Real-time payments enable instant fund transfers between banks, enhancing speed and convenience for consumers and businesses worldwide. In contrast, the SWIFT network facilitates secure international money transfers but often involves longer processing times and intermediary banks. Explore the differences and benefits of real-time payments versus SWIFT to optimize your banking transactions.

Why it is important

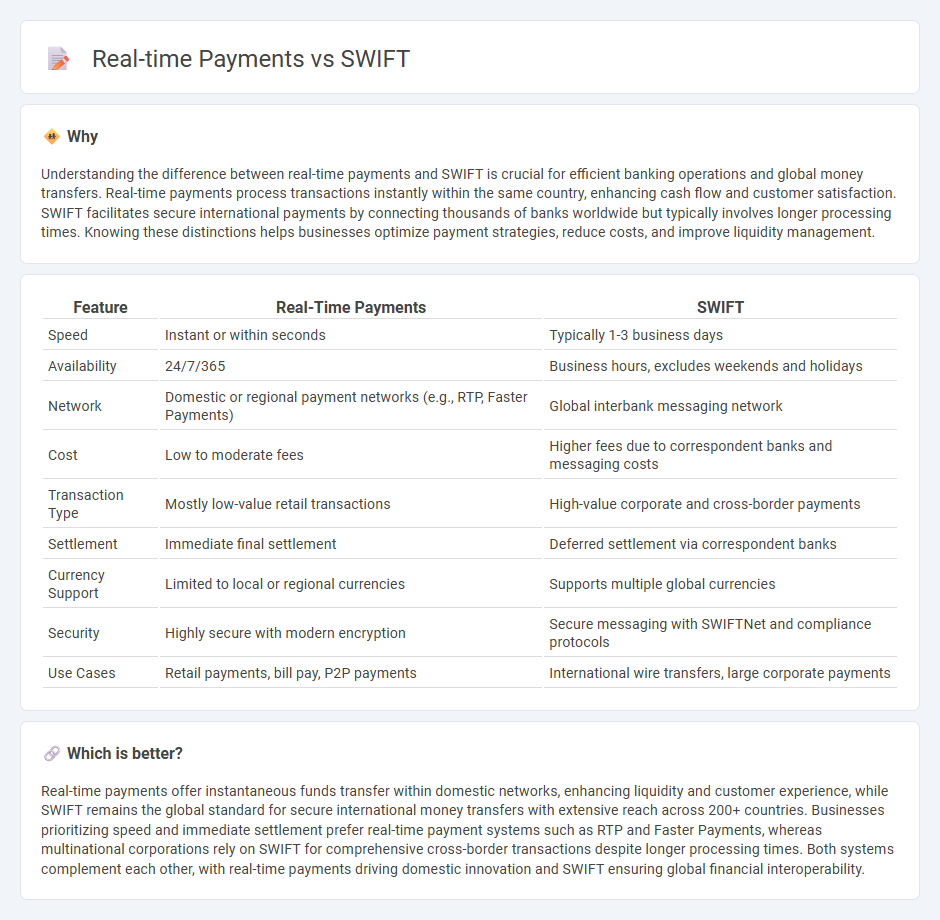

Understanding the difference between real-time payments and SWIFT is crucial for efficient banking operations and global money transfers. Real-time payments process transactions instantly within the same country, enhancing cash flow and customer satisfaction. SWIFT facilitates secure international payments by connecting thousands of banks worldwide but typically involves longer processing times. Knowing these distinctions helps businesses optimize payment strategies, reduce costs, and improve liquidity management.

Comparison Table

| Feature | Real-Time Payments | SWIFT |

|---|---|---|

| Speed | Instant or within seconds | Typically 1-3 business days |

| Availability | 24/7/365 | Business hours, excludes weekends and holidays |

| Network | Domestic or regional payment networks (e.g., RTP, Faster Payments) | Global interbank messaging network |

| Cost | Low to moderate fees | Higher fees due to correspondent banks and messaging costs |

| Transaction Type | Mostly low-value retail transactions | High-value corporate and cross-border payments |

| Settlement | Immediate final settlement | Deferred settlement via correspondent banks |

| Currency Support | Limited to local or regional currencies | Supports multiple global currencies |

| Security | Highly secure with modern encryption | Secure messaging with SWIFTNet and compliance protocols |

| Use Cases | Retail payments, bill pay, P2P payments | International wire transfers, large corporate payments |

Which is better?

Real-time payments offer instantaneous funds transfer within domestic networks, enhancing liquidity and customer experience, while SWIFT remains the global standard for secure international money transfers with extensive reach across 200+ countries. Businesses prioritizing speed and immediate settlement prefer real-time payment systems such as RTP and Faster Payments, whereas multinational corporations rely on SWIFT for comprehensive cross-border transactions despite longer processing times. Both systems complement each other, with real-time payments driving domestic innovation and SWIFT ensuring global financial interoperability.

Connection

Real-time payments and SWIFT are connected through their roles in facilitating faster and more efficient cross-border financial transactions. SWIFT provides the secure messaging infrastructure that enables banks to communicate payment instructions globally, while real-time payment systems process these transactions instantaneously, reducing settlement times and enhancing liquidity management. The integration of SWIFT gpi (global payment innovation) with real-time payment networks accelerates transaction tracking and transparency across international banking corridors.

Key Terms

Settlement Speed

SWIFT transactions typically take 1-3 business days for settlement due to international banking processes and time zone differences, while real-time payments offer near-instant settlement within seconds, enabling faster fund availability. Real-time payment systems, such as RTP in the US or Faster Payments in the UK, leverage modern infrastructure to streamline transactions and reduce settlement delays significantly. Explore our detailed analysis to understand how settlement speed impacts global financial operations.

Messaging Standards

SWIFT relies on the ISO 20022 messaging standard to enable secure and standardized cross-border financial communications, ensuring interoperability among global banks. Real-time payments leverage evolving ISO 20022 protocols optimized for instant fund transfer and immediate settlement within domestic and regional networks. Explore the intricacies of messaging standards in financial transactions to understand their impact on payment speed and security.

Cross-Border Transfer

SWIFT remains the predominant global network for cross-border transfers, enabling secure and standardized international payments between over 11,000 financial institutions across more than 200 countries. Real-time payment systems, such as RTP or Faster Payments, offer near-instant settlement but are typically limited by regional infrastructure and interoperability constraints in international transfers. Explore how these payment networks compare in speed, cost, and scalability to optimize your cross-border transactions.

Source and External Links

SWIFT - Wikipedia - The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a cooperative founded in 1973 in Belgium that provides a secure network for transmitting financial messages between institutions but does not hold funds or perform settlement itself.

Swift: Homepage - SWIFT offers a global open standard for financial messaging, including payments, securities, risk and compliance solutions, and promotes interoperability for both traditional and digital currencies.

Swift.org - Welcome to Swift.org - Swift is also the name of a fast, safe, and expressive programming language developed for multiple platforms including macOS, Linux, and Windows, widely used for app development and systems programming.

dowidth.com

dowidth.com