Negative interest rates occur when central banks set policy rates below zero, compelling commercial banks to pay for holding excess reserves, contrasting with positive base rates that influence borrowing costs and economic activity. This unconventional monetary policy aims to stimulate lending and investment during economic downturns, though it can erode bank profitability and savers' returns. Explore the complexities and economic implications of negative interest rates versus traditional base rates to understand their impact on global finance.

Why it is important

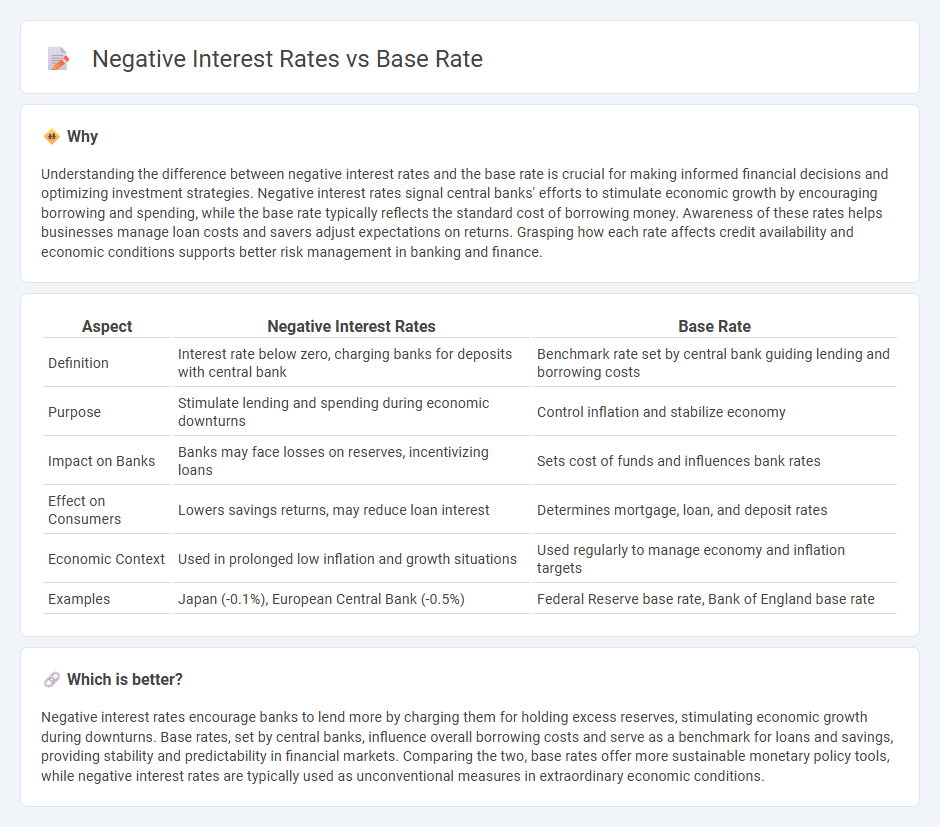

Understanding the difference between negative interest rates and the base rate is crucial for making informed financial decisions and optimizing investment strategies. Negative interest rates signal central banks' efforts to stimulate economic growth by encouraging borrowing and spending, while the base rate typically reflects the standard cost of borrowing money. Awareness of these rates helps businesses manage loan costs and savers adjust expectations on returns. Grasping how each rate affects credit availability and economic conditions supports better risk management in banking and finance.

Comparison Table

| Aspect | Negative Interest Rates | Base Rate |

|---|---|---|

| Definition | Interest rate below zero, charging banks for deposits with central bank | Benchmark rate set by central bank guiding lending and borrowing costs |

| Purpose | Stimulate lending and spending during economic downturns | Control inflation and stabilize economy |

| Impact on Banks | Banks may face losses on reserves, incentivizing loans | Sets cost of funds and influences bank rates |

| Effect on Consumers | Lowers savings returns, may reduce loan interest | Determines mortgage, loan, and deposit rates |

| Economic Context | Used in prolonged low inflation and growth situations | Used regularly to manage economy and inflation targets |

| Examples | Japan (-0.1%), European Central Bank (-0.5%) | Federal Reserve base rate, Bank of England base rate |

Which is better?

Negative interest rates encourage banks to lend more by charging them for holding excess reserves, stimulating economic growth during downturns. Base rates, set by central banks, influence overall borrowing costs and serve as a benchmark for loans and savings, providing stability and predictability in financial markets. Comparing the two, base rates offer more sustainable monetary policy tools, while negative interest rates are typically used as unconventional measures in extraordinary economic conditions.

Connection

Negative interest rates occur when central banks set the base rate below zero to stimulate economic activity by encouraging banks to lend more rather than hold reserves. This unconventional monetary policy impacts commercial bank lending rates, deposit costs, and overall financial market stability. Investors and consumers adjust behavior in response to these shifts in base rates, influencing credit flows and economic growth.

Key Terms

Benchmark Rate

The base rate, serving as a key benchmark interest rate, influences borrowing costs and monetary policy decisions within an economy, typically representing the minimum rate at which banks lend to customers. Negative interest rates occur when central banks set benchmark rates below zero, aiming to stimulate economic activity by encouraging lending and spending rather than saving. Explore more about how benchmark rates impact financial markets and economic strategies.

Monetary Policy

The base rate, set by central banks, serves as a benchmark for lending and borrowing costs, influencing inflation and economic growth. Negative interest rates represent an unconventional monetary policy tool aimed at stimulating spending by charging banks for holding excess reserves, thereby encouraging lending. Explore how these tools shape economic stability and central bank strategies in detail.

Deposit Rate

The base rate serves as the benchmark interest rate set by central banks, influencing deposit rates which determine returns for savers and guide overall economic activity. Negative interest rates occur when central banks push base rates below zero to stimulate lending and spending, causing deposit rates to sometimes turn negative, leading banks to charge customers for holding deposits. Explore how these contrasting rate policies impact personal savings and financial markets in depth.

Source and External Links

Base rate: Explanation & influencing factors | Swoop US - The base rate is a benchmark interest rate set by central banks to serve as a reference for interest rates on loans and savings, influencing borrowing costs and economic activity.

What is the Base Rate? - FOREX.com - The base rate is the interest rate a central bank charges commercial banks for loans, used as a tool to regulate the economy by adjusting the incentive to spend or save.

Base Rate | Practical Law - Westlaw - In loan agreements, the base rate is a floating reference rate, often defined as the greatest of the lender's prime rate, a set margin above the federal funds rate, or a margin above Adjusted Term SOFR, plus an agreed margin.

dowidth.com

dowidth.com