Wealthtech platforms focus on optimizing investment management through advanced algorithms and personalized financial strategies, enhancing wealth growth for individuals and institutions. Payment gateways facilitate secure and efficient online transaction processing, enabling seamless money transfers between consumers and merchants. Explore how these fintech innovations transform financial services and empower user experiences.

Why it is important

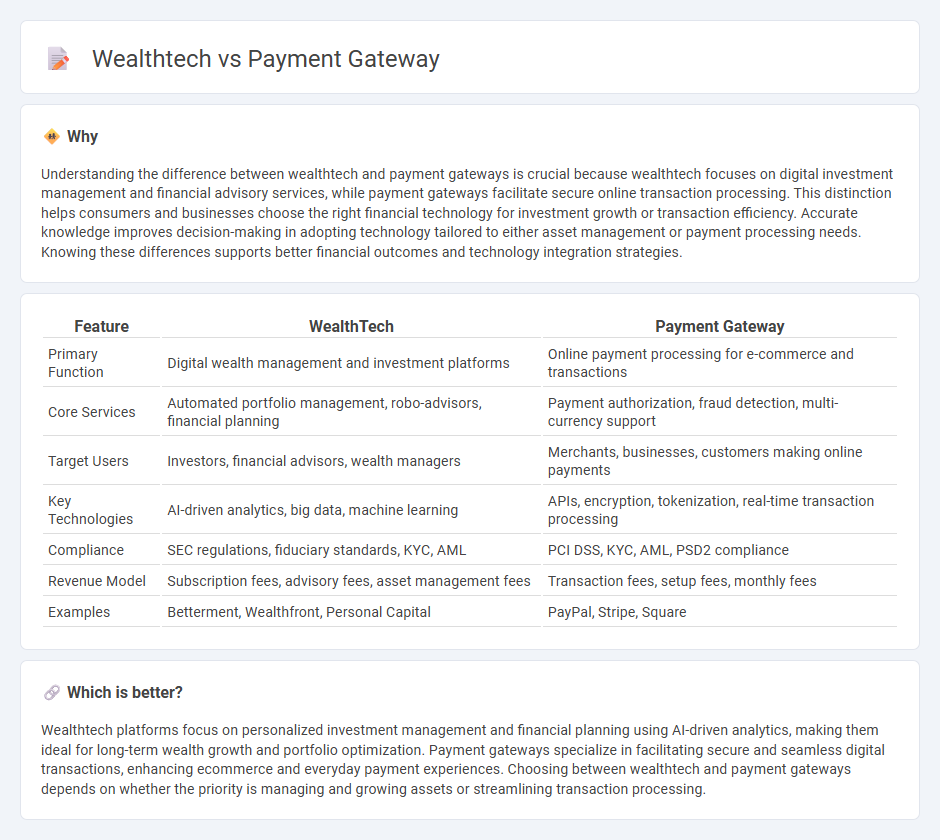

Understanding the difference between wealthtech and payment gateways is crucial because wealthtech focuses on digital investment management and financial advisory services, while payment gateways facilitate secure online transaction processing. This distinction helps consumers and businesses choose the right financial technology for investment growth or transaction efficiency. Accurate knowledge improves decision-making in adopting technology tailored to either asset management or payment processing needs. Knowing these differences supports better financial outcomes and technology integration strategies.

Comparison Table

| Feature | WealthTech | Payment Gateway |

|---|---|---|

| Primary Function | Digital wealth management and investment platforms | Online payment processing for e-commerce and transactions |

| Core Services | Automated portfolio management, robo-advisors, financial planning | Payment authorization, fraud detection, multi-currency support |

| Target Users | Investors, financial advisors, wealth managers | Merchants, businesses, customers making online payments |

| Key Technologies | AI-driven analytics, big data, machine learning | APIs, encryption, tokenization, real-time transaction processing |

| Compliance | SEC regulations, fiduciary standards, KYC, AML | PCI DSS, KYC, AML, PSD2 compliance |

| Revenue Model | Subscription fees, advisory fees, asset management fees | Transaction fees, setup fees, monthly fees |

| Examples | Betterment, Wealthfront, Personal Capital | PayPal, Stripe, Square |

Which is better?

Wealthtech platforms focus on personalized investment management and financial planning using AI-driven analytics, making them ideal for long-term wealth growth and portfolio optimization. Payment gateways specialize in facilitating secure and seamless digital transactions, enhancing ecommerce and everyday payment experiences. Choosing between wealthtech and payment gateways depends on whether the priority is managing and growing assets or streamlining transaction processing.

Connection

Wealthtech platforms integrate payment gateways to enable seamless investment transactions and real-time fund transfers, enhancing user experience and transaction security. Payment gateways facilitate swift execution of trades, subscription payments, and portfolio funding within wealth management applications. This integration streamlines financial operations while ensuring compliance with banking regulations and data encryption standards.

Key Terms

**Payment Gateway:**

Payment gateways are crucial fintech components enabling secure online transaction processing by authorizing credit card and digital payments between merchants and customers. These systems prioritize encryption, fraud detection, and seamless integration with e-commerce platforms to ensure smooth financial operations. Explore more to understand how payment gateways revolutionize digital commerce and enhance consumer trust.

Transaction Processing

Payment gateways specialize in secure transaction processing by facilitating the authorization and settlement of payments between customers, merchants, and banks, ensuring seamless and real-time payment experiences. Wealthtech platforms integrate advanced transaction processing capabilities with portfolio management and financial advisory tools, focusing on investment transactions and wealth transfer. Explore more to understand how each technology enhances financial operations through innovative transaction solutions.

Merchant Account

A payment gateway serves as the technology that authorizes and processes online payment transactions, directly linking merchants to acquiring banks via a merchant account for seamless fund transfers. Wealthtech platforms, on the other hand, focus on leveraging digital solutions to enhance wealth management services and do not primarily handle merchant accounts or payment processing infrastructure. Explore the key differences between payment gateways and wealthtech solutions to optimize your business financial operations.

Source and External Links

What is a Payment Gateway and how does it work? - A payment gateway is a tool that securely validates customers' credit card details and transfers transaction information to payment processors, facilitating authorization and completion of online payments through various providers like Stripe, PayPal, and Authorize.Net.

Payment gateway - A payment gateway is a merchant service facilitating credit card or direct payment processing by securely transferring transaction information between the customer, merchant, and acquiring bank or payment processor.

Payment Gateways: What They Are And How To Choose One - Payment gateways act as intermediaries in online transactions, securely capturing and transmitting payment data with encryption and compliance protocols, allowing merchants to customize checkout experiences and support cross-border payments.

dowidth.com

dowidth.com