Digital wealth management leverages AI-driven algorithms and big data analytics to provide personalized investment strategies with lower fees and 24/7 accessibility. Financial planners offer tailored advice through human expertise, focusing on holistic financial goals, risk management, and personalized client relationships. Explore the advantages and applications of both to determine the best approach for your financial future.

Why it is important

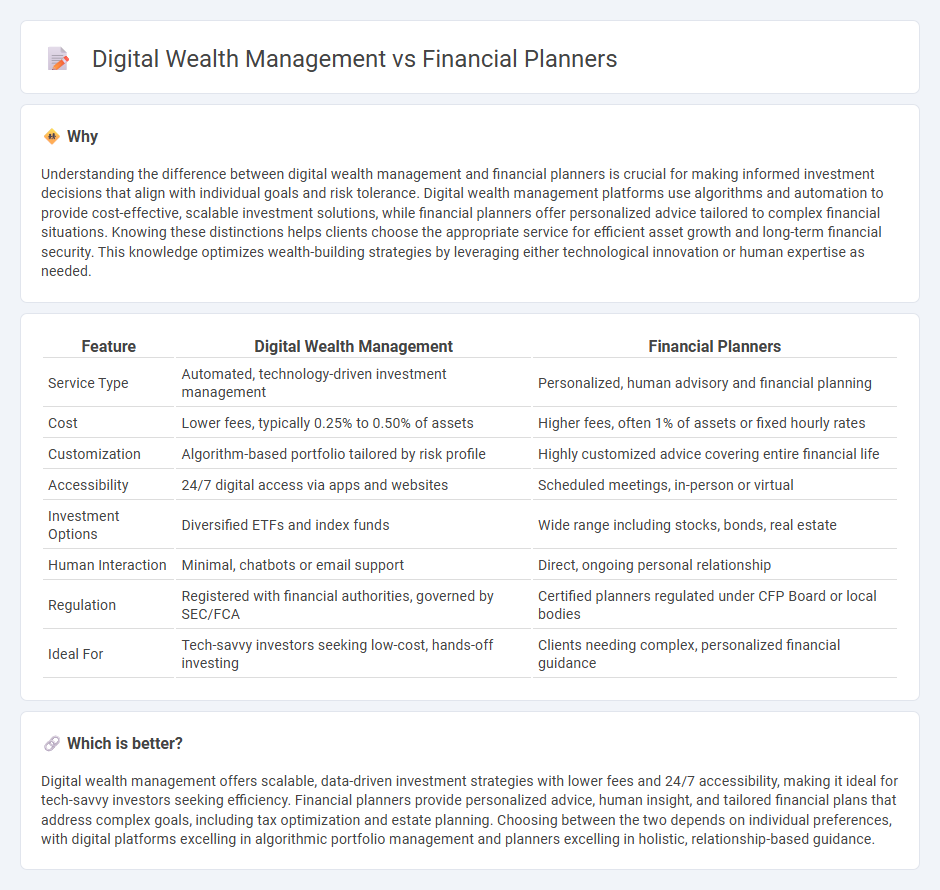

Understanding the difference between digital wealth management and financial planners is crucial for making informed investment decisions that align with individual goals and risk tolerance. Digital wealth management platforms use algorithms and automation to provide cost-effective, scalable investment solutions, while financial planners offer personalized advice tailored to complex financial situations. Knowing these distinctions helps clients choose the appropriate service for efficient asset growth and long-term financial security. This knowledge optimizes wealth-building strategies by leveraging either technological innovation or human expertise as needed.

Comparison Table

| Feature | Digital Wealth Management | Financial Planners |

|---|---|---|

| Service Type | Automated, technology-driven investment management | Personalized, human advisory and financial planning |

| Cost | Lower fees, typically 0.25% to 0.50% of assets | Higher fees, often 1% of assets or fixed hourly rates |

| Customization | Algorithm-based portfolio tailored by risk profile | Highly customized advice covering entire financial life |

| Accessibility | 24/7 digital access via apps and websites | Scheduled meetings, in-person or virtual |

| Investment Options | Diversified ETFs and index funds | Wide range including stocks, bonds, real estate |

| Human Interaction | Minimal, chatbots or email support | Direct, ongoing personal relationship |

| Regulation | Registered with financial authorities, governed by SEC/FCA | Certified planners regulated under CFP Board or local bodies |

| Ideal For | Tech-savvy investors seeking low-cost, hands-off investing | Clients needing complex, personalized financial guidance |

Which is better?

Digital wealth management offers scalable, data-driven investment strategies with lower fees and 24/7 accessibility, making it ideal for tech-savvy investors seeking efficiency. Financial planners provide personalized advice, human insight, and tailored financial plans that address complex goals, including tax optimization and estate planning. Choosing between the two depends on individual preferences, with digital platforms excelling in algorithmic portfolio management and planners excelling in holistic, relationship-based guidance.

Connection

Digital wealth management leverages advanced algorithms and AI to analyze financial data, enabling personalized investment strategies tailored by financial planners. Financial planners utilize these digital tools to streamline portfolio management, optimize asset allocation, and enhance client engagement through real-time insights. This integration improves decision-making accuracy and efficiency, driving better financial outcomes for clients.

Key Terms

Robo-advisors

Financial planners offer personalized investment strategies and holistic financial advice, while digital wealth management platforms leverage algorithms to provide cost-effective, automated portfolio management. Robo-advisors use artificial intelligence and machine learning to deliver efficient asset allocation, tax optimization, and continuous portfolio rebalancing at lower fees. Explore the benefits and limitations of robo-advisors to find the ideal approach for your financial goals.

Asset allocation

Financial planners offer personalized asset allocation strategies based on individual goals, risk tolerance, and market conditions, leveraging deep expertise and ongoing adjustments. Digital wealth management platforms utilize algorithms and data-driven models to optimize asset allocation efficiently and cost-effectively, often providing real-time portfolio rebalancing. Explore how each approach can enhance your investment strategy and tailor your asset allocation to meet financial objectives.

Fiduciary duty

Financial planners adhere to a fiduciary duty, legally requiring them to act in their clients' best interests, ensuring personalized advice aligned with individual financial goals. Digital wealth management platforms utilize algorithms and automated tools to optimize portfolios but may lack a personalized fiduciary commitment. Explore how fiduciary duty impacts your financial strategy and decision-making.

Source and External Links

Financial Planners - Financial planners come from diverse professional backgrounds--including investment advisers, brokers, insurance agents, and accountants--and may offer a broad range of services, from holistic financial planning to product-specific recommendations, but not all have rigorous credentials or oversight.

NAPFA: The National Association of Personal Financial Advisors - NAPFA is a professional association representing over 4,600 fee-only, fiduciary financial planners who adhere to high ethical standards, provide comprehensive planning, and always act in the client's best interest.

Let's Make a Plan: Financial Advisors & Planning - The CERTIFIED FINANCIAL PLANNER(tm) (CFP(r)) designation is the recognized standard in the field, with CFP(r) professionals required to complete extensive education, pass a comprehensive exam, and commit to ethical standards in serving clients' interests.

dowidth.com

dowidth.com