Core banking modernization integrates advanced cloud-based platforms, real-time processing, and API-driven architectures that enhance scalability, security, and customer experience. Legacy system migration involves transitioning outdated, monolithic infrastructure to agile, flexible solutions while minimizing downtime and data loss. Explore the benefits and challenges of each approach to determine the optimal strategy for your financial institution's future.

Why it is important

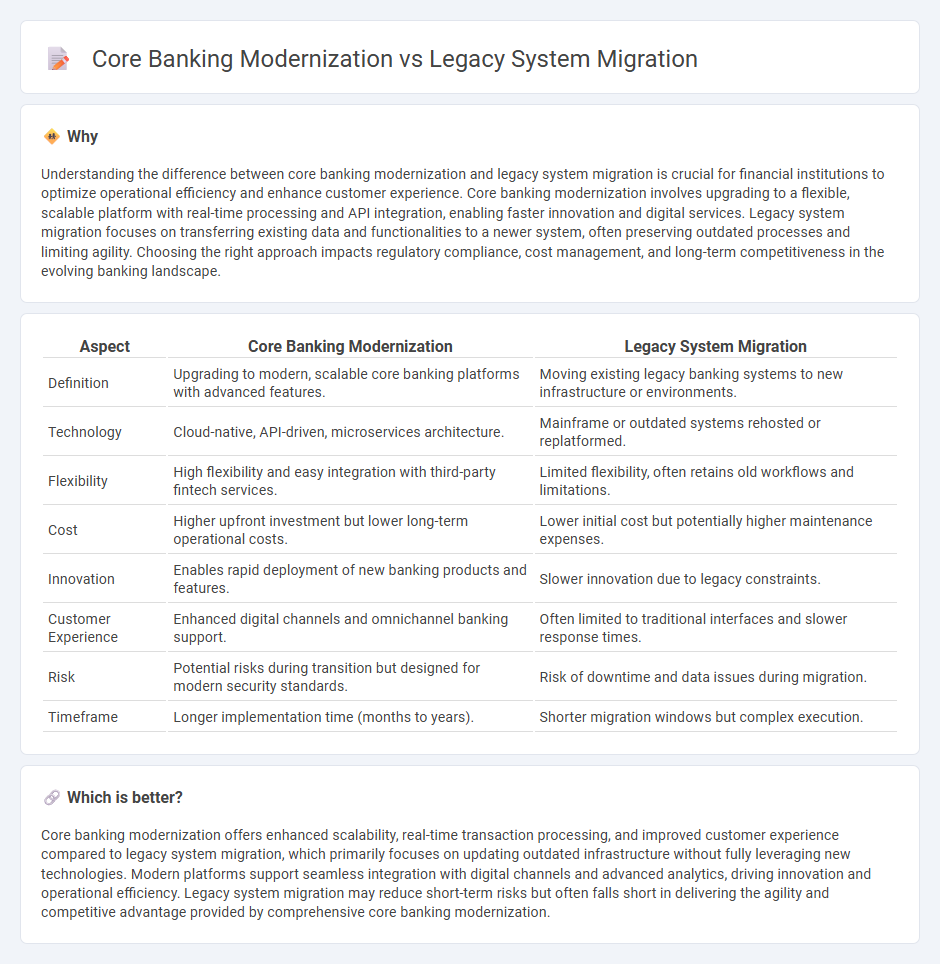

Understanding the difference between core banking modernization and legacy system migration is crucial for financial institutions to optimize operational efficiency and enhance customer experience. Core banking modernization involves upgrading to a flexible, scalable platform with real-time processing and API integration, enabling faster innovation and digital services. Legacy system migration focuses on transferring existing data and functionalities to a newer system, often preserving outdated processes and limiting agility. Choosing the right approach impacts regulatory compliance, cost management, and long-term competitiveness in the evolving banking landscape.

