Digital identity verification leverages biometric data, AI algorithms, and secure databases to authenticate customers quickly and reduce fraud risk compared to traditional physical KYC methods, which require in-person document checks and manual validation. Digital methods enhance customer experience by enabling instant access to banking services, while physical KYC remains necessary in certain jurisdictions for compliance with regulatory standards. Explore the advances in digital identity verification to understand its impact on modern banking security and efficiency.

Why it is important

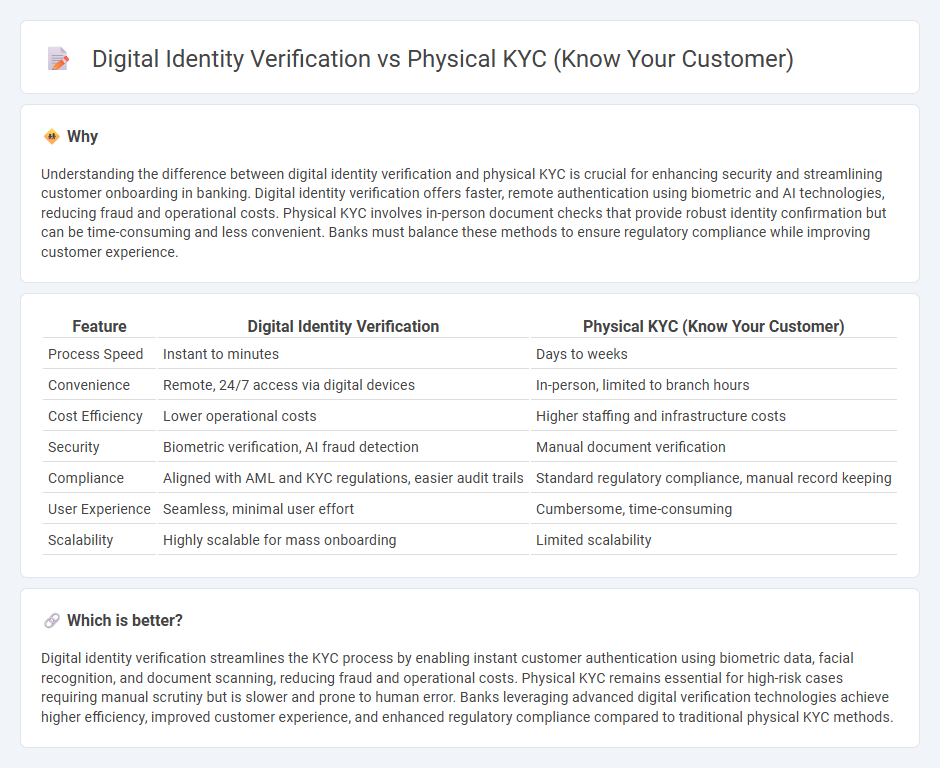

Understanding the difference between digital identity verification and physical KYC is crucial for enhancing security and streamlining customer onboarding in banking. Digital identity verification offers faster, remote authentication using biometric and AI technologies, reducing fraud and operational costs. Physical KYC involves in-person document checks that provide robust identity confirmation but can be time-consuming and less convenient. Banks must balance these methods to ensure regulatory compliance while improving customer experience.

Comparison Table

| Feature | Digital Identity Verification | Physical KYC (Know Your Customer) |

|---|---|---|

| Process Speed | Instant to minutes | Days to weeks |

| Convenience | Remote, 24/7 access via digital devices | In-person, limited to branch hours |

| Cost Efficiency | Lower operational costs | Higher staffing and infrastructure costs |

| Security | Biometric verification, AI fraud detection | Manual document verification |

| Compliance | Aligned with AML and KYC regulations, easier audit trails | Standard regulatory compliance, manual record keeping |

| User Experience | Seamless, minimal user effort | Cumbersome, time-consuming |

| Scalability | Highly scalable for mass onboarding | Limited scalability |

Which is better?

Digital identity verification streamlines the KYC process by enabling instant customer authentication using biometric data, facial recognition, and document scanning, reducing fraud and operational costs. Physical KYC remains essential for high-risk cases requiring manual scrutiny but is slower and prone to human error. Banks leveraging advanced digital verification technologies achieve higher efficiency, improved customer experience, and enhanced regulatory compliance compared to traditional physical KYC methods.

Connection

Digital identity verification enhances the efficiency of physical KYC (Know Your Customer) processes by enabling rapid authentication of customer information and reducing fraud risks. Banks integrate biometric data, government-issued ID scans, and AI-driven liveness detection to validate identities during physical KYC procedures. This combination streamlines compliance with regulatory standards such as AML (Anti-Money Laundering) and GDPR, ensuring secure and accurate customer onboarding.

Key Terms

Document Verification

Physical KYC relies on manual inspection of government-issued documents such as passports and driver's licenses, which can be time-consuming and prone to human error. Digital identity verification employs AI-powered document verification technology to authenticate IDs quickly and accurately, using OCR and biometric checks to detect forgery and fraud. Explore how document verification transforms KYC processes with enhanced security and efficiency.

Biometric Authentication

Physical KYC involves in-person identity verification through document inspection, while digital identity verification utilizes biometric authentication such as fingerprint or facial recognition for remote and instant validation. Biometric authentication enhances security by providing unique, hard-to-forge identifiers, reducing fraud risks compared to traditional physical checks. Explore the latest advancements in biometric authentication technology to understand how it transforms identity verification processes.

In-person Verification

In-person verification within physical KYC processes involves direct interaction between the customer and verification agent, ensuring authenticity through biometric checks, document inspection, and live presence validation. This method reduces fraud risks by capturing real-time data and preventing identity theft compared to digital identity verification, which relies on electronic data and remote verification tools. Explore more about how in-person verification enhances security and compliance in KYC frameworks.

Source and External Links

KYC Verification: Full Guide to Know Your Customer Compliance - Physical KYC involves collecting and verifying customer identity documents such as ID cards, proof of address, and verifying these through in-person checks including liveness and document authenticity to comply with regulatory requirements and risk assessment steps.

What is Know Your Customer (KYC)? - Socure Glossary - Physical KYC requires customers to provide physical identification documents such as passports or national IDs, which are manually verified to confirm their identity and conduct customer due diligence and risk assessment.

KYC: What It Is, Types, Process & Who Needs It | Ondato Blog - Physical KYC, also called in-person verification, requires the customer's physical presence to present identity documents for biometric validation and document authenticity checks conducted by humans or assisted through technology for secure personal identification.

dowidth.com

dowidth.com