Sustainable banking focuses on environmentally and socially responsible financing that supports green projects and ethical practices, aiming to promote long-term ecological balance and social welfare. Investment banking specializes in capital markets activities such as underwriting, mergers and acquisitions, and asset management, primarily driving corporate growth and wealth creation. Explore how these banking sectors shape the future of finance and economic sustainability.

Why it is important

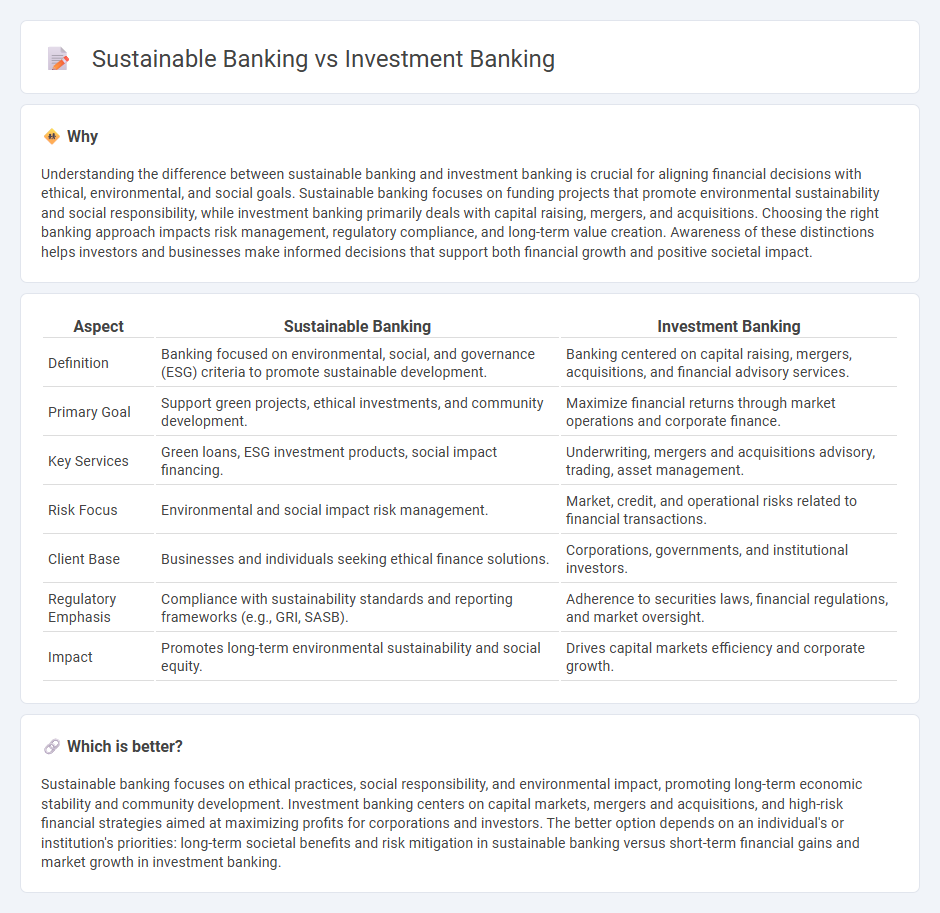

Understanding the difference between sustainable banking and investment banking is crucial for aligning financial decisions with ethical, environmental, and social goals. Sustainable banking focuses on funding projects that promote environmental sustainability and social responsibility, while investment banking primarily deals with capital raising, mergers, and acquisitions. Choosing the right banking approach impacts risk management, regulatory compliance, and long-term value creation. Awareness of these distinctions helps investors and businesses make informed decisions that support both financial growth and positive societal impact.

Comparison Table

| Aspect | Sustainable Banking | Investment Banking |

|---|---|---|

| Definition | Banking focused on environmental, social, and governance (ESG) criteria to promote sustainable development. | Banking centered on capital raising, mergers, acquisitions, and financial advisory services. |

| Primary Goal | Support green projects, ethical investments, and community development. | Maximize financial returns through market operations and corporate finance. |

| Key Services | Green loans, ESG investment products, social impact financing. | Underwriting, mergers and acquisitions advisory, trading, asset management. |

| Risk Focus | Environmental and social impact risk management. | Market, credit, and operational risks related to financial transactions. |

| Client Base | Businesses and individuals seeking ethical finance solutions. | Corporations, governments, and institutional investors. |

| Regulatory Emphasis | Compliance with sustainability standards and reporting frameworks (e.g., GRI, SASB). | Adherence to securities laws, financial regulations, and market oversight. |

| Impact | Promotes long-term environmental sustainability and social equity. | Drives capital markets efficiency and corporate growth. |

Which is better?

Sustainable banking focuses on ethical practices, social responsibility, and environmental impact, promoting long-term economic stability and community development. Investment banking centers on capital markets, mergers and acquisitions, and high-risk financial strategies aimed at maximizing profits for corporations and investors. The better option depends on an individual's or institution's priorities: long-term societal benefits and risk mitigation in sustainable banking versus short-term financial gains and market growth in investment banking.

Connection

Sustainable banking incorporates environmental, social, and governance (ESG) criteria into financial services, influencing investment decisions in investment banking by prioritizing projects with positive social and environmental impacts. Investment banking supports sustainable banking goals through underwriting green bonds, structuring sustainable financing, and advising clients on ESG risk management. This integration promotes capital allocation toward sustainable development and long-term financial resilience.

Key Terms

Capital Markets

Investment banking in capital markets centers on underwriting, mergers and acquisitions, and facilitating large-scale equity and debt transactions to optimize client financial growth. Sustainable banking prioritizes environmental, social, and governance (ESG) criteria within capital markets, emphasizing green bonds, socially responsible investments, and impact financing to drive long-term sustainable development. Explore how these banking models influence capital markets and investor strategies by learning more about their distinct approaches.

ESG (Environmental, Social, Governance)

Investment banking primarily focuses on capital raising, mergers and acquisitions, and financial advisory, with growing integration of ESG criteria to meet investor demand for responsible investments. Sustainable banking emphasizes financing projects that promote environmental protection, social equity, and good governance, often prioritizing green bonds, impact investing, and loans aligned with ESG goals. Discover how both sectors are evolving to balance profitability with sustainability by exploring their strategies and ESG frameworks in detail.

Underwriting

Investment banking underwriting primarily involves evaluating and assuming the risk of issuing securities for corporations, governments, and institutions to raise capital efficiently in global financial markets. In contrast, sustainable banking underwriting integrates environmental, social, and governance (ESG) criteria to support projects and issuers aligned with sustainable development goals, often emphasizing green bonds and social impact instruments. Discover how these differing underwriting approaches shape the future of finance and investment strategies.

Source and External Links

CFA Institute - What is an Investment Banker? - Investment bankers provide financial advisory services--including capital raising, mergers and acquisitions, and corporate restructuring--for companies, governments, and institutions, combining industry expertise with strong analytical and communication skills.

CFI - Investment Banking Overview - Investment banking is a specialized sector of finance that acts as an intermediary between investors and businesses, helping clients raise capital through underwriting and providing advisory services for mergers and acquisitions.

Wikipedia - Investment banking - Unlike commercial banks, investment banks do not accept deposits but instead earn fees by advising on and facilitating large financial transactions, such as securities issuance, mergers, and acquisitions, and are regulated by entities like the SEC and FINRA.

dowidth.com

dowidth.com