Debt recycling is a strategic approach that converts non-deductible home loan debt into tax-deductible investment debt, enhancing wealth over time. Fixed-rate mortgages offer stability by locking in an interest rate for the loan term, protecting borrowers from rate fluctuations. Explore the benefits and risks of each to determine the best fit for your financial goals.

Why it is important

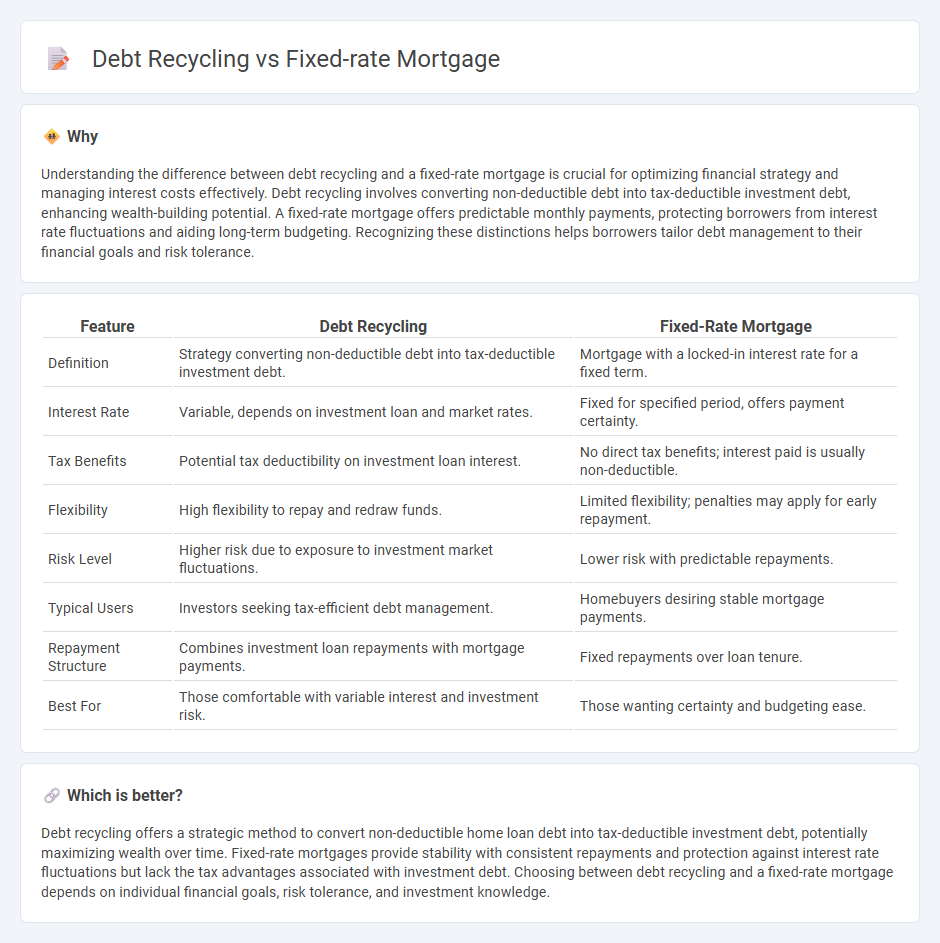

Understanding the difference between debt recycling and a fixed-rate mortgage is crucial for optimizing financial strategy and managing interest costs effectively. Debt recycling involves converting non-deductible debt into tax-deductible investment debt, enhancing wealth-building potential. A fixed-rate mortgage offers predictable monthly payments, protecting borrowers from interest rate fluctuations and aiding long-term budgeting. Recognizing these distinctions helps borrowers tailor debt management to their financial goals and risk tolerance.

Comparison Table

| Feature | Debt Recycling | Fixed-Rate Mortgage |

|---|---|---|

| Definition | Strategy converting non-deductible debt into tax-deductible investment debt. | Mortgage with a locked-in interest rate for a fixed term. |

| Interest Rate | Variable, depends on investment loan and market rates. | Fixed for specified period, offers payment certainty. |

| Tax Benefits | Potential tax deductibility on investment loan interest. | No direct tax benefits; interest paid is usually non-deductible. |

| Flexibility | High flexibility to repay and redraw funds. | Limited flexibility; penalties may apply for early repayment. |

| Risk Level | Higher risk due to exposure to investment market fluctuations. | Lower risk with predictable repayments. |

| Typical Users | Investors seeking tax-efficient debt management. | Homebuyers desiring stable mortgage payments. |

| Repayment Structure | Combines investment loan repayments with mortgage payments. | Fixed repayments over loan tenure. |

| Best For | Those comfortable with variable interest and investment risk. | Those wanting certainty and budgeting ease. |

Which is better?

Debt recycling offers a strategic method to convert non-deductible home loan debt into tax-deductible investment debt, potentially maximizing wealth over time. Fixed-rate mortgages provide stability with consistent repayments and protection against interest rate fluctuations but lack the tax advantages associated with investment debt. Choosing between debt recycling and a fixed-rate mortgage depends on individual financial goals, risk tolerance, and investment knowledge.

Connection

Debt recycling leverages the equity in a home, often secured by a fixed-rate mortgage, to invest in income-generating assets while managing interest payments predictably. A fixed-rate mortgage provides stability in repayment schedules, enabling borrowers to strategically redirect funds previously allocated to non-deductible debt towards investments. This connection enhances wealth-building potential by maximizing tax benefits and maintaining consistent mortgage expenses.

Key Terms

Interest Rate

Fixed-rate mortgages offer a stable interest rate throughout the loan term, providing predictable monthly payments and protection against rising rates. Debt recycling typically involves variable interest rates, allowing borrowers to potentially reduce interest costs through strategic debt repayment and reinvestment. Explore how these approaches impact your loan interest rate and financial growth potential.

Loan Structure

Fixed-rate mortgages offer predictable monthly payments with interest rates locked for a set term, providing budget stability and protection against rate fluctuations. Debt recycling restructures your loan by converting non-deductible debt into tax-deductible investment debt, optimizing loan components for tax efficiency and wealth building. Explore how loan structure impacts financial strategy and potential benefits for your unique situation.

Equity

Fixed-rate mortgages offer predictable monthly payments and stability in interest rates, making it easier to build equity over time without unexpected increases. Debt recycling leverages existing equity by converting non-deductible debt into deductible investment debt, potentially accelerating wealth accumulation. Explore how balancing fixed-rate mortgage security with strategic debt recycling can optimize your equity growth.

Source and External Links

Fixed-rate mortgage - Wikipedia - A fixed-rate mortgage keeps the same interest rate for the entire loan term, so your principal and interest payments stay constant, making budgeting easier.

Fixed-rate mortgage benefits and options - Once you lock in a fixed-rate mortgage, your monthly mortgage payment remains unchanged unless you refinance, while the split between interest and principal gradually shifts as you pay down the loan.

Fixed Rate Mortgage Calculator | Fixed Interest Payments - U.S. Bank - Fixed-rate mortgages offer consistent monthly payments and are typically available in 10-, 15-, 20-, or 30-year terms, letting you compare payment amounts for different loan structures.

dowidth.com

dowidth.com