Predictive analytics in banking leverages advanced algorithms and historical data to forecast future customer behaviors, enhancing decision-making processes. Credit risk assessment evaluates the likelihood of a borrower defaulting on a loan, relying on financial history, credit scores, and economic indicators. Explore how integrating predictive analytics transforms credit risk assessment accuracy and efficiency.

Why it is important

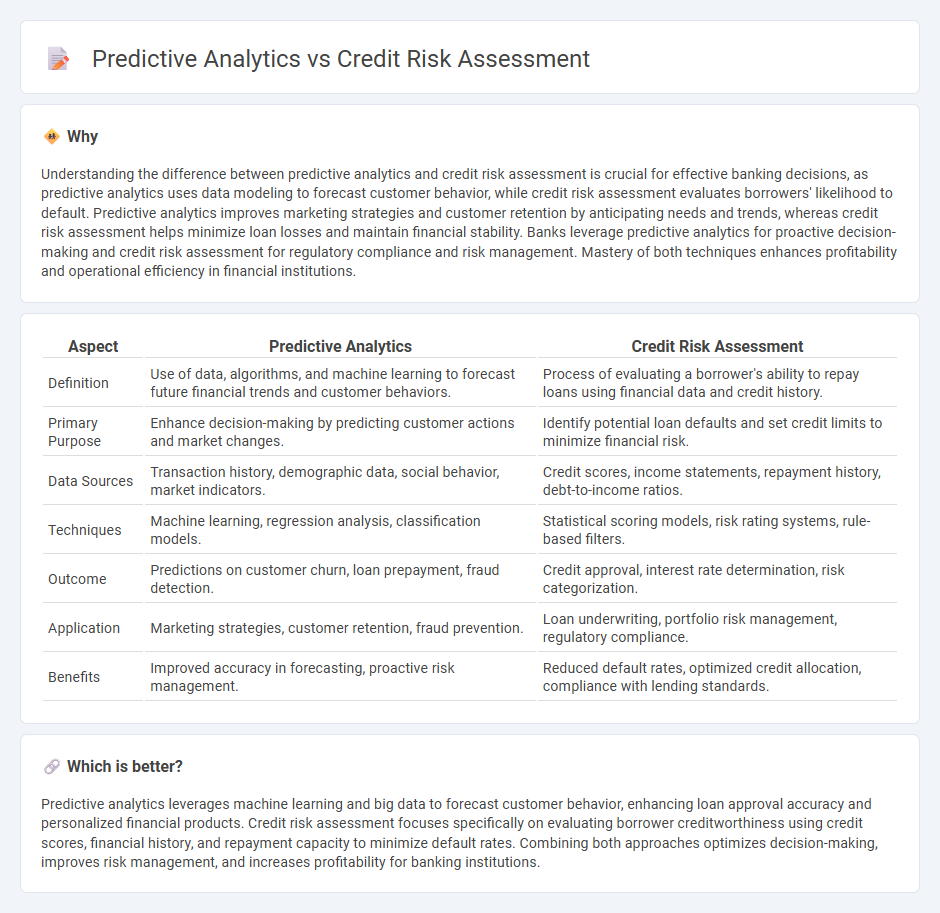

Understanding the difference between predictive analytics and credit risk assessment is crucial for effective banking decisions, as predictive analytics uses data modeling to forecast customer behavior, while credit risk assessment evaluates borrowers' likelihood to default. Predictive analytics improves marketing strategies and customer retention by anticipating needs and trends, whereas credit risk assessment helps minimize loan losses and maintain financial stability. Banks leverage predictive analytics for proactive decision-making and credit risk assessment for regulatory compliance and risk management. Mastery of both techniques enhances profitability and operational efficiency in financial institutions.

Comparison Table

| Aspect | Predictive Analytics | Credit Risk Assessment |

|---|---|---|

| Definition | Use of data, algorithms, and machine learning to forecast future financial trends and customer behaviors. | Process of evaluating a borrower's ability to repay loans using financial data and credit history. |

| Primary Purpose | Enhance decision-making by predicting customer actions and market changes. | Identify potential loan defaults and set credit limits to minimize financial risk. |

| Data Sources | Transaction history, demographic data, social behavior, market indicators. | Credit scores, income statements, repayment history, debt-to-income ratios. |

| Techniques | Machine learning, regression analysis, classification models. | Statistical scoring models, risk rating systems, rule-based filters. |

| Outcome | Predictions on customer churn, loan prepayment, fraud detection. | Credit approval, interest rate determination, risk categorization. |

| Application | Marketing strategies, customer retention, fraud prevention. | Loan underwriting, portfolio risk management, regulatory compliance. |

| Benefits | Improved accuracy in forecasting, proactive risk management. | Reduced default rates, optimized credit allocation, compliance with lending standards. |

Which is better?

Predictive analytics leverages machine learning and big data to forecast customer behavior, enhancing loan approval accuracy and personalized financial products. Credit risk assessment focuses specifically on evaluating borrower creditworthiness using credit scores, financial history, and repayment capacity to minimize default rates. Combining both approaches optimizes decision-making, improves risk management, and increases profitability for banking institutions.

Connection

Predictive analytics enhances credit risk assessment by using historical data and machine learning algorithms to forecast a borrower's likelihood of default. This connection enables banks to make informed lending decisions, minimize losses, and optimize credit portfolios. Advanced predictive models analyze patterns in credit scores, payment history, and economic indicators to improve risk evaluation accuracy.

Key Terms

**Credit Risk Assessment:**

Credit Risk Assessment involves evaluating the likelihood that a borrower will default on a loan by analyzing financial history, credit scores, income stability, and market conditions using quantitative models and expert judgment. It helps financial institutions manage lending risks, set appropriate interest rates, and maintain regulatory compliance through techniques such as scorecards, risk rating systems, and stress testing. Explore more to understand how Credit Risk Assessment enhances decision-making and safeguards portfolios.

Credit Score

Credit risk assessment evaluates the likelihood of a borrower defaulting based on historical financial behavior and credit score metrics, while predictive analytics uses advanced algorithms and machine learning to forecast future creditworthiness by analyzing patterns in credit score data. Credit scores remain a critical input within both approaches, serving as a standardized indicator of financial reliability that predictive models enhance by integrating broader datasets and trend analysis. Explore how combining traditional credit scoring with predictive analytics can transform lending decisions and risk management strategies.

Probability of Default (PD)

Credit risk assessment primarily focuses on estimating the Probability of Default (PD) to evaluate a borrower's likelihood of failing to meet debt obligations, using historical financial data and credit behavior. Predictive analytics enhances this process by leveraging advanced machine learning algorithms and vast datasets to improve PD accuracy and identify subtle risk patterns. Explore how integrating predictive analytics with traditional PD models transforms credit risk management.

Source and External Links

Beginner's guide to lending: How to assess credit risk - Taktile - Credit risk assessment involves a structured 4-step process: pre-selection, creditworthiness assessment, affordability calculation, and limit-setting/pricing, usually guided by a credit policy to predict and mitigate loan repayment risk, with statistical models often used to analyze past customer behavior or expert models in the absence of historical data and always considering regulatory requirements.

Credit Risk Analysis - Overview and Purpose - Credit risk analysis weighs the costs and benefits of taking on credit risk by estimating factors like probability of default, loss-given default, and exposure at default to manage acceptable risk levels aligned with lender goals such as profitability and business growth.

Credit Risk Assessment | Allianz Trade US - Credit risk assessment evaluates the likelihood a customer will default, factoring in credit scores, current financial activity, external economic conditions, and market trends to refine creditworthiness beyond traditional credit scoring models.

dowidth.com

dowidth.com