Digital onboarding streamlines the account opening process by enabling customers to complete verification and document submission remotely via secure mobile apps or websites. Self-service kiosks enhance in-branch experiences by providing interactive terminals for quick transactions, identity verification, and application processing without staff assistance. Explore the benefits and efficiency of these technologies in modern banking.

Why it is important

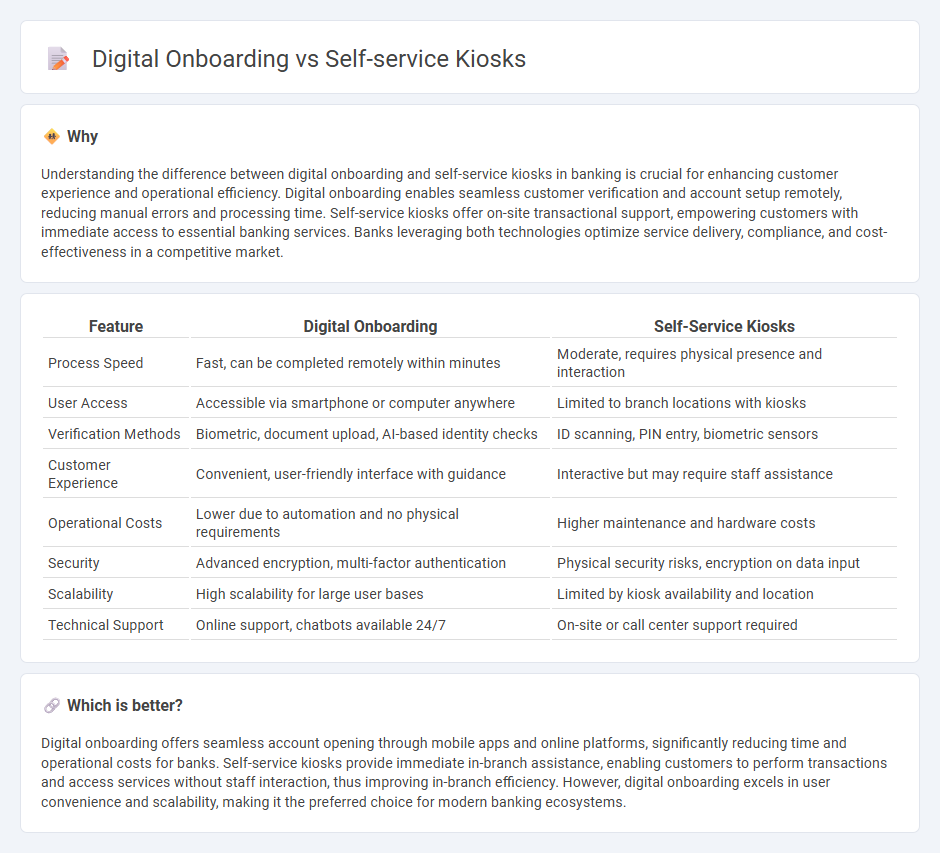

Understanding the difference between digital onboarding and self-service kiosks in banking is crucial for enhancing customer experience and operational efficiency. Digital onboarding enables seamless customer verification and account setup remotely, reducing manual errors and processing time. Self-service kiosks offer on-site transactional support, empowering customers with immediate access to essential banking services. Banks leveraging both technologies optimize service delivery, compliance, and cost-effectiveness in a competitive market.

Comparison Table

| Feature | Digital Onboarding | Self-Service Kiosks |

|---|---|---|

| Process Speed | Fast, can be completed remotely within minutes | Moderate, requires physical presence and interaction |

| User Access | Accessible via smartphone or computer anywhere | Limited to branch locations with kiosks |

| Verification Methods | Biometric, document upload, AI-based identity checks | ID scanning, PIN entry, biometric sensors |

| Customer Experience | Convenient, user-friendly interface with guidance | Interactive but may require staff assistance |

| Operational Costs | Lower due to automation and no physical requirements | Higher maintenance and hardware costs |

| Security | Advanced encryption, multi-factor authentication | Physical security risks, encryption on data input |

| Scalability | High scalability for large user bases | Limited by kiosk availability and location |

| Technical Support | Online support, chatbots available 24/7 | On-site or call center support required |

Which is better?

Digital onboarding offers seamless account opening through mobile apps and online platforms, significantly reducing time and operational costs for banks. Self-service kiosks provide immediate in-branch assistance, enabling customers to perform transactions and access services without staff interaction, thus improving in-branch efficiency. However, digital onboarding excels in user convenience and scalability, making it the preferred choice for modern banking ecosystems.

Connection

Digital onboarding streamlines customer account creation by enabling identity verification and document submission through online platforms, reducing branch visit necessity. Self-service kiosks complement this process by providing accessible, automated stations within or near branches for customers to complete onboarding tasks independently. Both technologies enhance operational efficiency, improve customer experience, and accelerate account activation in modern banking.

Key Terms

Authentication

Self-service kiosks utilize biometric and document scanning technologies to authenticate users efficiently in physical locations, ensuring quick identity verification for services like banking or retail. Digital onboarding relies heavily on AI-driven facial recognition and multi-factor authentication to securely verify identities remotely, enhancing user experience and reducing fraud risk. Explore deeper into how authentication methods shape customer trust and operational security in both systems.

Biometric Verification

Self-service kiosks and digital onboarding both leverage biometric verification to enhance security and user convenience, with kiosks often using fingerprint or facial recognition directly on-site, while digital onboarding integrates biometric data capture within remote identity verification processes. Biometric verification ensures accurate identity authentication, reduces fraud, and speeds up user access in sectors like banking, healthcare, and travel. Explore how biometric solutions optimize these platforms for improved security and user experience.

User Interface

Self-service kiosks feature tactile interfaces with physical buttons and touchscreens designed for quick, intuitive interactions in public spaces, while digital onboarding emphasizes seamless, personalized UI across multiple devices for remote accessibility. Effective user interface design for kiosks prioritizes simplicity and clear navigation to accommodate diverse users, whereas digital onboarding interfaces leverage adaptive layouts and guided workflows to enhance user engagement and data accuracy. Explore detailed comparisons to optimize user interface strategies for both self-service kiosks and digital onboarding systems.

Source and External Links

Self Service Kiosks | Elo(r) Official Website - Elo offers modular self-service kiosks for self-ordering, self-checkout, and visitor check-in, enabling businesses to boost throughput, reduce wait times, and empower customers with more control over their experience.

Self Service Kiosks 101 - Self-service kiosks are interactive touchscreen devices used for ordering, checkout, visitor check-in, product information, customer registration, loyalty programs, and wayfinding in various business environments.

Self-Service Kiosks: How They Could Work for Your Business - Self-service kiosks allow customers to buy products or services without staff assistance, improving order accuracy, reducing labor costs, and enhancing the customer experience by enabling faster, more controlled transactions.

dowidth.com

dowidth.com