Personal finance automation leverages AI-driven tools and software to streamline budgeting, saving, and investing, providing users with personalized financial management within traditional banking frameworks. Decentralized finance (DeFi) utilizes blockchain technology to offer peer-to-peer financial services without intermediaries, enabling more transparent, accessible, and often lower-cost transactions. Explore the evolving landscape of banking innovations and see how these approaches can transform your financial strategy.

Why it is important

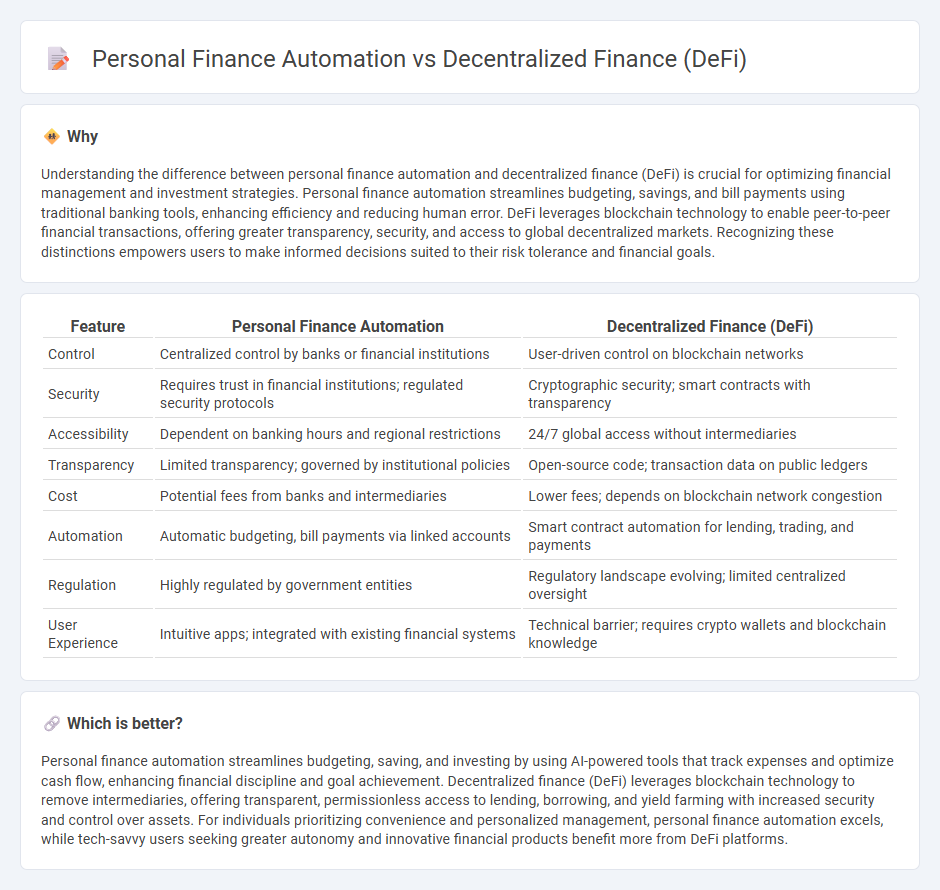

Understanding the difference between personal finance automation and decentralized finance (DeFi) is crucial for optimizing financial management and investment strategies. Personal finance automation streamlines budgeting, savings, and bill payments using traditional banking tools, enhancing efficiency and reducing human error. DeFi leverages blockchain technology to enable peer-to-peer financial transactions, offering greater transparency, security, and access to global decentralized markets. Recognizing these distinctions empowers users to make informed decisions suited to their risk tolerance and financial goals.

Comparison Table

| Feature | Personal Finance Automation | Decentralized Finance (DeFi) |

|---|---|---|

| Control | Centralized control by banks or financial institutions | User-driven control on blockchain networks |

| Security | Requires trust in financial institutions; regulated security protocols | Cryptographic security; smart contracts with transparency |

| Accessibility | Dependent on banking hours and regional restrictions | 24/7 global access without intermediaries |

| Transparency | Limited transparency; governed by institutional policies | Open-source code; transaction data on public ledgers |

| Cost | Potential fees from banks and intermediaries | Lower fees; depends on blockchain network congestion |

| Automation | Automatic budgeting, bill payments via linked accounts | Smart contract automation for lending, trading, and payments |

| Regulation | Highly regulated by government entities | Regulatory landscape evolving; limited centralized oversight |

| User Experience | Intuitive apps; integrated with existing financial systems | Technical barrier; requires crypto wallets and blockchain knowledge |

Which is better?

Personal finance automation streamlines budgeting, saving, and investing by using AI-powered tools that track expenses and optimize cash flow, enhancing financial discipline and goal achievement. Decentralized finance (DeFi) leverages blockchain technology to remove intermediaries, offering transparent, permissionless access to lending, borrowing, and yield farming with increased security and control over assets. For individuals prioritizing convenience and personalized management, personal finance automation excels, while tech-savvy users seeking greater autonomy and innovative financial products benefit more from DeFi platforms.

Connection

Personal finance automation enhances user control over decentralized finance (DeFi) by enabling seamless integration of budget tracking, expense management, and automated investment strategies through blockchain-based platforms. DeFi protocols leverage smart contracts to facilitate transparent, trustless transactions, which align with automation tools that optimize cash flow and portfolio rebalancing in real time. The synergy between personal finance automation and DeFi improves financial efficiency, security, and accessibility for individuals managing digital assets and traditional banking activities.

Key Terms

**Decentralized Finance (DeFi):**

Decentralized Finance (DeFi) leverages blockchain technology to create open financial systems without intermediaries, enabling peer-to-peer transactions and smart contracts that facilitate lending, borrowing, and trading. DeFi platforms offer transparency, reduced costs, and increased accessibility compared to traditional financial services, making them a transformative innovation in the global financial ecosystem. Explore how DeFi is reshaping financial independence and what it means for the future of personal finance.

Smart Contracts

Smart contracts are the backbone of decentralized finance (DeFi), enabling programmable, trustless transactions on blockchain networks, while personal finance automation relies on centralized software for expense tracking and budgeting. DeFi's smart contracts facilitate seamless trading, lending, and yield farming without intermediaries, contrasting with traditional automation tools that provide rule-based alerts and payments. Explore how smart contracts transform financial management beyond conventional automation by understanding their use cases and protocols.

Liquidity Pools

Liquidity pools serve as a foundational element in decentralized finance (DeFi) by enabling users to provide assets and facilitate automated trading without intermediaries. In contrast, personal finance automation leverages traditional banking APIs and algorithms to optimize individual cash flow and investment management rather than pooling assets collectively. Explore how liquidity pools revolutionize access to decentralized markets and compare their impact with personal finance tools to understand modern financial automation.

Source and External Links

Decentralized finance - DeFi refers to financial instruments and services--such as lending, borrowing, trading, and insuring--operated via smart contracts on public blockchains, reducing reliance on traditional intermediaries like banks and exchanges.

What is DeFi? - DeFi is an umbrella term for peer-to-peer financial services on public blockchains (mainly Ethereum), enabling activities like earning interest, borrowing, lending, and trading without centralized control or intermediaries.

The Technology of Decentralized Finance (DeFi) - DeFi leverages distributed ledger technology and smart contracts to offer financial services such as lending, investing, and exchanging cryptoassets, with users interacting directly with software protocols instead of traditional financial institutions.

dowidth.com

dowidth.com