates with credit bureaus, underwriting engines, customer databases |

| User Interface | Simple, intuitive dashboards for personal finance overview | Complex workflows designed for loan officers and underwriters |

| Compliance Focus | Limited compliance features, mainly data privacy | Strong focus on regulatory compliance (KYC, AML, lending laws) |

| Data Used | Transactional data, income, expenses, credit scores for personal insights | Applicant financial data, credit history, collateral info for loan decisions |

| Automation Level | Automatic expense categorization and alerts | End-to-end automation from application to disbursement |

| Security | Strong encryption and authentication for individual user data | High-level security protocols to protect sensitive borrower information |

Which is better?

Personal financial management (PFM) tools offer comprehensive budgeting, expense tracking, and goal-setting features that empower individuals to take control of their finances effectively. Loan origination systems (LOS) streamline the lending process for banks by automating application processing, credit scoring, and regulatory compliance, enhancing operational efficiency and reducing approval times. Choosing between PFM tools and LOS depends on whether the focus is on consumer financial empowerment or optimizing institutional lending workflows.

Connection

Personal financial management tools collect and analyze user financial data, providing insights that enhance loan origination systems by enabling more accurate credit risk assessment and personalized loan offers. Integration of these tools allows lenders to streamline application processing, reduce defaults through better borrower understanding, and improve overall customer experience. This connected ecosystem leverages real-time financial behavior data, facilitating faster decision-making and efficient loan approval workflows.

Key Terms

**Loan Origination Systems:**

Loan origination systems streamline the loan application process by automating credit checks, document verification, and underwriting, significantly reducing approval times and operational costs. These platforms utilize AI and machine learning algorithms to assess borrower risk profiles and ensure regulatory compliance. Explore how integrating advanced loan origination systems can enhance lending efficiency and improve customer experience.

Credit Underwriting

Loan origination systems automate the credit underwriting process by using advanced algorithms to assess borrower risk, verify financial information, and generate credit scores for efficient loan approval. Personal financial management tools provide consumers with insights into their creditworthiness by tracking spending habits, budgets, and credit reports but lack the deep underwriting capabilities of loan origination systems. Explore how integrating both technologies can enhance credit decision accuracy and customer experience.

Application Processing

Loan origination systems streamline application processing by automating credit checks, document verification, and risk assessment, enabling faster loan approvals and reduced manual errors. Personal financial management tools primarily focus on budgeting, expense tracking, and financial goal setting, offering minimal support for loan application workflows. Explore detailed comparisons to understand how each system optimizes application processes and enhances user experiences.

Source and External Links

What is a Loan Origination System? Benefits For Banks ... - Alogent - A loan origination system (LOS) is technology used by financial institutions to automate and comply with loan documentation processes, thereby increasing efficiency, reducing compliance risk, and ensuring collectability during foreclosures.

Loan Origination Software System - MeridianLink - MeridianLink offers an end-to-end digital loan origination platform that streamlines lending for various loan types with cloud-based automation, seamless third-party integrations, and tools to accelerate growth and ROI for financial institutions.

Top 10 Best Loan Origination Systems to Consider in 2025 - ABLE Platform leads as a flexible, scalable loan origination software that supports cloud and on-premises setups, low-code customization, and integration features to enhance operational efficiency, compliance, and user experience across the loan lifecycle.

dowidth.com

dowidth.com