Super apps integrate multiple financial services, including payments, lending, and investments, offering users a seamless banking experience within a single platform. Payment gateways specialize in processing online transactions securely, enabling businesses to accept various digital payment methods efficiently. Discover how these innovations are transforming the banking landscape and enhancing consumer convenience.

Why it is important

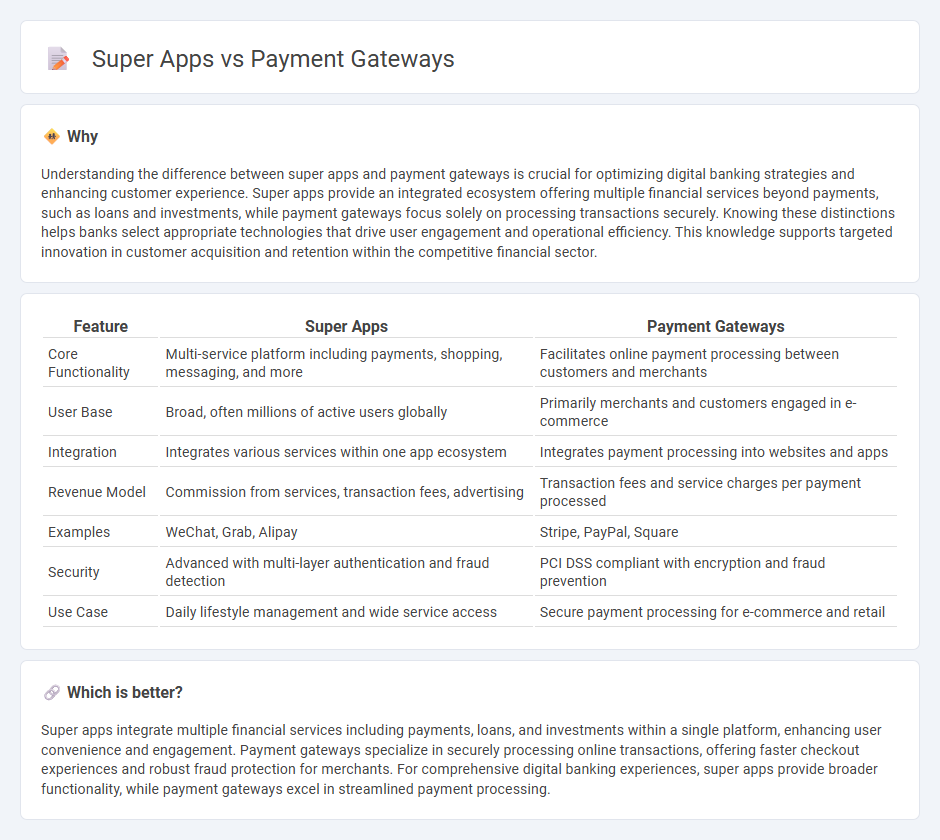

Understanding the difference between super apps and payment gateways is crucial for optimizing digital banking strategies and enhancing customer experience. Super apps provide an integrated ecosystem offering multiple financial services beyond payments, such as loans and investments, while payment gateways focus solely on processing transactions securely. Knowing these distinctions helps banks select appropriate technologies that drive user engagement and operational efficiency. This knowledge supports targeted innovation in customer acquisition and retention within the competitive financial sector.

Comparison Table

| Feature | Super Apps | Payment Gateways |

|---|---|---|

| Core Functionality | Multi-service platform including payments, shopping, messaging, and more | Facilitates online payment processing between customers and merchants |

| User Base | Broad, often millions of active users globally | Primarily merchants and customers engaged in e-commerce |

| Integration | Integrates various services within one app ecosystem | Integrates payment processing into websites and apps |

| Revenue Model | Commission from services, transaction fees, advertising | Transaction fees and service charges per payment processed |

| Examples | WeChat, Grab, Alipay | Stripe, PayPal, Square |

| Security | Advanced with multi-layer authentication and fraud detection | PCI DSS compliant with encryption and fraud prevention |

| Use Case | Daily lifestyle management and wide service access | Secure payment processing for e-commerce and retail |

Which is better?

Super apps integrate multiple financial services including payments, loans, and investments within a single platform, enhancing user convenience and engagement. Payment gateways specialize in securely processing online transactions, offering faster checkout experiences and robust fraud protection for merchants. For comprehensive digital banking experiences, super apps provide broader functionality, while payment gateways excel in streamlined payment processing.

Connection

Super apps integrate multiple financial services within a single platform, streamlining user access to payment gateways for seamless transactions. Payment gateways facilitate secure processing of digital payments, enabling super apps to offer instant fund transfers, bill payments, and e-commerce checkouts. The interconnected ecosystem enhances banking efficiency by leveraging APIs and real-time data exchange to support diverse financial activities.

Key Terms

Integration

Payment gateways facilitate seamless transaction processing by integrating with e-commerce platforms, mobile apps, and websites to enable secure payment acceptance across various channels. Super apps, on the other hand, offer a unified ecosystem by integrating multiple services such as payments, messaging, ride-hailing, and food delivery within a single interface, enhancing user convenience and engagement. Explore more about how integration strategies differ between payment gateways and super apps to optimize your business solutions.

User Experience

Payment gateways streamline transactions by offering fast, secure, and seamless processing, enhancing user trust and convenience. Super apps integrate multiple services, including payments, messaging, and shopping, into a single platform, creating a unified and immersive user experience. Explore how balancing specialized payment solutions with multifunctional super apps can redefine user satisfaction and engagement.

Ecosystem

Payment gateways serve as standalone platforms facilitating secure online transactions, primarily focused on processing payments between merchants and customers. Super apps integrate payment gateways within a broader ecosystem that includes services like messaging, shopping, ride-hailing, and financial management, creating a seamless user experience across multiple domains. Explore the evolving dynamics between payment gateways and super app ecosystems to understand their impact on digital commerce.

Source and External Links

Payment Gateways in 2025: Main Types + How They Work - Payment gateways are merchant services that process credit card payments for both online and physical stores, with examples including PayPal, Square, Stripe, and Apple Pay, each offering different features for secure and flexible transaction processing.

Payment Gateways: What They Are And How To Choose One - Payment gateways act as secure intermediaries in online transactions, connecting customers, businesses, and banks while using advanced encryption and compliance standards to protect sensitive payment data.

Payment gateway - Wikipedia - A payment gateway authorizes credit card or direct payment processing for merchants, transferring transaction information between payment portals and banks, and can be provided by financial institutions or specialized service providers.

dowidth.com

dowidth.com