Crypto custody solutions provide secure digital asset storage using advanced encryption and multi-signature technology, ensuring protection from cyber threats and unauthorized access. In contrast, traditional safe deposit boxes offer physical security for valuables but lack accessibility and protection against digital vulnerabilities. Explore the key differences between crypto custody services and safe deposit boxes to determine the best option for securing your assets.

Why it is important

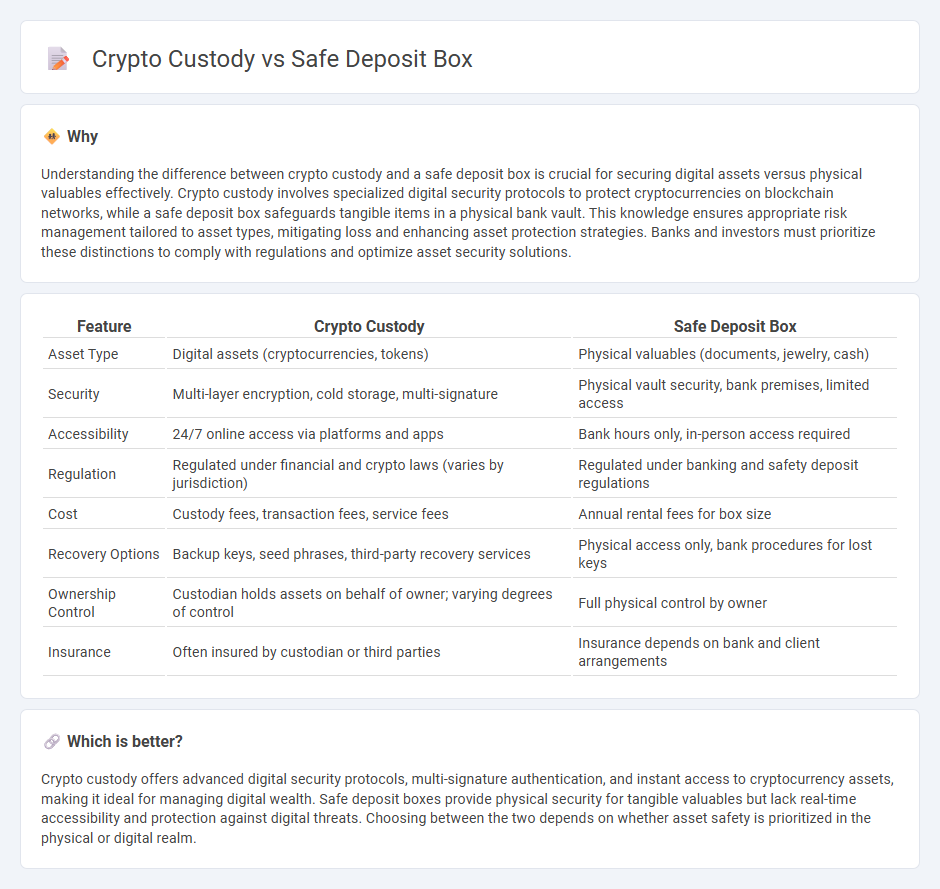

Understanding the difference between crypto custody and a safe deposit box is crucial for securing digital assets versus physical valuables effectively. Crypto custody involves specialized digital security protocols to protect cryptocurrencies on blockchain networks, while a safe deposit box safeguards tangible items in a physical bank vault. This knowledge ensures appropriate risk management tailored to asset types, mitigating loss and enhancing asset protection strategies. Banks and investors must prioritize these distinctions to comply with regulations and optimize asset security solutions.

Comparison Table

| Feature | Crypto Custody | Safe Deposit Box |

|---|---|---|

| Asset Type | Digital assets (cryptocurrencies, tokens) | Physical valuables (documents, jewelry, cash) |

| Security | Multi-layer encryption, cold storage, multi-signature | Physical vault security, bank premises, limited access |

| Accessibility | 24/7 online access via platforms and apps | Bank hours only, in-person access required |

| Regulation | Regulated under financial and crypto laws (varies by jurisdiction) | Regulated under banking and safety deposit regulations |

| Cost | Custody fees, transaction fees, service fees | Annual rental fees for box size |

| Recovery Options | Backup keys, seed phrases, third-party recovery services | Physical access only, bank procedures for lost keys |

| Ownership Control | Custodian holds assets on behalf of owner; varying degrees of control | Full physical control by owner |

| Insurance | Often insured by custodian or third parties | Insurance depends on bank and client arrangements |

Which is better?

Crypto custody offers advanced digital security protocols, multi-signature authentication, and instant access to cryptocurrency assets, making it ideal for managing digital wealth. Safe deposit boxes provide physical security for tangible valuables but lack real-time accessibility and protection against digital threats. Choosing between the two depends on whether asset safety is prioritized in the physical or digital realm.

Connection

Crypto custody services provide secure storage solutions for digital assets, similar to how safe deposit boxes at banks protect physical valuables. Both methods emphasize risk mitigation through controlled access, robust encryption, and advanced security protocols. Integrating safe deposit box principles with crypto custody enhances asset protection by combining tangible security measures with digital safeguards.

Key Terms

Physical Vault (Safe Deposit Box)

A physical vault, such as a safe deposit box, provides secure, offline storage for valuable items including documents, jewelry, and physical cryptocurrency wallets, minimizing risk from cyber threats. Unlike crypto custody services that rely on digital security measures, safe deposit boxes protect assets from hacking, data breaches, and technical failures by being completely disconnected from the internet. Explore the benefits and limitations of physical vault storage to determine the best option for safeguarding your valuable assets.

Private Key (Crypto Custody)

A safe deposit box provides physical security for valuable items but lacks the cryptographic protection essential for safeguarding private keys in crypto custody, which are digital credentials that grant access to cryptocurrency assets. Crypto custody solutions employ advanced encryption and multi-signature technologies to ensure private key security, reducing risks of theft and unauthorized access compared to traditional storage methods. Discover how evolving crypto custody options offer tailored approaches to private key management for enhanced asset protection.

Access Control

Safe deposit boxes provide physical access control through secured vaults and biometric or key-based entry systems, limiting access to authorized individuals. Crypto custody solutions use multi-factor authentication, hardware security modules (HSMs), and cryptographic keys to enforce strict digital access control, often incorporating multi-signature protocols for enhanced security. Explore how these access control mechanisms impact the safety and management of your valuables and digital assets.

Source and External Links

Safe deposit box - Wikipedia - A safe deposit box is an individually secured container, typically held within a bank or institution's vault, used for storing valuables like jewelry, important documents, or precious metals for protection against theft, fire, or other risks, but the contents are not insured by the bank or FDIC in the U.S., requiring separate insurance if desired.

10 Surprising Things You Didn't Know About Safe Deposit Boxes - Safe deposit boxes are not theft-proof and offer no government or bank insurance for contents, so separate coverage must be purchased; also, only those named on the lease can access the box, which can complicate access in emergencies or after death.

Safe Deposit Box: What To Know - Bankrate - Safe deposit boxes are best for irreplaceable items and documents, but not for things needed on short notice, since access is limited to bank hours, and--like other sources--note that contents are uninsured unless you arrange private coverage.

dowidth.com

dowidth.com