Invisible payments use background technologies like AI and biometrics to complete transactions without explicit user interaction, enhancing convenience and security in banking. NFC payments rely on near-field communication to enable fast, contactless transactions through smartphones or cards, widely adopted in retail environments for seamless checkout. Discover how these advanced payment methods are revolutionizing everyday banking experiences.

Why it is important

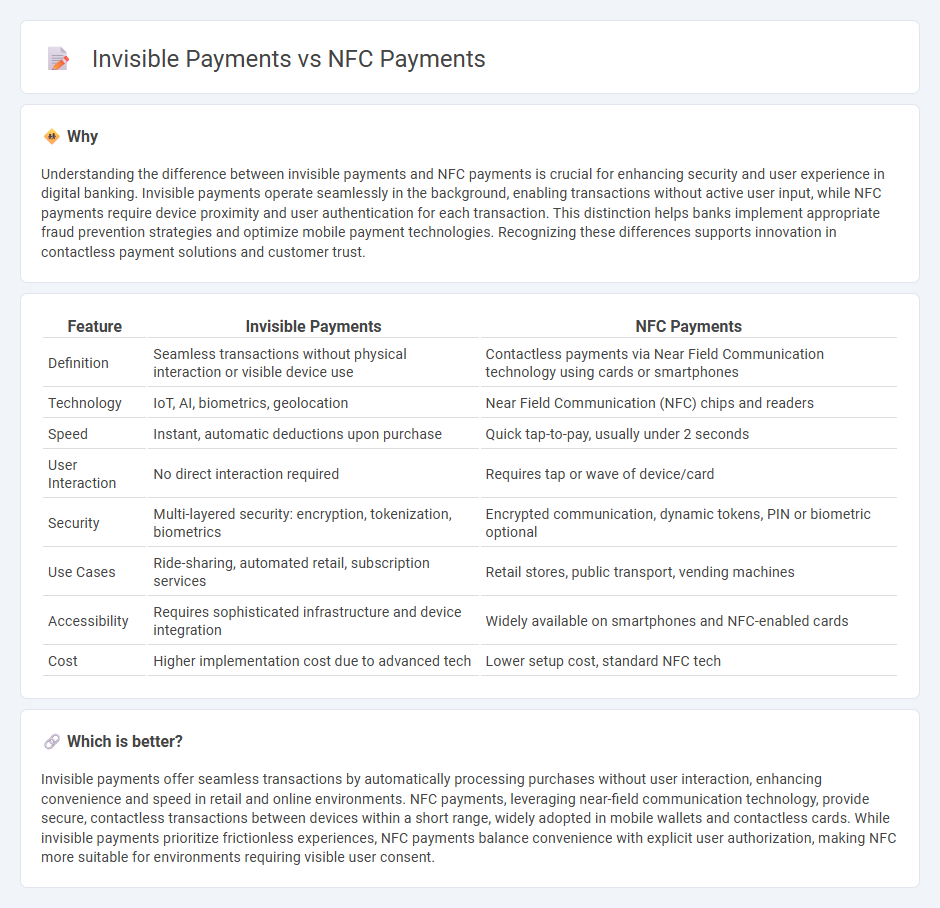

Understanding the difference between invisible payments and NFC payments is crucial for enhancing security and user experience in digital banking. Invisible payments operate seamlessly in the background, enabling transactions without active user input, while NFC payments require device proximity and user authentication for each transaction. This distinction helps banks implement appropriate fraud prevention strategies and optimize mobile payment technologies. Recognizing these differences supports innovation in contactless payment solutions and customer trust.

Comparison Table

| Feature | Invisible Payments | NFC Payments |

|---|---|---|

| Definition | Seamless transactions without physical interaction or visible device use | Contactless payments via Near Field Communication technology using cards or smartphones |

| Technology | IoT, AI, biometrics, geolocation | Near Field Communication (NFC) chips and readers |

| Speed | Instant, automatic deductions upon purchase | Quick tap-to-pay, usually under 2 seconds |

| User Interaction | No direct interaction required | Requires tap or wave of device/card |

| Security | Multi-layered security: encryption, tokenization, biometrics | Encrypted communication, dynamic tokens, PIN or biometric optional |

| Use Cases | Ride-sharing, automated retail, subscription services | Retail stores, public transport, vending machines |

| Accessibility | Requires sophisticated infrastructure and device integration | Widely available on smartphones and NFC-enabled cards |

| Cost | Higher implementation cost due to advanced tech | Lower setup cost, standard NFC tech |

Which is better?

Invisible payments offer seamless transactions by automatically processing purchases without user interaction, enhancing convenience and speed in retail and online environments. NFC payments, leveraging near-field communication technology, provide secure, contactless transactions between devices within a short range, widely adopted in mobile wallets and contactless cards. While invisible payments prioritize frictionless experiences, NFC payments balance convenience with explicit user authorization, making NFC more suitable for environments requiring visible user consent.

Connection

Invisible payments leverage Near Field Communication (NFC) technology to enable seamless transactions without physical card interaction, enhancing user convenience and security. NFC payments use short-range communication between devices, facilitating contactless transfers that power invisible payment methods in retail and mobile banking. This integration reduces transaction friction and accelerates the adoption of digital wallets and contactless banking solutions.

Key Terms

Contactless

Contactless payments encompass NFC technology, enabling transactions through secure radio waves without physical contact, while invisible payments operate seamlessly in the background, often leveraging biometrics or tokenization for frictionless checkout experiences. NFC payments are widely adopted in mobile wallets, providing convenience and enhanced security for retail and transit industries. Discover how these innovations are revolutionizing payment ecosystems and consumer behavior by exploring detailed comparisons and future trends.

Tokenization

Tokenization in NFC payments replaces sensitive card details with unique digital tokens, enhancing security by preventing data breaches during transactions. Invisible payments extend tokenization by integrating biometric authentication and encrypted data transmission for seamless, contactless purchases without user interaction. Explore how tokenization revolutionizes payment security and user experience in these emerging technologies.

Seamless

NFC payments utilize near-field communication technology to enable quick, contactless transactions through smartphones or cards, enhancing convenience and security at point-of-sale terminals. Invisible payments, exemplified by platforms like Seamless, prioritize frictionless experiences by processing transactions automatically without any user interaction, ideal for food delivery and streamlined checkout processes. Discover how Seamless revolutionizes the payment landscape by combining convenience with cutting-edge technology for effortless purchasing.

Source and External Links

NFC Payments Explained: Benefits & How They Work - NFC payments are contactless transactions using short-range wireless technology that securely transmits encrypted payment credentials from an NFC-enabled device to a point-of-sale terminal, completing the transaction within seconds with multifactor authentication and tokenization for security.

What are NFC mobile payments? Everything to know [2025] - NFC mobile payments allow smartphones and tablets to communicate wirelessly over a short distance with payment readers to enable quick contactless payments without physical cards, relying on encrypted radio frequency identification technology.

What are NFC Mobile Payments and How Do They Work? - NFC mobile payments use encrypted communication between mobile wallets or NFC-enabled cards and payment terminals; they use two-way encryption and biometric authentication for enhanced security, transmitting one-time-use codes to complete transactions securely.

dowidth.com

dowidth.com