Robo advisors utilize advanced algorithms and artificial intelligence to provide automated, low-cost investment management tailored to individual risk profiles, while traditional wealth managers offer personalized, human-driven financial planning and advice with face-to-face interaction. Robo advisors typically appeal to tech-savvy investors seeking convenience and lower fees, whereas traditional wealth managers cater to clients valuing customized strategies and comprehensive wealth services. Explore the differences in service models and outcomes to determine the best approach for your financial goals.

Why it is important

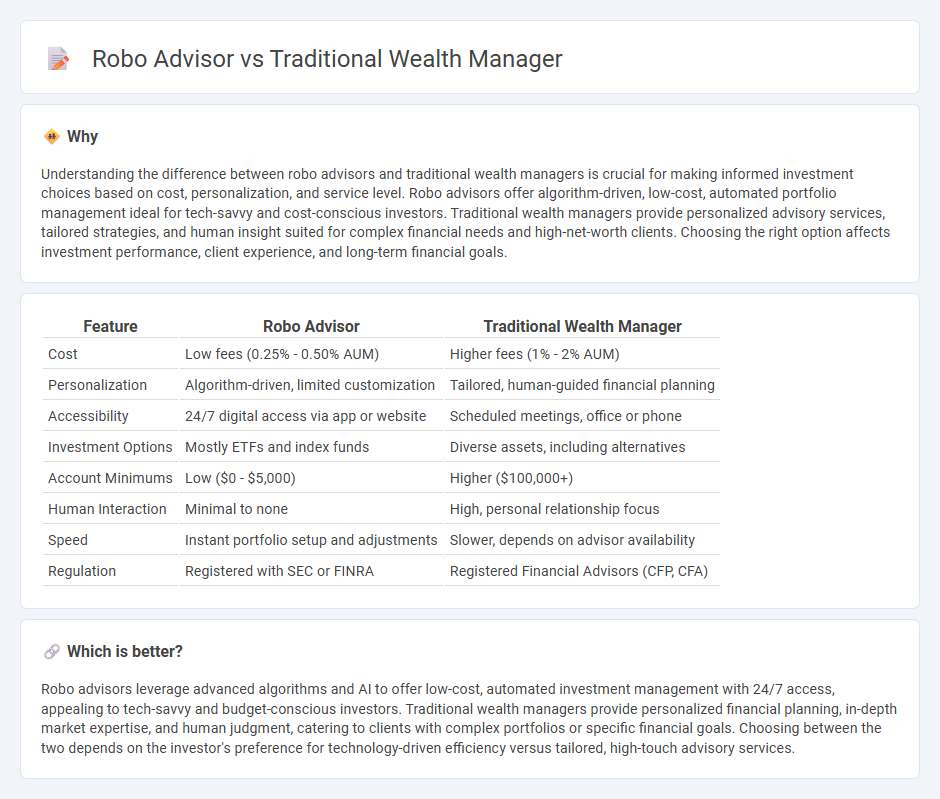

Understanding the difference between robo advisors and traditional wealth managers is crucial for making informed investment choices based on cost, personalization, and service level. Robo advisors offer algorithm-driven, low-cost, automated portfolio management ideal for tech-savvy and cost-conscious investors. Traditional wealth managers provide personalized advisory services, tailored strategies, and human insight suited for complex financial needs and high-net-worth clients. Choosing the right option affects investment performance, client experience, and long-term financial goals.

Comparison Table

| Feature | Robo Advisor | Traditional Wealth Manager |

|---|---|---|

| Cost | Low fees (0.25% - 0.50% AUM) | Higher fees (1% - 2% AUM) |

| Personalization | Algorithm-driven, limited customization | Tailored, human-guided financial planning |

| Accessibility | 24/7 digital access via app or website | Scheduled meetings, office or phone |

| Investment Options | Mostly ETFs and index funds | Diverse assets, including alternatives |

| Account Minimums | Low ($0 - $5,000) | Higher ($100,000+) |

| Human Interaction | Minimal to none | High, personal relationship focus |

| Speed | Instant portfolio setup and adjustments | Slower, depends on advisor availability |

| Regulation | Registered with SEC or FINRA | Registered Financial Advisors (CFP, CFA) |

Which is better?

Robo advisors leverage advanced algorithms and AI to offer low-cost, automated investment management with 24/7 access, appealing to tech-savvy and budget-conscious investors. Traditional wealth managers provide personalized financial planning, in-depth market expertise, and human judgment, catering to clients with complex portfolios or specific financial goals. Choosing between the two depends on the investor's preference for technology-driven efficiency versus tailored, high-touch advisory services.

Connection

Robo advisors and traditional wealth managers are connected through their shared goal of optimizing investment strategies and enhancing portfolio management for clients. Robo advisors leverage algorithms and AI to provide automated, low-cost financial advice, while traditional wealth managers offer personalized, human-driven insights and relationship-based services. This integration allows clients to benefit from efficient digital tools combined with expert financial planning and tailored wealth management solutions.

Key Terms

Human Advisory

Traditional wealth managers offer personalized financial planning through human advisory, providing tailored investment strategies based on individual goals and risk tolerance. Robo advisors leverage algorithms and automated processes to deliver cost-effective, scalable portfolio management with minimal human interaction. Explore how human advisory enhances client experience and investment outcomes by learning more about traditional wealth management.

Automated Algorithms

Traditional wealth managers rely on personalized advice and human expertise to create tailored financial plans. Robo advisors utilize automated algorithms and machine learning to provide cost-effective, data-driven investment strategies with minimal human intervention. Explore how automated algorithms reshape wealth management and investment opportunities today.

Personalization

Traditional wealth managers offer highly personalized financial planning by tailoring strategies to individual goals, risk tolerance, and life events through direct human interaction. Robo advisors utilize algorithms and AI to provide automated portfolio management with limited customization based on client-inputted data and risk profiles. Explore the differences in personalization to determine which investment approach suits your unique financial needs.

Source and External Links

How Wealth Management Differs from Traditional Financial Roles - Traditional financial roles often focus on transactional advice, while traditional wealth managers provide a more holistic, client-centric approach that integrates investment management, risk assessment, retirement planning, and long-term financial strategies tailored to individual client needs.

The Difference Between Family Office vs. Wealth Management - Traditional wealth management primarily centers on investment advisory and financial planning, offering services like asset allocation and retirement planning, but with less customization and depth than family offices, which may also handle family governance and legacy planning.

Wealth management - Traditional wealth management services include structuring and planning wealth to assist in growing, preserving, and protecting assets, typically delivered to mass affluent or high-net-worth clients by large financial institutions, independent advisers, or portfolio managers, often with varying degrees of customization depending on client assets.

dowidth.com

dowidth.com