Stablecoin rails enable seamless, real-time digital currency transactions on blockchain networks, offering increased transparency and lower fees compared to traditional card networks like Visa and Mastercard, which rely on established payment processing infrastructures. These decentralized systems reduce reliance on intermediaries, accelerating cross-border payments and enhancing financial inclusion. Explore the evolving dynamics between stablecoin rails and card networks to understand the future of digital payments.

Why it is important

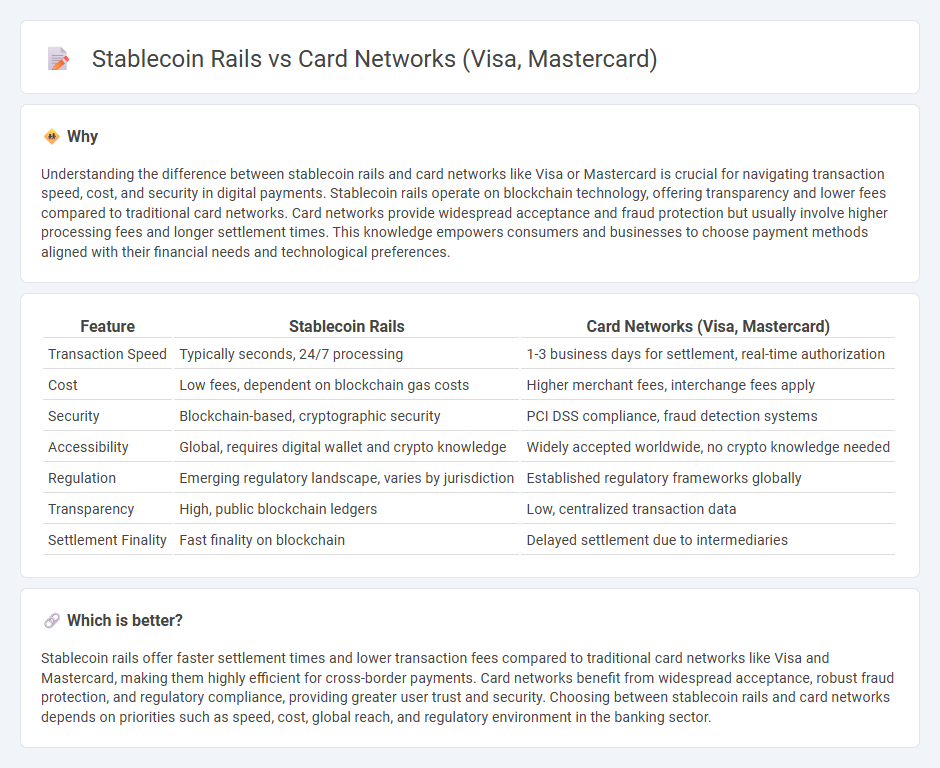

Understanding the difference between stablecoin rails and card networks like Visa or Mastercard is crucial for navigating transaction speed, cost, and security in digital payments. Stablecoin rails operate on blockchain technology, offering transparency and lower fees compared to traditional card networks. Card networks provide widespread acceptance and fraud protection but usually involve higher processing fees and longer settlement times. This knowledge empowers consumers and businesses to choose payment methods aligned with their financial needs and technological preferences.

Comparison Table

| Feature | Stablecoin Rails | Card Networks (Visa, Mastercard) |

|---|---|---|

| Transaction Speed | Typically seconds, 24/7 processing | 1-3 business days for settlement, real-time authorization |

| Cost | Low fees, dependent on blockchain gas costs | Higher merchant fees, interchange fees apply |

| Security | Blockchain-based, cryptographic security | PCI DSS compliance, fraud detection systems |

| Accessibility | Global, requires digital wallet and crypto knowledge | Widely accepted worldwide, no crypto knowledge needed |

| Regulation | Emerging regulatory landscape, varies by jurisdiction | Established regulatory frameworks globally |

| Transparency | High, public blockchain ledgers | Low, centralized transaction data |

| Settlement Finality | Fast finality on blockchain | Delayed settlement due to intermediaries |

Which is better?

Stablecoin rails offer faster settlement times and lower transaction fees compared to traditional card networks like Visa and Mastercard, making them highly efficient for cross-border payments. Card networks benefit from widespread acceptance, robust fraud protection, and regulatory compliance, providing greater user trust and security. Choosing between stablecoin rails and card networks depends on priorities such as speed, cost, global reach, and regulatory environment in the banking sector.

Connection

Stablecoin rails utilize blockchain technology to facilitate fast, secure, and low-cost digital currency transactions, enhancing cross-border payment efficiency within the banking sector. Card networks like Visa and Mastercard are integrating stablecoin rails to enable seamless conversion between fiat and stablecoins, supporting real-time settlement and improving liquidity for merchants and consumers. This synergy promotes interoperability between traditional banking systems and decentralized finance, driving innovation in payment infrastructure.

Key Terms

Interchange Fees

Card networks like Visa and Mastercard charge interchange fees averaging 1.5% to 3% per transaction, supporting extensive payment infrastructure and fraud prevention mechanisms. Stablecoin rails operate with significantly lower transaction costs, often under 1%, by leveraging blockchain technology to enable near-instant, cross-border payments without traditional intermediaries. Explore how the evolving payment landscape impacts merchants and consumers by understanding the nuances of interchange fees on stablecoin networks.

Settlement Layer

Visa and Mastercard operate on traditional payment rails with established settlement layers heavily reliant on banking intermediaries, often resulting in delayed transaction finality. Stablecoin rails leverage blockchain technology to provide near-instantaneous settlement and increased transparency by recording transactions on a decentralized ledger. Explore how stablecoin settlement layers could revolutionize global payments and reduce dependency on legacy card networks.

Tokenization

Card networks such as Visa and Mastercard utilize tokenization to enhance transaction security by replacing sensitive card information with unique digital tokens, reducing fraud risk and ensuring data privacy. Stablecoin rails leverage blockchain technology for instant, transparent settlements and cost-efficient cross-border payments, with tokenization enabling secure management of digital assets within the network. Explore how the evolution of tokenization shapes the future of payment ecosystems and digital finance.

Source and External Links

Payment networks explained | Checkout.com - Visa and Mastercard dominate the global credit card market, facilitating transactions between cardholders, merchants, and banks, with Visa holding a 61.6% US market share and Mastercard about 25.7%.

Visa and Mastercard: The Global Payment Duopoly - Quartr - Visa and Mastercard together account for 90% of global payment processing, leveraging their extensive networks, bank partnerships, and scalable infrastructure to maintain a dominant position.

What Is a Credit Card Network? | Capital One - Visa and Mastercard are two of the four major US credit card networks, connecting card issuers and merchant banks to process transactions quickly and securely.

dowidth.com

dowidth.com