Pay by bank enables direct transfers from customers' bank accounts, offering enhanced security and reduced transaction fees compared to traditional methods. Contactless payment utilizes near-field communication (NFC) technology, allowing quick, convenient transactions via cards or mobile devices without physical contact. Discover the benefits and differences between pay by bank and contactless payment options today.

Why it is important

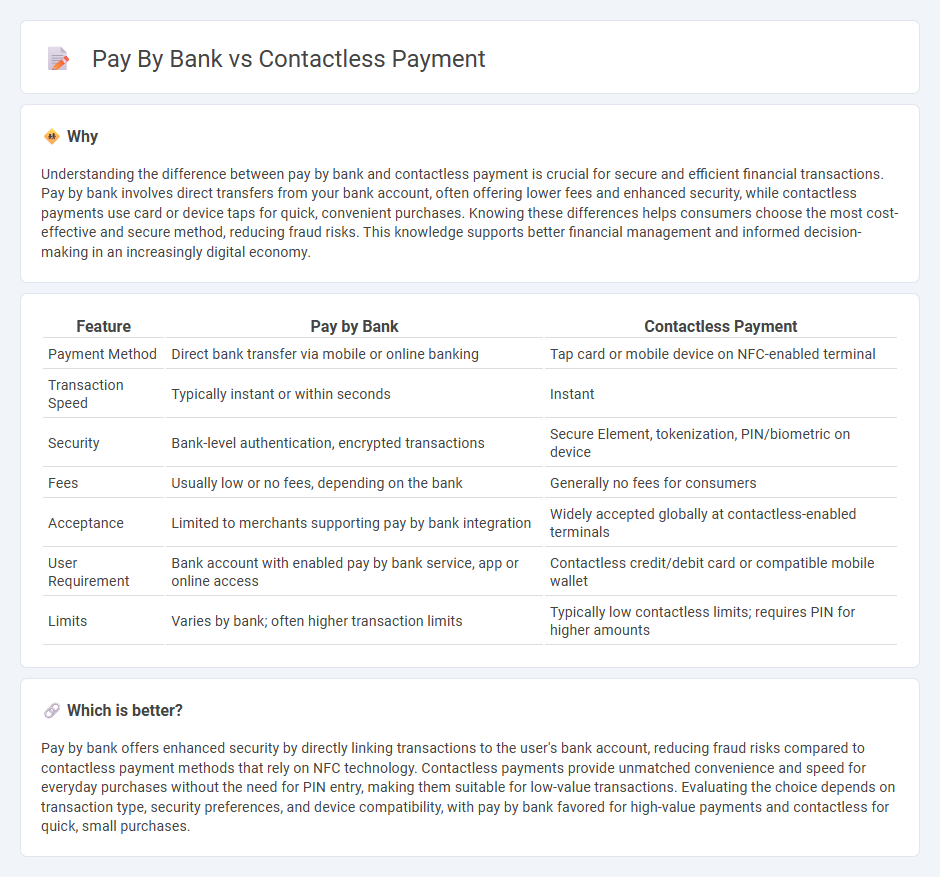

Understanding the difference between pay by bank and contactless payment is crucial for secure and efficient financial transactions. Pay by bank involves direct transfers from your bank account, often offering lower fees and enhanced security, while contactless payments use card or device taps for quick, convenient purchases. Knowing these differences helps consumers choose the most cost-effective and secure method, reducing fraud risks. This knowledge supports better financial management and informed decision-making in an increasingly digital economy.

Comparison Table

| Feature | Pay by Bank | Contactless Payment |

|---|---|---|

| Payment Method | Direct bank transfer via mobile or online banking | Tap card or mobile device on NFC-enabled terminal |

| Transaction Speed | Typically instant or within seconds | Instant |

| Security | Bank-level authentication, encrypted transactions | Secure Element, tokenization, PIN/biometric on device |

| Fees | Usually low or no fees, depending on the bank | Generally no fees for consumers |

| Acceptance | Limited to merchants supporting pay by bank integration | Widely accepted globally at contactless-enabled terminals |

| User Requirement | Bank account with enabled pay by bank service, app or online access | Contactless credit/debit card or compatible mobile wallet |

| Limits | Varies by bank; often higher transaction limits | Typically low contactless limits; requires PIN for higher amounts |

Which is better?

Pay by bank offers enhanced security by directly linking transactions to the user's bank account, reducing fraud risks compared to contactless payment methods that rely on NFC technology. Contactless payments provide unmatched convenience and speed for everyday purchases without the need for PIN entry, making them suitable for low-value transactions. Evaluating the choice depends on transaction type, security preferences, and device compatibility, with pay by bank favored for high-value payments and contactless for quick, small purchases.

Connection

Pay by bank and contactless payment are interconnected through the use of near-field communication (NFC) technology and secure banking APIs that facilitate real-time, cardless transactions directly from users' bank accounts. Contactless payment methods leverage pay by bank systems to authorize and authenticate payments quickly, enhancing convenience and security at point-of-sale terminals. This integration minimizes the need for physical cards, reducing fraud risks while streamlining the payment process for consumers and merchants alike.

Key Terms

Near Field Communication (NFC)

Contactless payment leverages Near Field Communication (NFC) technology to enable fast, secure transactions via smartphones or cards by simply tapping on a payment terminal, often protected by encryption and tokenization for enhanced security. Pay by bank integrates directly with a user's bank account using NFC-enabled digital identity verification, providing a streamlined payment experience without the need for card networks, reducing transaction fees. Explore detailed comparisons and benefits of NFC-based contactless payments versus pay by bank solutions for a deeper understanding.

Open Banking

Contactless payment leverages NFC technology to enable swift transactions via cards or mobile wallets, while pay by bank uses Open Banking APIs to initiate secure direct debits from a user's bank account, enhancing security and reducing fraud risk. Open Banking facilitates real-time authentication and account verification, providing merchants with greater control and transparency over the payment process compared to traditional contactless methods. Explore how Open Banking transforms payment experiences and drives seamless financial interactions.

Authentication

Contactless payment relies on Near Field Communication (NFC) technology coupled with tokenization to ensure secure transactions without physical card interaction. Pay by bank methods leverage multi-factor authentication protocols and direct bank authorization, enhancing transaction security through real-time account verification. Explore how these authentication mechanisms impact user security and convenience in modern payment systems.

Source and External Links

What Is Contactless Payment and How Does it Work (2025) - Square - Contactless payment allows consumers to make secure transactions simply by tapping a payment card, smartphone, or wearable device on a terminal using NFC technology, enabling fast and encrypted payments without physical contact or PIN entry for smaller amounts.

What Is a Contactless Card & How Does It Work? | Capital One - Contactless credit and debit cards let users pay quickly by tapping or holding their card near a payment terminal, offering convenience and security compared to swiping or inserting the card, often indicated by a sideways Wi-Fi-like symbol.

Contactless payment - Wikipedia - Contactless payment systems include cards and mobile devices that use RFID or NFC to transmit payment information securely at close range, commonly employing EMV standards and tokenization technologies like Apple Pay and Google Pay for secure, proximity-based transactions.

dowidth.com

dowidth.com