Alternative credit data, including utility bills and rental payment history, offers banks a broader perspective on a consumer's creditworthiness beyond traditional credit scores. Rental payment history, in particular, provides valuable insights into consistent financial behavior for individuals with limited credit history. Explore how integrating rental payment data can enhance credit assessments and expand lending opportunities.

Why it is important

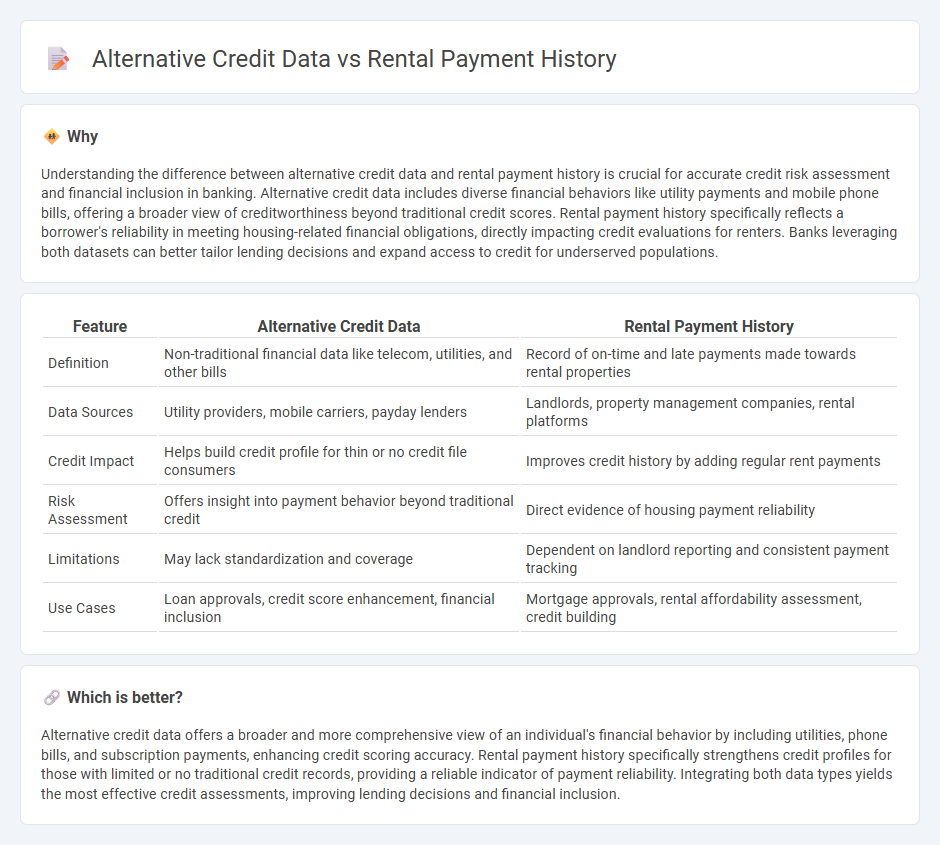

Understanding the difference between alternative credit data and rental payment history is crucial for accurate credit risk assessment and financial inclusion in banking. Alternative credit data includes diverse financial behaviors like utility payments and mobile phone bills, offering a broader view of creditworthiness beyond traditional credit scores. Rental payment history specifically reflects a borrower's reliability in meeting housing-related financial obligations, directly impacting credit evaluations for renters. Banks leveraging both datasets can better tailor lending decisions and expand access to credit for underserved populations.

Comparison Table

| Feature | Alternative Credit Data | Rental Payment History |

|---|---|---|

| Definition | Non-traditional financial data like telecom, utilities, and other bills | Record of on-time and late payments made towards rental properties |

| Data Sources | Utility providers, mobile carriers, payday lenders | Landlords, property management companies, rental platforms |

| Credit Impact | Helps build credit profile for thin or no credit file consumers | Improves credit history by adding regular rent payments |

| Risk Assessment | Offers insight into payment behavior beyond traditional credit | Direct evidence of housing payment reliability |

| Limitations | May lack standardization and coverage | Dependent on landlord reporting and consistent payment tracking |

| Use Cases | Loan approvals, credit score enhancement, financial inclusion | Mortgage approvals, rental affordability assessment, credit building |

Which is better?

Alternative credit data offers a broader and more comprehensive view of an individual's financial behavior by including utilities, phone bills, and subscription payments, enhancing credit scoring accuracy. Rental payment history specifically strengthens credit profiles for those with limited or no traditional credit records, providing a reliable indicator of payment reliability. Integrating both data types yields the most effective credit assessments, improving lending decisions and financial inclusion.

Connection

Alternative credit data, including rental payment history, provides lenders with a broader view of an individual's creditworthiness beyond traditional credit reports. Rental payment history, being a consistent and timely monthly expense, helps demonstrate financial responsibility for those with limited conventional credit activity. Incorporating this data into banking credit assessments enhances risk evaluation and expands credit access for underserved borrowers.

Key Terms

Credit Score

Rental payment history significantly influences credit scores by providing lenders with consistent evidence of timely payments, enhancing creditworthiness evaluations. Alternative credit data, including utility bills and subscription payments, further enrich credit profiles for individuals with sparse traditional credit history, potentially increasing credit score accuracy and access to credit. Explore how these data types impact your credit score and borrowing potential to make informed financial decisions.

Payment Reporting

Rental payment history provides a direct record of tenants' on-time payments, crucial for assessing creditworthiness in traditional and alternative credit scoring models. Alternative credit data encompasses broader financial behaviors, including utility bills and subscription payments, enhancing the accuracy of credit risk evaluations. Explore how integrating rental payment reporting can improve financial inclusion and lending decisions.

Non-Traditional Data

Rental payment history offers a valuable insight into a tenant's financial responsibility, often capturing consistent monthly payments that traditional credit reports may overlook, especially for those with limited credit files. Alternative credit data, encompassing utilities, telecom, and subscription payments, broadens the credit profile by including various non-traditional financial behaviors that reflect real-time payment reliability. Explore how integrating non-traditional data sources enhances credit assessments and financial inclusivity for more accurate risk evaluation.

Source and External Links

How to Use Rent-Reporting Services to Build Credit - NerdWallet -- Rent-reporting services can add your rental payments to your credit report, potentially helping you build credit history, but you generally need a third-party service to do this--landlords don't automatically report unless they use such a service.

Rent Payment History Assessment included in Loan Product Advisor -- Some mortgage lenders may use verified rent payment history as part of your credit assessment, which can impact your borrowing eligibility and risk class under certain scenarios.

How to Check and Obtain Your Rental History Report - RentSpree -- You can request a free copy of your rental history report annually under the Fair Credit Reporting Act, allowing you to review and correct your reported rental payment and lease details before applying for a new rental.

dowidth.com

dowidth.com