Loyalty fintech companies leverage advanced technology and personalized rewards programs to enhance customer engagement and retention in contrast to traditional incumbent banks reliant on legacy systems and standard loyalty approaches. These fintech firms utilize data analytics and seamless user experiences to offer tailored financial incentives that drive higher satisfaction and long-term loyalty. Discover more about how loyalty fintech is reshaping customer relationships in the banking sector.

Why it is important

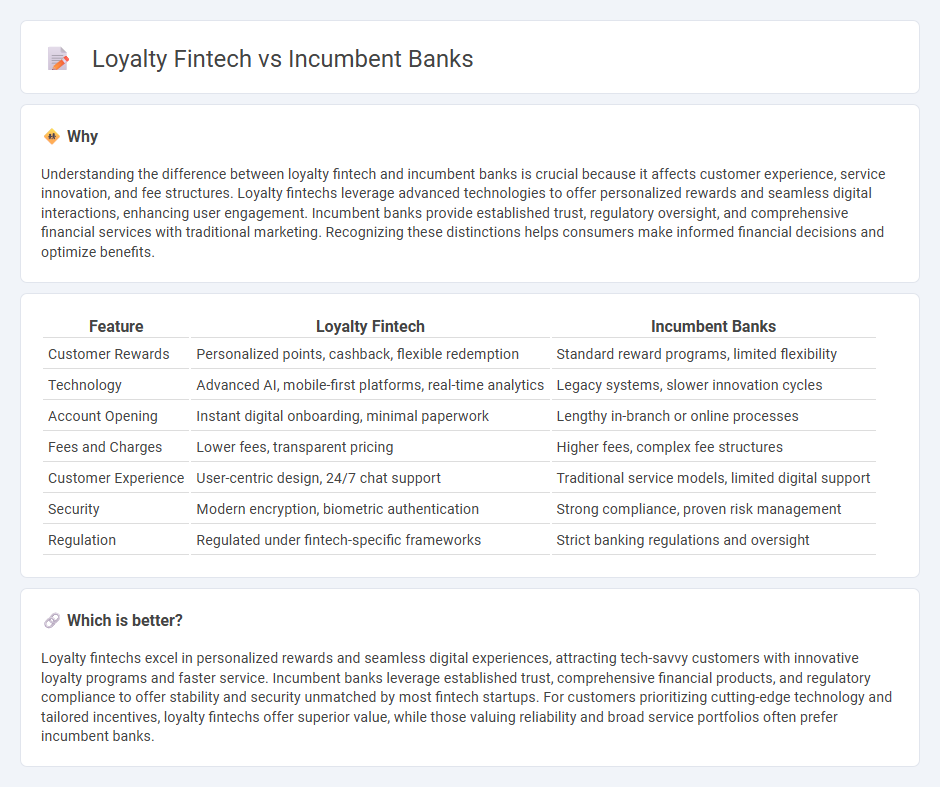

Understanding the difference between loyalty fintech and incumbent banks is crucial because it affects customer experience, service innovation, and fee structures. Loyalty fintechs leverage advanced technologies to offer personalized rewards and seamless digital interactions, enhancing user engagement. Incumbent banks provide established trust, regulatory oversight, and comprehensive financial services with traditional marketing. Recognizing these distinctions helps consumers make informed financial decisions and optimize benefits.

Comparison Table

| Feature | Loyalty Fintech | Incumbent Banks |

|---|---|---|

| Customer Rewards | Personalized points, cashback, flexible redemption | Standard reward programs, limited flexibility |

| Technology | Advanced AI, mobile-first platforms, real-time analytics | Legacy systems, slower innovation cycles |

| Account Opening | Instant digital onboarding, minimal paperwork | Lengthy in-branch or online processes |

| Fees and Charges | Lower fees, transparent pricing | Higher fees, complex fee structures |

| Customer Experience | User-centric design, 24/7 chat support | Traditional service models, limited digital support |

| Security | Modern encryption, biometric authentication | Strong compliance, proven risk management |

| Regulation | Regulated under fintech-specific frameworks | Strict banking regulations and oversight |

Which is better?

Loyalty fintechs excel in personalized rewards and seamless digital experiences, attracting tech-savvy customers with innovative loyalty programs and faster service. Incumbent banks leverage established trust, comprehensive financial products, and regulatory compliance to offer stability and security unmatched by most fintech startups. For customers prioritizing cutting-edge technology and tailored incentives, loyalty fintechs offer superior value, while those valuing reliability and broad service portfolios often prefer incumbent banks.

Connection

Loyalty fintech platforms enhance customer engagement by integrating personalized rewards and data-driven insights within incumbent banks' services, driving retention and increasing transaction frequency. Incumbent banks leverage fintech solutions to modernize loyalty programs, utilizing AI and blockchain technology to offer seamless, secure, and transparent reward systems. Collaboration between fintech innovators and traditional banks fosters a competitive edge by combining trusted banking infrastructure with agile, customer-centric loyalty experiences.

Key Terms

Legacy Systems

Incumbent banks often struggle with legacy systems that hinder innovation and slow down the delivery of new financial services, creating operational inefficiencies and higher maintenance costs. Loyalty fintech companies leverage modern, cloud-based architectures to provide seamless, customer-centric loyalty solutions that integrate easily with digital wallets and CRM platforms. Explore how these technological differences impact customer retention and competitive advantage in the evolving financial landscape.

Customer Retention

Incumbent banks often rely on traditional loyalty programs and established trust to retain customers, leveraging their extensive branch networks and comprehensive financial product offerings. Loyalty fintech companies, however, utilize advanced data analytics, personalized rewards, and user-friendly digital experiences to enhance customer engagement and retention more dynamically. Explore how innovative fintech solutions are reshaping customer loyalty strategies in the financial sector.

Digital Innovation

Incumbent banks leverage established customer bases and regulatory expertise but often face challenges in rapidly adopting cutting-edge digital innovations. Loyalty fintech companies prioritize personalized rewards and seamless user experiences through advanced AI-driven platforms and blockchain technology to enhance customer retention. Explore how digital innovation shapes the competitive landscape between incumbent banks and loyalty fintech.

Source and External Links

incumbent banks - Reports, Statistics & Marketing Trends - eMarketer - Incumbent banks dominate digital account openings, with 92.3% of 5.2 million digital accounts opened in 2023 belonging to them, outperforming digital-only banks amid economic uncertainty.

Banking-as-a-Service and how incumbent banks can benefit - Utimaco - Incumbent banks face competition from FinTechs but can leverage Banking-as-a-Service and embedded finance models through digitization, automation, and partnerships, despite losing some trust advantage.

Disrupting the disruptors: Business building for banks - McKinsey - Incumbent banks can compete with new entrants by leveraging their resources to offer digital-first services, embedded finance, and platform models while balancing innovation with their established strengths.

dowidth.com

dowidth.com