Synthetic identity fraud involves creating fake identities using fabricated personal information to open fraudulent bank accounts and apply for credit, causing substantial financial losses. First-party fraud occurs when legitimate customers, often facing financial distress, intentionally provide false information or manipulate transactions to deceive banks for personal gain. Discover more about how these fraud types impact banking security and prevention strategies.

Why it is important

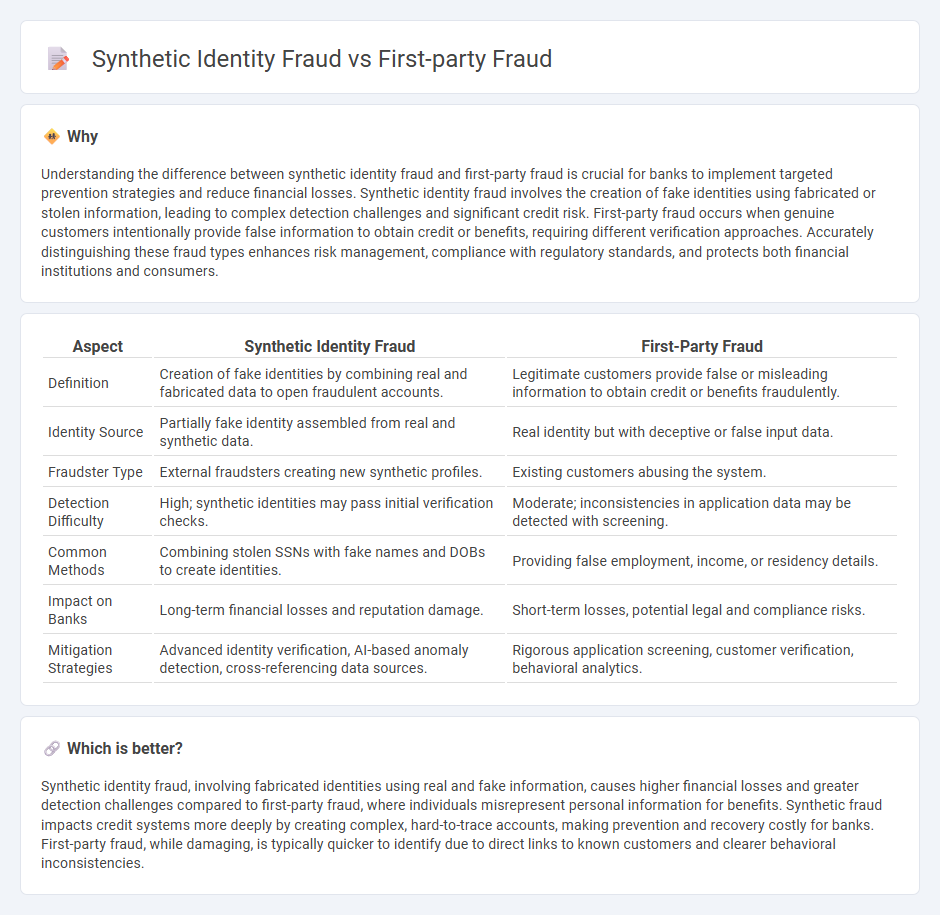

Understanding the difference between synthetic identity fraud and first-party fraud is crucial for banks to implement targeted prevention strategies and reduce financial losses. Synthetic identity fraud involves the creation of fake identities using fabricated or stolen information, leading to complex detection challenges and significant credit risk. First-party fraud occurs when genuine customers intentionally provide false information to obtain credit or benefits, requiring different verification approaches. Accurately distinguishing these fraud types enhances risk management, compliance with regulatory standards, and protects both financial institutions and consumers.

Comparison Table

| Aspect | Synthetic Identity Fraud | First-Party Fraud |

|---|---|---|

| Definition | Creation of fake identities by combining real and fabricated data to open fraudulent accounts. | Legitimate customers provide false or misleading information to obtain credit or benefits fraudulently. |

| Identity Source | Partially fake identity assembled from real and synthetic data. | Real identity but with deceptive or false input data. |

| Fraudster Type | External fraudsters creating new synthetic profiles. | Existing customers abusing the system. |

| Detection Difficulty | High; synthetic identities may pass initial verification checks. | Moderate; inconsistencies in application data may be detected with screening. |

| Common Methods | Combining stolen SSNs with fake names and DOBs to create identities. | Providing false employment, income, or residency details. |

| Impact on Banks | Long-term financial losses and reputation damage. | Short-term losses, potential legal and compliance risks. |

| Mitigation Strategies | Advanced identity verification, AI-based anomaly detection, cross-referencing data sources. | Rigorous application screening, customer verification, behavioral analytics. |

Which is better?

Synthetic identity fraud, involving fabricated identities using real and fake information, causes higher financial losses and greater detection challenges compared to first-party fraud, where individuals misrepresent personal information for benefits. Synthetic fraud impacts credit systems more deeply by creating complex, hard-to-trace accounts, making prevention and recovery costly for banks. First-party fraud, while damaging, is typically quicker to identify due to direct links to known customers and clearer behavioral inconsistencies.

Connection

Synthetic identity fraud combines fake and real data to create a new identity that appears authentic for banking applications. First-party fraud occurs when genuine customers misuse their accounts or credentials, often overlapping with synthetic fraud tactics to exploit banking systems. Both types of fraud exploit identity verification weaknesses, leading to significant financial losses and increased risks for banks.

Key Terms

Identity Theft

First-party fraud involves an individual using their real identity to commit deception, often through loan default or credit card fraud, while synthetic identity fraud fabricates entirely new identities by combining real and fake information to create a non-existent person for financial gain. Identity theft plays a crucial role in both; in first-party fraud, it may involve identity misuse by the actual person, whereas synthetic identity fraud leverages stolen data elements to build a fraudulent profile undetectable by traditional checks. Explore in-depth strategies and technologies to combat these evolving fraud tactics and protect identity assets effectively.

Account Origination

First-party fraud in account origination involves individuals using their real identities to misrepresent information and obtain credit or services fraudulently, impacting risk assessment processes directly. Synthetic identity fraud combines real and fabricated information to create new identities, posing greater challenges in verification and detection at the account creation stage. Explore advanced solutions to distinguish and prevent these fraud types effectively.

Credit Reporting

First-party fraud involves individuals providing false information to obtain credit, directly impacting credit reporting accuracy by inflating risk profiles. Synthetic identity fraud combines real and fabricated data to create new identities, leading to complex challenges in distinguishing legitimate credit behavior from fraudulent activity. Explore how advanced credit reporting technologies can detect and mitigate these fraud types effectively.

Source and External Links

What is first-party fraud? Here's what businesses need to know - First-party fraud occurs when individuals or groups misrepresent themselves or manipulate their own accounts to gain financially, including schemes like application fraud, chargeback fraud, synthetic identity fraud, and bust-out schemes.

First-party fraud: what is the difference with third-party fraud? - First-party fraud involves giving false information or misrepresenting oneself to unlawfully benefit financially or obtain goods, with losses exceeding $100 billion and affecting the majority of businesses annually.

What is First-Party Fraud? | Socure - Glossary - First-party fraud is defined as using one's own identity to commit dishonest acts for personal or financial gain, committed by individuals ranging from average consumers to organized groups and insiders, and distinguished from second- and third-party fraud by identity misuse.

dowidth.com

dowidth.com