Hyperpersonalization in banking uses real-time data and AI algorithms to deliver tailored financial products and services that meet individual customer needs, enhancing customer engagement and satisfaction. Micro-segmentation divides the customer base into highly specific groups based on behavior, preferences, and demographics, enabling targeted marketing strategies and improved risk management. Explore how these cutting-edge approaches transform customer experiences and operational efficiency in modern banking.

Why it is important

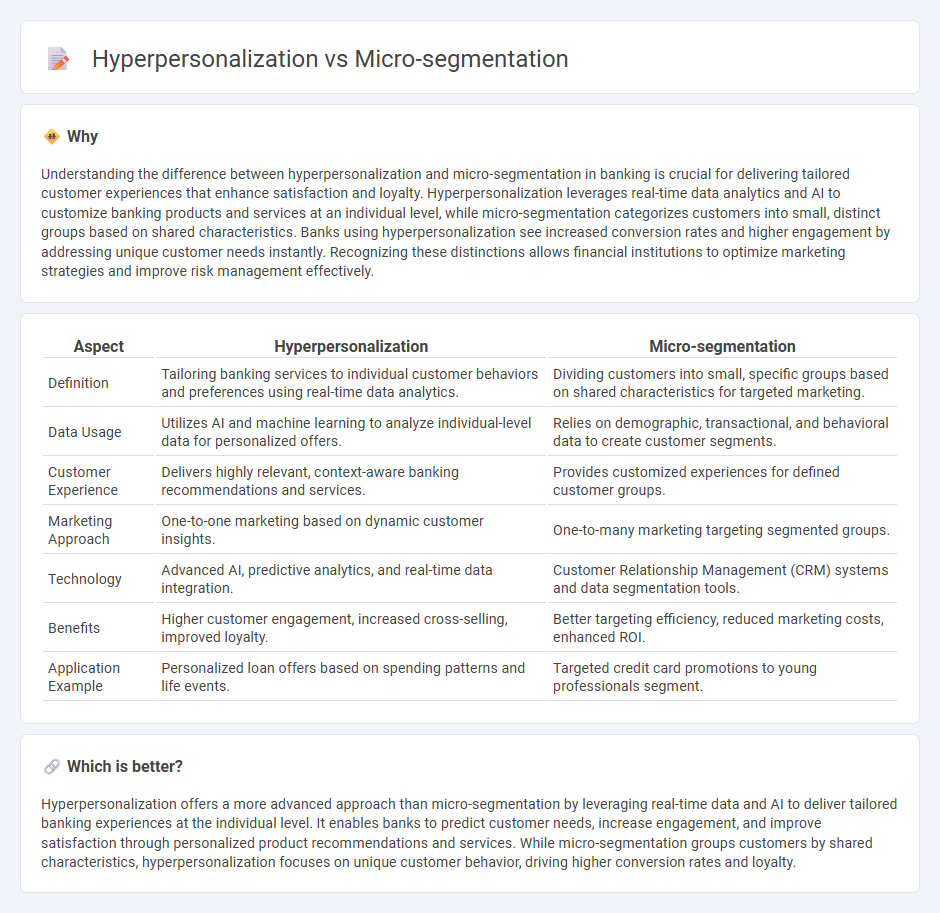

Understanding the difference between hyperpersonalization and micro-segmentation in banking is crucial for delivering tailored customer experiences that enhance satisfaction and loyalty. Hyperpersonalization leverages real-time data analytics and AI to customize banking products and services at an individual level, while micro-segmentation categorizes customers into small, distinct groups based on shared characteristics. Banks using hyperpersonalization see increased conversion rates and higher engagement by addressing unique customer needs instantly. Recognizing these distinctions allows financial institutions to optimize marketing strategies and improve risk management effectively.

Comparison Table

| Aspect | Hyperpersonalization | Micro-segmentation |

|---|---|---|

| Definition | Tailoring banking services to individual customer behaviors and preferences using real-time data analytics. | Dividing customers into small, specific groups based on shared characteristics for targeted marketing. |

| Data Usage | Utilizes AI and machine learning to analyze individual-level data for personalized offers. | Relies on demographic, transactional, and behavioral data to create customer segments. |

| Customer Experience | Delivers highly relevant, context-aware banking recommendations and services. | Provides customized experiences for defined customer groups. |

| Marketing Approach | One-to-one marketing based on dynamic customer insights. | One-to-many marketing targeting segmented groups. |

| Technology | Advanced AI, predictive analytics, and real-time data integration. | Customer Relationship Management (CRM) systems and data segmentation tools. |

| Benefits | Higher customer engagement, increased cross-selling, improved loyalty. | Better targeting efficiency, reduced marketing costs, enhanced ROI. |

| Application Example | Personalized loan offers based on spending patterns and life events. | Targeted credit card promotions to young professionals segment. |

Which is better?

Hyperpersonalization offers a more advanced approach than micro-segmentation by leveraging real-time data and AI to deliver tailored banking experiences at the individual level. It enables banks to predict customer needs, increase engagement, and improve satisfaction through personalized product recommendations and services. While micro-segmentation groups customers by shared characteristics, hyperpersonalization focuses on unique customer behavior, driving higher conversion rates and loyalty.

Connection

Hyperpersonalization in banking leverages advanced data analytics and AI to tailor financial products and services based on individual customer behaviors and preferences. Micro-segmentation divides the customer base into highly specific groups using demographic, psychographic, and transactional data, enabling precise targeting strategies. The integration of hyperpersonalization and micro-segmentation drives enhanced customer engagement, higher conversion rates, and improved customer loyalty in banking.

Key Terms

Customer Profiling

Micro-segmentation divides customers into highly specific groups based on detailed data attributes such as demographics, behavior, and purchase history, enabling targeted marketing strategies. Hyperpersonalization uses real-time data and AI to tailor individual customer experiences dynamically, incorporating factors like browsing behavior, preferences, and contextual signals. Explore the nuances of customer profiling to leverage both techniques effectively for maximizing engagement and conversion rates.

Behavioral Analytics

Micro-segmentation uses detailed behavioral analytics to divide customers into very specific groups based on their actions, preferences, and interactions, enabling more accurate targeting in marketing campaigns. Hyperpersonalization leverages real-time behavioral data and AI algorithms to tailor individual customer experiences and content dynamically, enhancing engagement and conversion rates. Explore the latest advancements in behavioral analytics to see how micro-segmentation and hyperpersonalization can transform your customer strategy.

Tailored Offerings

Micro-segmentation divides customers into narrowly defined groups based on specific behaviors and attributes, enabling highly tailored marketing strategies. Hyperpersonalization uses real-time data and AI to deliver individualized experiences and product recommendations on a one-to-one basis. Discover how integrating both approaches can revolutionize your tailored offerings for maximum customer impact.

Source and External Links

Microsegmentation (network security) - Wikipedia - Microsegmentation is a network security approach that creates per-machine security zones in data centers and cloud deployments to segregate and secure workloads independently, implemented via native OS firewalls, host agents, hypervisor segmentation, or network ACLs.

Cybersecurity 101: Microsegmentation - Illumio - Microsegmentation splits a network into smaller, isolated sections at a granular level such as workloads, applications, or devices to limit attack spread and support Zero Trust security by enforcing strict communication policies.

What is microsegmentation? | Cloudflare - Microsegmentation divides a network into discrete segments with distinct security policies, confining threats to compromised segments to prevent lateral movement, and is a key part of Zero Trust security architectures.

dowidth.com

dowidth.com