Sustainable banking focuses on financing projects that promote environmental, social, and governance (ESG) goals, aiming to support long-term ecological balance and social equity. Corporate banking primarily serves large businesses by providing tailored financial products such as loans, treasury management, and investment services to fuel growth and operational efficiency. Explore how these two banking approaches meet evolving client needs and contribute to economic resilience.

Why it is important

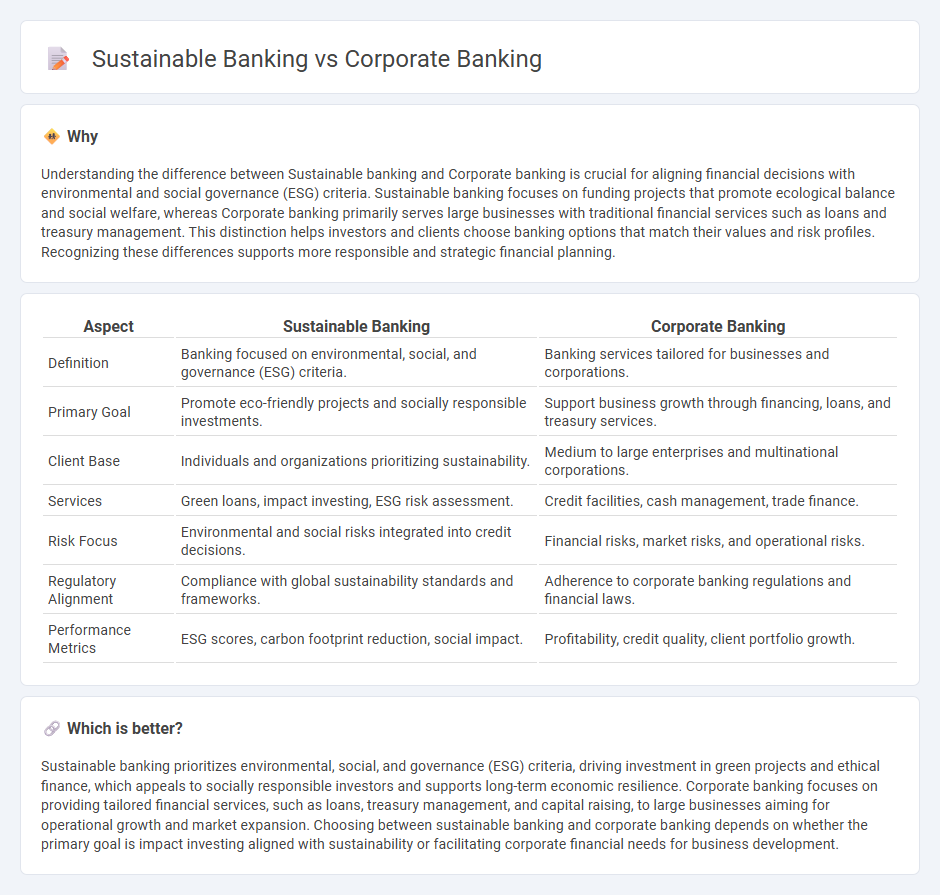

Understanding the difference between Sustainable banking and Corporate banking is crucial for aligning financial decisions with environmental and social governance (ESG) criteria. Sustainable banking focuses on funding projects that promote ecological balance and social welfare, whereas Corporate banking primarily serves large businesses with traditional financial services such as loans and treasury management. This distinction helps investors and clients choose banking options that match their values and risk profiles. Recognizing these differences supports more responsible and strategic financial planning.

Comparison Table

| Aspect | Sustainable Banking | Corporate Banking |

|---|---|---|

| Definition | Banking focused on environmental, social, and governance (ESG) criteria. | Banking services tailored for businesses and corporations. |

| Primary Goal | Promote eco-friendly projects and socially responsible investments. | Support business growth through financing, loans, and treasury services. |

| Client Base | Individuals and organizations prioritizing sustainability. | Medium to large enterprises and multinational corporations. |

| Services | Green loans, impact investing, ESG risk assessment. | Credit facilities, cash management, trade finance. |

| Risk Focus | Environmental and social risks integrated into credit decisions. | Financial risks, market risks, and operational risks. |

| Regulatory Alignment | Compliance with global sustainability standards and frameworks. | Adherence to corporate banking regulations and financial laws. |

| Performance Metrics | ESG scores, carbon footprint reduction, social impact. | Profitability, credit quality, client portfolio growth. |

Which is better?

Sustainable banking prioritizes environmental, social, and governance (ESG) criteria, driving investment in green projects and ethical finance, which appeals to socially responsible investors and supports long-term economic resilience. Corporate banking focuses on providing tailored financial services, such as loans, treasury management, and capital raising, to large businesses aiming for operational growth and market expansion. Choosing between sustainable banking and corporate banking depends on whether the primary goal is impact investing aligned with sustainability or facilitating corporate financial needs for business development.

Connection

Sustainable banking integrates environmental, social, and governance (ESG) criteria into corporate banking by encouraging businesses to adopt eco-friendly practices and responsible governance in their operations. Corporate banking facilitates sustainable projects through green financing, impact investing, and offering tailored financial products that support renewable energy, social initiatives, and ethical supply chains. This synergy promotes long-term value creation for banks, clients, and society by aligning financial growth with sustainability goals.

Key Terms

Corporate Lending

Corporate banking primarily concentrates on providing financial services such as corporate lending, cash management, and treasury solutions to large businesses and multinational corporations. Sustainable banking integrates environmental, social, and governance (ESG) criteria into corporate lending decisions to promote green projects and socially responsible investments. Explore how these two banking approaches shape the future of corporate lending and impact business growth and sustainability.

Green Finance

Corporate banking primarily emphasizes financial services such as lending, treasury management, and risk assessment for large businesses, while sustainable banking integrates environmental, social, and governance (ESG) criteria into financial decision-making, focusing on long-term ecological impact. Green finance, a subset of sustainable banking, directs investments toward projects that promote renewable energy, energy efficiency, and climate change mitigation, reducing carbon footprints and fostering sustainable development. Explore in-depth how green finance is transforming the corporate banking landscape and driving global sustainability goals.

Environmental, Social, and Governance (ESG)

Corporate banking typically centers on providing financial services such as loans, credit, and treasury management to large corporations, focusing on profit maximization and risk management within traditional banking frameworks. Sustainable banking integrates Environmental, Social, and Governance (ESG) criteria into lending and investment decisions, promoting ethical practices, reducing environmental impact, and enhancing social responsibility while supporting long-term economic growth. Explore how merging corporate banking with ESG principles drives innovation and resilience in financial markets.

Source and External Links

Corporate Banking | Ultimate Guide - Corporate banking is a bank division that provides large loans to corporations, financial institutions, and governments, focusing on products like revolving credit facilities and term loans to support large-scale corporate financing needs.

Corporate Banking - Overview, Business Banking Spectrum - Corporate banking offers services such as cash management, payment processing, credit products, and syndicated loans to large, often publicly traded, companies, acting as a hybrid between commercial and investment banking.

The Definitive Guide to Corporate Banking - Corporate bankers serve as relationship managers connecting clients to various banking services including credit, cash management, trade finance, and liquidity management, aiming to maximize revenue per client through credit expertise and client retention.

dowidth.com

dowidth.com