Core banking modernization focuses on upgrading legacy systems to enhance processing speed, security, and scalability, enabling banks to handle high volumes of transactions efficiently. Omnichannel banking integrates multiple customer touchpoints, such as mobile apps, ATMs, and branch services, to deliver a seamless and consistent user experience across all platforms. Explore how these advancements are transforming the banking industry to meet evolving customer expectations and regulatory demands.

Why it is important

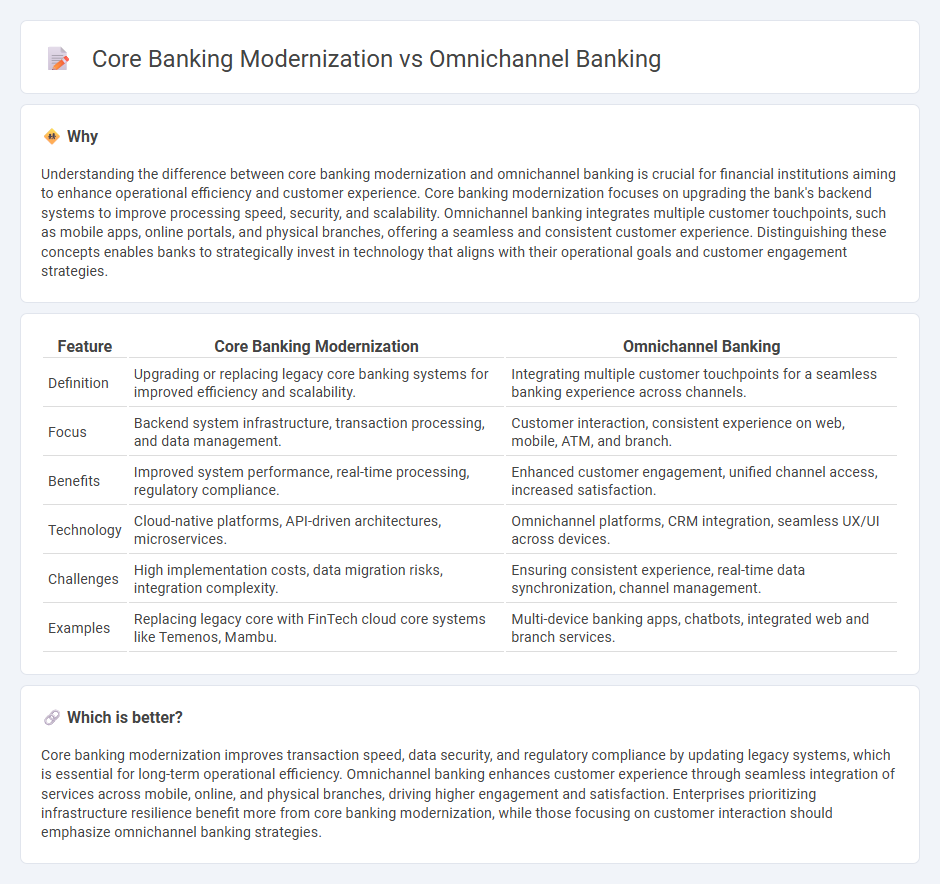

Understanding the difference between core banking modernization and omnichannel banking is crucial for financial institutions aiming to enhance operational efficiency and customer experience. Core banking modernization focuses on upgrading the bank's backend systems to improve processing speed, security, and scalability. Omnichannel banking integrates multiple customer touchpoints, such as mobile apps, online portals, and physical branches, offering a seamless and consistent customer experience. Distinguishing these concepts enables banks to strategically invest in technology that aligns with their operational goals and customer engagement strategies.

Comparison Table

| Feature | Core Banking Modernization | Omnichannel Banking |

|---|---|---|

| Definition | Upgrading or replacing legacy core banking systems for improved efficiency and scalability. | Integrating multiple customer touchpoints for a seamless banking experience across channels. |

| Focus | Backend system infrastructure, transaction processing, and data management. | Customer interaction, consistent experience on web, mobile, ATM, and branch. |

| Benefits | Improved system performance, real-time processing, regulatory compliance. | Enhanced customer engagement, unified channel access, increased satisfaction. |

| Technology | Cloud-native platforms, API-driven architectures, microservices. | Omnichannel platforms, CRM integration, seamless UX/UI across devices. |

| Challenges | High implementation costs, data migration risks, integration complexity. | Ensuring consistent experience, real-time data synchronization, channel management. |

| Examples | Replacing legacy core with FinTech cloud core systems like Temenos, Mambu. | Multi-device banking apps, chatbots, integrated web and branch services. |

Which is better?

Core banking modernization improves transaction speed, data security, and regulatory compliance by updating legacy systems, which is essential for long-term operational efficiency. Omnichannel banking enhances customer experience through seamless integration of services across mobile, online, and physical branches, driving higher engagement and satisfaction. Enterprises prioritizing infrastructure resilience benefit more from core banking modernization, while those focusing on customer interaction should emphasize omnichannel banking strategies.

Connection

Core banking modernization enables seamless integration of systems and real-time data processing, which is essential for delivering a consistent Omnichannel banking experience across branches, mobile apps, ATMs, and online platforms. This modernization supports scalable infrastructure and enhanced APIs, allowing banks to provide personalized services and improve customer engagement through synchronized channels. By upgrading core banking systems, financial institutions can effectively meet the growing demand for unified, convenient, and efficient banking interactions.

Key Terms

Customer Experience Integration

Omnichannel banking enhances customer experience by providing seamless access across multiple channels such as mobile, web, and branch services, while core banking modernization updates backend systems for improved efficiency and agility. Integrating omnichannel solutions with modernized core banking platforms enables real-time data synchronization, personalized services, and consistent user experiences. Explore how combining these strategies drives superior customer satisfaction and operational success.

Legacy System Transformation

Omnichannel banking integrates multiple customer touchpoints into a seamless experience, while core banking modernization targets upgrading legacy systems to improve operational efficiency and scalability. Legacy system transformation involves migrating outdated infrastructure to cloud-based platforms, enhancing real-time data access and reducing maintenance costs. Explore how combining omnichannel strategies with core banking modernization drives digital transformation in financial institutions.

Digital Platform Scalability

Omnichannel banking enhances customer experience by integrating multiple channels into a seamless interface, boosting engagement and driving revenue growth. Core banking modernization ensures a scalable digital platform capable of handling increased transaction volumes, reducing downtime, and supporting agile innovation. Discover how leveraging scalable digital platforms can transform your banking operations and customer interactions.

Source and External Links

Omnichannel Banking: What & Why does It Matters in 2025 - Omnichannel banking integrates various channels like online, mobile, in-person, and digital assistants to provide customers a seamless experience, allowing them to access banking services anytime, anywhere with consistent support.

Omnichannel Banking Strategy: A Guide to Integrated Banking CX - Omnichannel banking enhances customer satisfaction and loyalty by offering seamless digital integration and consistent service across channels, while helping banks gain data-driven insights and operational efficiency.

What is Omnichannel Banking, and How Does it Grow Revenue? - Omnichannel banking connects mobile apps, online banking, ATMs, and branches into a single, smooth experience, enabling customers to switch channels without disruption, which improves convenience, retention, and revenue growth.

dowidth.com

dowidth.com