Social trading leverages collective investor behaviors by allowing users to follow and copy the trades of experienced traders, fostering a community-driven investment environment. Robo-advisory uses advanced algorithms and artificial intelligence to provide automated, personalized portfolio management with minimal human intervention. Explore the distinctions and benefits of social trading and robo-advisory to better understand modern investment strategies.

Why it is important

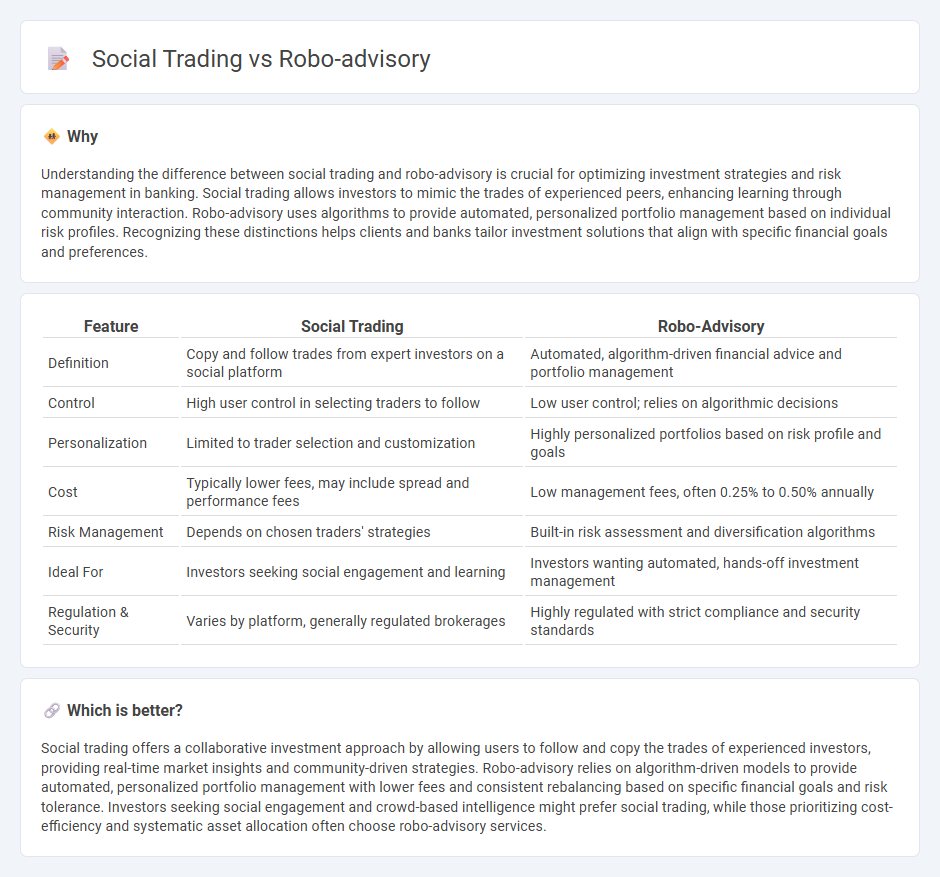

Understanding the difference between social trading and robo-advisory is crucial for optimizing investment strategies and risk management in banking. Social trading allows investors to mimic the trades of experienced peers, enhancing learning through community interaction. Robo-advisory uses algorithms to provide automated, personalized portfolio management based on individual risk profiles. Recognizing these distinctions helps clients and banks tailor investment solutions that align with specific financial goals and preferences.

Comparison Table

| Feature | Social Trading | Robo-Advisory |

|---|---|---|

| Definition | Copy and follow trades from expert investors on a social platform | Automated, algorithm-driven financial advice and portfolio management |

| Control | High user control in selecting traders to follow | Low user control; relies on algorithmic decisions |

| Personalization | Limited to trader selection and customization | Highly personalized portfolios based on risk profile and goals |

| Cost | Typically lower fees, may include spread and performance fees | Low management fees, often 0.25% to 0.50% annually |

| Risk Management | Depends on chosen traders' strategies | Built-in risk assessment and diversification algorithms |

| Ideal For | Investors seeking social engagement and learning | Investors wanting automated, hands-off investment management |

| Regulation & Security | Varies by platform, generally regulated brokerages | Highly regulated with strict compliance and security standards |

Which is better?

Social trading offers a collaborative investment approach by allowing users to follow and copy the trades of experienced investors, providing real-time market insights and community-driven strategies. Robo-advisory relies on algorithm-driven models to provide automated, personalized portfolio management with lower fees and consistent rebalancing based on specific financial goals and risk tolerance. Investors seeking social engagement and crowd-based intelligence might prefer social trading, while those prioritizing cost-efficiency and systematic asset allocation often choose robo-advisory services.

Connection

Social trading platforms integrate real-time market data with community-driven insights, enabling investors to replicate successful trades through automated systems. Robo-advisory leverages AI algorithms to provide personalized investment strategies based on user profiles and market trends. The fusion of social trading with robo-advisory enhances portfolio diversification by combining crowd wisdom with algorithmic precision.

Key Terms

Algorithmic Portfolio Management

Algorithmic portfolio management leverages robo-advisors to automate investment strategies using data-driven algorithms, optimizing asset allocation and risk management without human bias. Social trading platforms integrate algorithmic insights with community-driven strategies, allowing investors to replicate or follow portfolio decisions from experienced traders. Explore the distinct benefits and mechanisms of algorithmic portfolio management in robo-advisory and social trading to enhance your investment approach.

Copy Trading

Copy trading enables investors to automatically replicate the trades of experienced traders, providing an accessible way to leverage expert strategies without active management. Unlike robo-advisory, which relies solely on algorithm-driven portfolio management, copy trading integrates social elements by allowing users to follow and learn from real traders' decisions. Explore how copy trading combines social networking with automated investing to enhance trading outcomes.

Risk Profiling

Robo-advisory platforms leverage advanced algorithms to create precise risk profiles based on individual investor data such as age, income, and investment goals, facilitating automated, personalized portfolio management. In contrast, social trading platforms emphasize community insights and strategy copying, presenting risk profiles influenced by peer activity rather than purely algorithmic assessment. Explore how both methods impact investment safety and growth by learning more about risk profiling in robo-advisory and social trading.

Source and External Links

Robo-advisor - Wikipedia - Robo-advisors are digital platforms that provide personalized financial advice and automated investment management using algorithms, with minimal human intervention, typically focusing on ETF-based portfolios.

What is a robo advisor? | Robo advisory services - Fidelity Investments - A robo-advisor is an affordable, technology-driven service that automates investing based on user-provided details about goals, risk tolerance, and finances, then manages and rebalances the portfolio automatically over time.

Best Robo-Advisors: Top Picks for 2025 - NerdWallet - Robo-advisors use computer algorithms to build, manage, and optimize investment portfolios at low cost, often including features like automatic rebalancing and tax optimization, and may offer access to human advisors for an additional fee.

dowidth.com

dowidth.com