Personal finance automation streamlines budgeting by utilizing apps and software to track income, expenses, and savings goals in real-time, significantly reducing human error and time investment. Manual budgeting requires careful record-keeping and regular updates, offering greater control but increasing the risk of oversight. Explore how integrating automation can enhance your financial planning efficiency and accuracy.

Why it is important

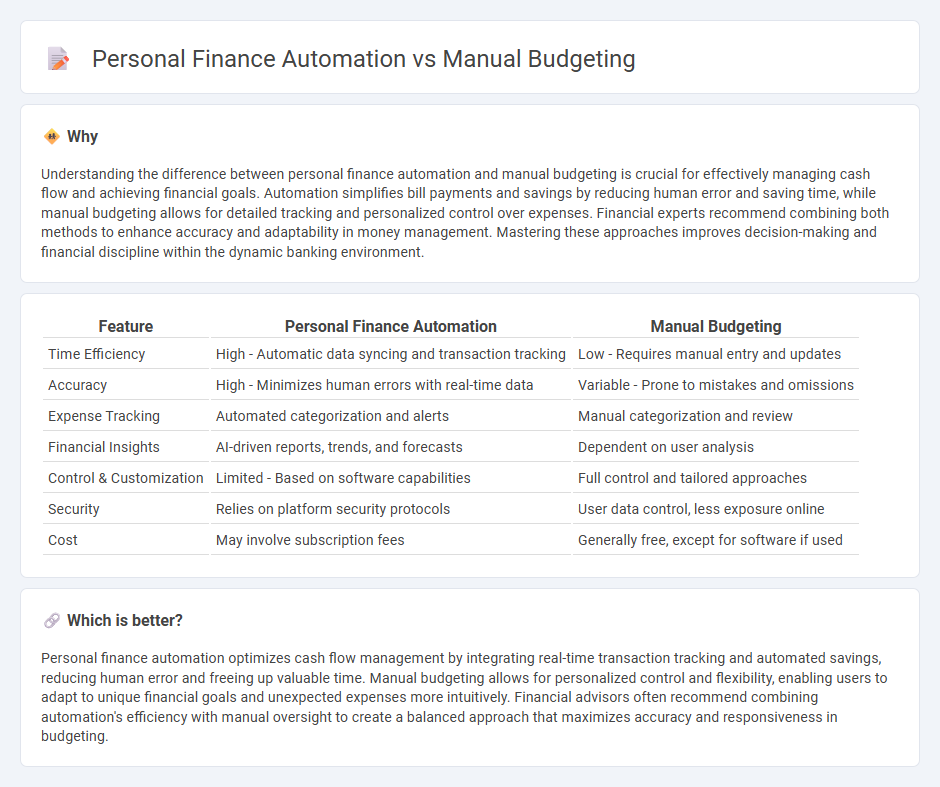

Understanding the difference between personal finance automation and manual budgeting is crucial for effectively managing cash flow and achieving financial goals. Automation simplifies bill payments and savings by reducing human error and saving time, while manual budgeting allows for detailed tracking and personalized control over expenses. Financial experts recommend combining both methods to enhance accuracy and adaptability in money management. Mastering these approaches improves decision-making and financial discipline within the dynamic banking environment.

Comparison Table

| Feature | Personal Finance Automation | Manual Budgeting |

|---|---|---|

| Time Efficiency | High - Automatic data syncing and transaction tracking | Low - Requires manual entry and updates |

| Accuracy | High - Minimizes human errors with real-time data | Variable - Prone to mistakes and omissions |

| Expense Tracking | Automated categorization and alerts | Manual categorization and review |

| Financial Insights | AI-driven reports, trends, and forecasts | Dependent on user analysis |

| Control & Customization | Limited - Based on software capabilities | Full control and tailored approaches |

| Security | Relies on platform security protocols | User data control, less exposure online |

| Cost | May involve subscription fees | Generally free, except for software if used |

Which is better?

Personal finance automation optimizes cash flow management by integrating real-time transaction tracking and automated savings, reducing human error and freeing up valuable time. Manual budgeting allows for personalized control and flexibility, enabling users to adapt to unique financial goals and unexpected expenses more intuitively. Financial advisors often recommend combining automation's efficiency with manual oversight to create a balanced approach that maximizes accuracy and responsiveness in budgeting.

Connection

Personal finance automation leverages technology to track expenses, categorize transactions, and generate reports, enhancing the accuracy and efficiency of manual budgeting. By integrating automated data collection with manual budget adjustments, individuals gain real-time insights and greater control over their financial goals. This synergy improves cash flow management, reduces human error, and encourages disciplined spending habits.

Key Terms

Expense Tracking

Manual budgeting involves tracking expenses by recording each transaction manually, providing detailed control but requiring significant time and effort. Personal finance automation leverages software to automatically categorize and monitor expenses, increasing accuracy and saving time through real-time updates. Explore how these approaches impact your financial management efficiency and decision-making.

Categorization

Manual budgeting requires individuals to categorize expenses and income manually, which can be time-consuming and prone to errors. Personal finance automation uses AI-driven tools to automatically categorize transactions with high accuracy, enabling real-time insights into spending patterns. Explore how categorization in personal finance automation can streamline your budget management.

Reconciliation

Manual budgeting requires detailed tracking of each expense and income to ensure accurate reconciliation, often involving spreadsheets or paper records. Personal finance automation streamlines reconciliation by automatically categorizing transactions and syncing bank accounts, reducing errors and saving time. Explore how automation can enhance your reconciliation process and improve financial accuracy.

Source and External Links

Your guide to creating a budget plan - Better Money Habits - Manual budgeting involves calculating your net income, tracking your spending carefully (using pen and paper or spreadsheets), grouping fixed and variable expenses, and then creating a budget plan based on realistic goals and detailed expense tracking.

Free Budget Template and Tips For Getting Started - NerdWallet - A manual budgeting approach can use printable worksheets or spreadsheets where you enter your income, fixed expenses, variable costs, and debts to plan spending and savings, often guided by budgeting rules like the 50/30/20 rule.

Budget planner | Free online budget planning tool - MoneyHelper - Manual budgeting requires gathering financial documents such as payslips, bank statements, and bills to accurately list all income and outgoings, then totaling them to see what money remains and identify possible savings.

dowidth.com

dowidth.com