Invisible payments leverage advanced technologies like NFC, biometric authentication, and mobile wallets to enable seamless transactions without physical cash or card swipes. These digital payment methods enhance convenience, security, and transaction speed compared to traditional cash payments, which involve physical handling and increased risk of theft or loss. Discover how invisible payments are transforming the future of banking and consumer transactions.

Why it is important

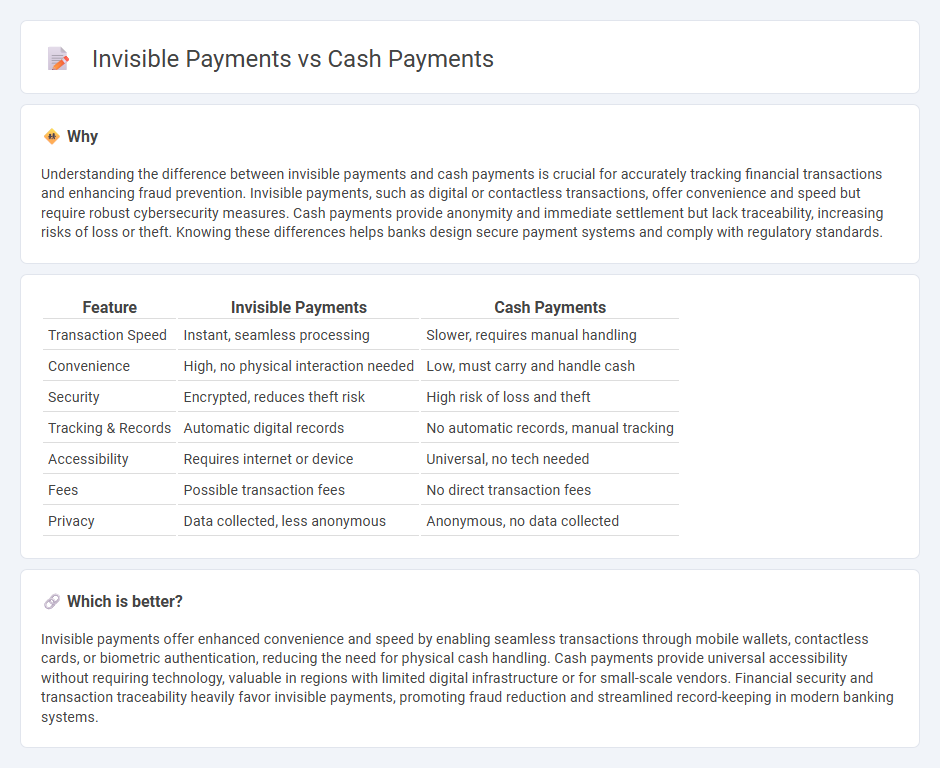

Understanding the difference between invisible payments and cash payments is crucial for accurately tracking financial transactions and enhancing fraud prevention. Invisible payments, such as digital or contactless transactions, offer convenience and speed but require robust cybersecurity measures. Cash payments provide anonymity and immediate settlement but lack traceability, increasing risks of loss or theft. Knowing these differences helps banks design secure payment systems and comply with regulatory standards.

Comparison Table

| Feature | Invisible Payments | Cash Payments |

|---|---|---|

| Transaction Speed | Instant, seamless processing | Slower, requires manual handling |

| Convenience | High, no physical interaction needed | Low, must carry and handle cash |

| Security | Encrypted, reduces theft risk | High risk of loss and theft |

| Tracking & Records | Automatic digital records | No automatic records, manual tracking |

| Accessibility | Requires internet or device | Universal, no tech needed |

| Fees | Possible transaction fees | No direct transaction fees |

| Privacy | Data collected, less anonymous | Anonymous, no data collected |

Which is better?

Invisible payments offer enhanced convenience and speed by enabling seamless transactions through mobile wallets, contactless cards, or biometric authentication, reducing the need for physical cash handling. Cash payments provide universal accessibility without requiring technology, valuable in regions with limited digital infrastructure or for small-scale vendors. Financial security and transaction traceability heavily favor invisible payments, promoting fraud reduction and streamlined record-keeping in modern banking systems.

Connection

Invisible payments leverage technologies like NFC, RFID, and biometric authentication to facilitate seamless cashless transactions, reducing reliance on physical cash. Cash payments still play a critical role in economies with limited digital infrastructure, highlighting the ongoing interplay between traditional currency and emerging payment innovations. The integration of invisible payments aims to enhance consumer convenience while maintaining the accessibility and acceptance of cash in diverse banking ecosystems.

Key Terms

Physical Currency

Physical currency transactions remain a fundamental aspect of cash payments, offering anonymity and immediate settlement without relying on digital infrastructure. Cash payments involving bills and coins enable seamless peer-to-peer exchanges and are widely accepted globally, particularly in areas with limited banking access. Explore the evolving role of physical currency in the modern economy to understand its ongoing relevance amidst rising digital payment trends.

Electronic Transfers

Electronic transfers dominate modern financial transactions by enabling secure, instant, and traceable payments without physical cash exchange. These invisible payments, including wire transfers, ACH, and mobile wallets, reduce fraud risks and enhance transactional efficiency compared to traditional cash payments. Explore more about how electronic transfers are reshaping payment ecosystems and driving financial inclusion.

Remittances

Cash payments in remittances provide immediate liquidity and are accessible in regions with limited digital infrastructure, enabling unbanked populations to receive funds securely. Invisible payments leverage digital channels such as mobile wallets and direct bank deposits, enhancing transaction speed, reducing costs, and increasing transparency in cross-border transfers. Explore the evolving landscape of cash and invisible payment methods to understand their impact on global remittance efficiency.

Source and External Links

Cash payment definition - AccountingTools - A cash payment is the physical exchange of bills or coins for goods or services, with key advantages including immediate completion, no fees, privacy, universal acceptance, no need for technology, and reduced fraud risk.

Cash Transaction: What is a Cash Payment and How it Works? - Cash transactions involve paying with physical currency at the time of purchase, ideal for small-value, immediate payments and widely accepted despite the rise of electronic methods.

The Advantages and Disadvantages of Cash Payment - PayComplete - Cash payments are widely accepted and provide immediate settlement and greater privacy, making them valuable for small businesses and consumers wary of data tracking.

dowidth.com

dowidth.com