Virtual cards offer enhanced security by generating unique card numbers for each transaction, reducing exposure to fraud compared to traditional cards. Tokenized payments replace sensitive card details with encrypted tokens, ensuring safer and faster transactions across digital platforms. Discover how these innovations are transforming banking security and convenience.

Why it is important

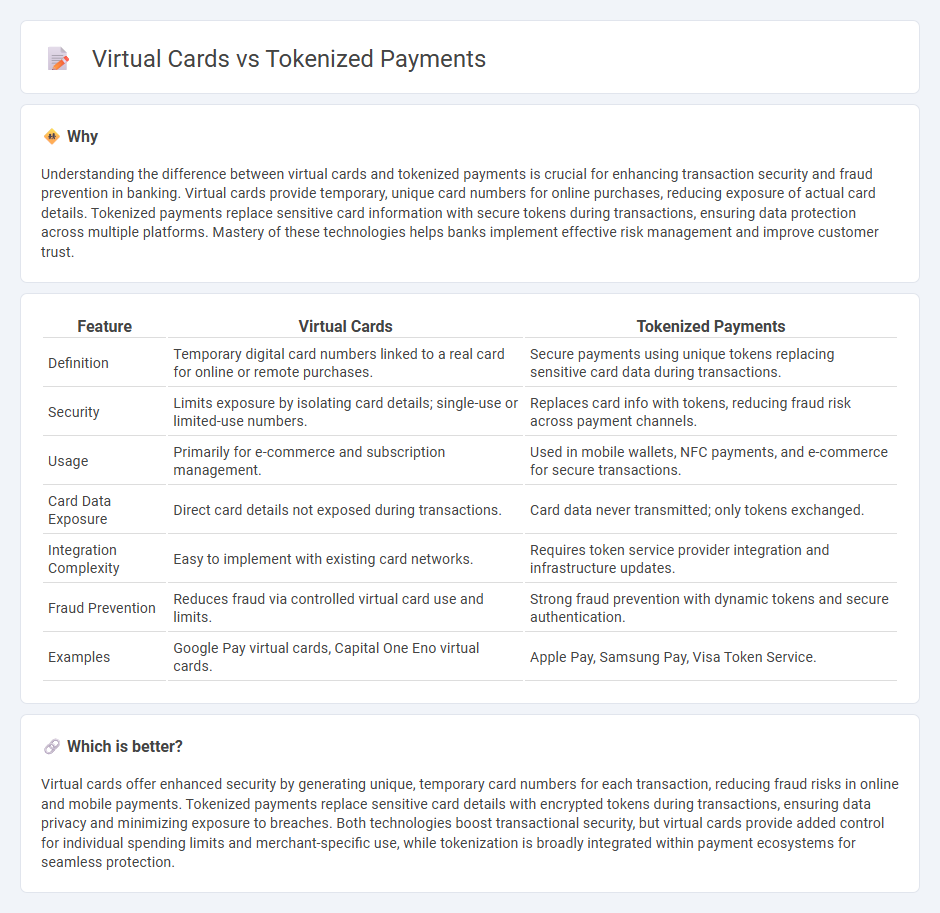

Understanding the difference between virtual cards and tokenized payments is crucial for enhancing transaction security and fraud prevention in banking. Virtual cards provide temporary, unique card numbers for online purchases, reducing exposure of actual card details. Tokenized payments replace sensitive card information with secure tokens during transactions, ensuring data protection across multiple platforms. Mastery of these technologies helps banks implement effective risk management and improve customer trust.

Comparison Table

| Feature | Virtual Cards | Tokenized Payments |

|---|---|---|

| Definition | Temporary digital card numbers linked to a real card for online or remote purchases. | Secure payments using unique tokens replacing sensitive card data during transactions. |

| Security | Limits exposure by isolating card details; single-use or limited-use numbers. | Replaces card info with tokens, reducing fraud risk across payment channels. |

| Usage | Primarily for e-commerce and subscription management. | Used in mobile wallets, NFC payments, and e-commerce for secure transactions. |

| Card Data Exposure | Direct card details not exposed during transactions. | Card data never transmitted; only tokens exchanged. |

| Integration Complexity | Easy to implement with existing card networks. | Requires token service provider integration and infrastructure updates. |

| Fraud Prevention | Reduces fraud via controlled virtual card use and limits. | Strong fraud prevention with dynamic tokens and secure authentication. |

| Examples | Google Pay virtual cards, Capital One Eno virtual cards. | Apple Pay, Samsung Pay, Visa Token Service. |

Which is better?

Virtual cards offer enhanced security by generating unique, temporary card numbers for each transaction, reducing fraud risks in online and mobile payments. Tokenized payments replace sensitive card details with encrypted tokens during transactions, ensuring data privacy and minimizing exposure to breaches. Both technologies boost transactional security, but virtual cards provide added control for individual spending limits and merchant-specific use, while tokenization is broadly integrated within payment ecosystems for seamless protection.

Connection

Virtual cards utilize tokenized payments by replacing sensitive card details with unique tokens during transactions, enhancing security and reducing fraud risk. Tokenization ensures that actual card information is never exposed, enabling safer online and contactless payments. This integration streamlines the payment process while maintaining compliance with industry standards like PCI DSS.

Key Terms

**Tokenized Payments:**

Tokenized payments replace sensitive card details with unique tokens during transactions, enhancing security and reducing fraud risks in digital payments. Unlike virtual cards, which generate temporary card numbers for online purchases, tokenized payments secure the transmission of real card data without exposing actual account information. Explore the benefits of tokenized payments for transforming secure commerce.

Tokenization

Tokenized payments enhance security by replacing sensitive card information with unique tokens, minimizing fraud risks during transactions. Virtual cards create disposable card numbers linked to actual accounts, offering control over spending and limiting exposure to theft. Explore how tokenization transforms payment security and efficiency in digital transactions.

Payment Network

Tokenized payments enhance security by replacing sensitive card information with unique tokens during transactions, which reduces fraud risks on Payment Network platforms. Virtual cards generate single-use or limited-use card numbers linked directly to the Payment Network, offering precise control over spending and integration with programmatic payment systems. Explore the benefits and implementation strategies of tokenized payments and virtual cards within various Payment Networks to optimize transaction security and efficiency.

Source and External Links

What is payment tokenization and how does it work? - Worldpay - Tokenization replaces sensitive payment data with a unique identifier during transactions, enabling secure, one-click, and recurring payments without merchants storing actual card details.

Payment tokenization 101: What it is and how it benefits businesses - Stripe - Tokenization transforms credit card numbers into random, nonsensitive tokens that businesses can safely store and transmit, reducing fraud risk and simplifying repeat and subscription payments.

What is tokenization? A primer on card tokenization - Mastercard - Tokenization substitutes your actual card number with a unique token for digital and mobile payments, improving security and approval rates while allowing continued use if your physical card is lost or stolen.

dowidth.com

dowidth.com