Comparison Table

| Aspect | Core Banking Modernization | Legacy System Migration |

|---|---|---|

| Definition | Upgrading to modern, scalable core banking platforms with advanced features. | Moving existing legacy banking systems to new infrastructure or environments. |

| Technology | Cloud-native, API-driven, microservices architecture. | Mainframe or outdated systems rehosted or replatformed. |

| Flexibility | High flexibility and easy integration with third-party fintech services. | Limited flexibility, often retains old workflows and limitations. |

| Cost | Higher upfront investment but lower long-term operational costs. | Lower initial cost but potentially higher maintenance expenses. |

| Innovation | Enables rapid deployment of new banking products and features. | Slower innovation due to legacy constraints. |

| Customer Experience | Enhanced digital channels and omnichannel banking support. | Often limited to traditional interfaces and slower response times. |

| Risk | Potential risks during transition but designed for modern security standards. | Risk of downtime and data issues during migration. |

| Timeframe | Longer implementation time (months to years). | Shorter migration windows but complex execution. |

Which is better?

Core banking modernization offers enhanced scalability, real-time transaction processing, and improved customer experience compared to legacy system migration, which primarily focuses on updating outdated infrastructure without fully leveraging new technologies. Modern platforms support seamless integration with digital channels and advanced analytics, driving innovation and operational efficiency. Legacy system migration may reduce short-term risks but often falls short in delivering the agility and competitive advantage provided by comprehensive core banking modernization.

Connection

Core banking modernization and legacy system migration are interconnected processes essential for financial institutions aiming to enhance operational efficiency and customer experience. Migrating from outdated legacy systems to modern core banking platforms enables real-time processing, improved scalability, and integration with digital channels. This transformation supports regulatory compliance, reduces maintenance costs, and fosters innovation in banking services.

Key Terms

Data Migration

Data migration is a critical component in both legacy system migration and core banking modernization, involving the transfer of vast amounts of transactional and customer data while ensuring integrity and compliance with regulatory standards like GDPR and PCI DSS. Legacy system migration focuses primarily on preserving existing data structures and formats to maintain operational continuity, whereas core banking modernization requires transforming data to fit new architecture models, enhancing real-time analytics and customer experience. Explore how strategic data migration methodologies can streamline your banking technology upgrades and reduce operational risks.

API Integration

Legacy system migration often involves transferring existing data and functionalities to updated platforms with minimal disruption, ensuring continuity in core banking operations. Core banking modernization emphasizes the development of scalable, API-driven architectures that enhance interoperability, agility, and customer-centric services. Explore the benefits and strategies of API integration to accelerate your institution's digital transformation.

Real-time Processing

Legacy system migration often involves transferring existing batch-processing architectures to more agile platforms, but may struggle to fully support real-time transaction processing crucial for modern banking operations. Core banking modernization integrates advanced technologies like in-memory computing and event-driven architectures, enabling instantaneous processing and real-time data synchronization across channels. Explore how real-time processing differentiates these strategies to enhance customer experience and operational efficiency.

Source and External Links

Making Business and IT Sense of Legacy System Migration - Faddom - Legacy system migration involves replacing outdated systems by assembling a project team, assessing and mapping existing systems, setting up the target environment, and executing data extraction, cleaning, conversion, and transfer with either an all-at-once or incremental approach tailored to business needs and minimizing disruptions.

Legacy System Migration Step-by-Step - Cprime - Running a legacy system migration includes engaging all stakeholders, analyzing current business workflows, defining milestones, choosing technologies that fit business needs, and continuously monitoring the new system post-migration to ensure performance and correct functionality.

Learning Legacy Systems Migration Inside and Out - OpenLegacy - OpenLegacy offers a cloud-native platform that facilitates legacy migration by generating digital-ready code from legacy assets without requiring major system changes, enabling organizations to modernize legacy systems via rebuilding, replatforming, or replacement while lowering cost, complexity, and risk.

dowidth.com

dowidth.com