Finfluencers leverage social media platforms to provide personalized banking insights, investment tips, and financial literacy content, fostering direct engagement and community-driven advice. Robo-advisors utilize sophisticated algorithms and artificial intelligence to deliver automated, cost-effective portfolio management and banking services tailored to individual risk profiles and goals. Discover how blending human expertise with technology is transforming the future of banking advisory services.

Why it is important

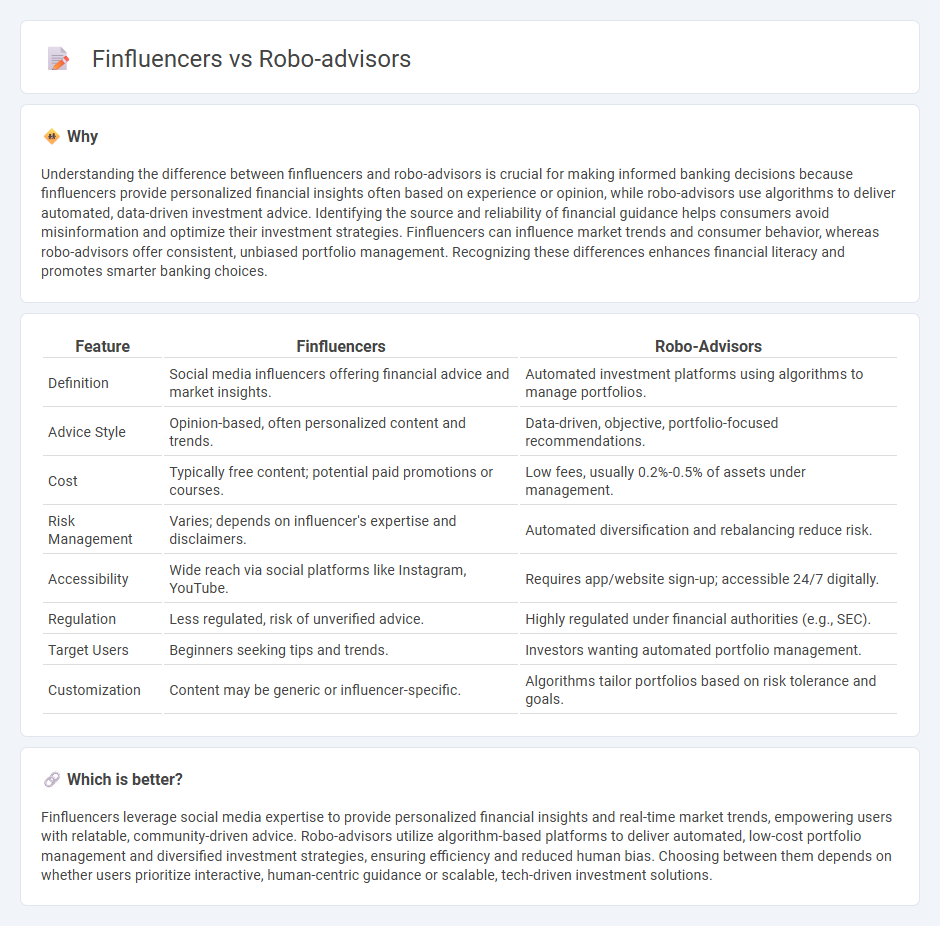

Understanding the difference between finfluencers and robo-advisors is crucial for making informed banking decisions because finfluencers provide personalized financial insights often based on experience or opinion, while robo-advisors use algorithms to deliver automated, data-driven investment advice. Identifying the source and reliability of financial guidance helps consumers avoid misinformation and optimize their investment strategies. Finfluencers can influence market trends and consumer behavior, whereas robo-advisors offer consistent, unbiased portfolio management. Recognizing these differences enhances financial literacy and promotes smarter banking choices.

Comparison Table

| Feature | Finfluencers | Robo-Advisors |

|---|---|---|

| Definition | Social media influencers offering financial advice and market insights. | Automated investment platforms using algorithms to manage portfolios. |

| Advice Style | Opinion-based, often personalized content and trends. | Data-driven, objective, portfolio-focused recommendations. |

| Cost | Typically free content; potential paid promotions or courses. | Low fees, usually 0.2%-0.5% of assets under management. |

| Risk Management | Varies; depends on influencer's expertise and disclaimers. | Automated diversification and rebalancing reduce risk. |

| Accessibility | Wide reach via social platforms like Instagram, YouTube. | Requires app/website sign-up; accessible 24/7 digitally. |

| Regulation | Less regulated, risk of unverified advice. | Highly regulated under financial authorities (e.g., SEC). |

| Target Users | Beginners seeking tips and trends. | Investors wanting automated portfolio management. |

| Customization | Content may be generic or influencer-specific. | Algorithms tailor portfolios based on risk tolerance and goals. |

Which is better?

Finfluencers leverage social media expertise to provide personalized financial insights and real-time market trends, empowering users with relatable, community-driven advice. Robo-advisors utilize algorithm-based platforms to deliver automated, low-cost portfolio management and diversified investment strategies, ensuring efficiency and reduced human bias. Choosing between them depends on whether users prioritize interactive, human-centric guidance or scalable, tech-driven investment solutions.

Connection

Finfluencers leverage social media platforms to provide accessible financial advice, significantly influencing consumer banking behavior. Robo-advisors use algorithm-driven technology to offer personalized investment management solutions, often recommended or reviewed by finfluencers in digital content. This synergy boosts the adoption of automated financial services, shaping modern banking trends and enhancing customer engagement.

Key Terms

Algorithmic Portfolio Management

Robo-advisors leverage advanced algorithmic portfolio management to offer automated, data-driven investment strategies with minimal human intervention, ensuring optimized asset allocation based on real-time market analysis. Finfluencers often provide personalized financial advice influenced by market trends and personal experience but lack the systematic precision inherent in algorithmic models. Explore how the integration of AI-driven robo-advisors is transforming portfolio management for investors seeking efficiency and scalability.

Social Media Influence

Robo-advisors leverage algorithms to provide automated investment management, emphasizing cost-efficiency and data-driven decisions, while finfluencers utilize social media platforms to share financial advice, often blending personal experience with market trends. The impact of social media influence is significant for finfluencers, shaping investor behavior through relatable content and community engagement, contrasting with the objective, technology-based approach of robo-advisors. Explore how these distinct channels affect financial decision-making and wealth management strategies.

Regulatory Oversight

Robo-advisors operate under stringent regulatory frameworks such as the SEC's Investment Advisers Act, ensuring transparency, fiduciary duty, and robust compliance standards. Finfluencers, often unregulated or loosely regulated, pose higher risks related to misinformation and lack clear accountability mechanisms. Explore the evolving regulatory landscape to understand how oversight shapes trust and protection in digital financial advice.

Source and External Links

Robo-advisor - Robo-advisors are digital financial advisers that provide personalized investment management online using algorithms with minimal human intervention, making wealth management accessible and affordable for broader audiences.

What is a robo advisor? | Robo advisory services - A robo-advisor uses digital technology and algorithms to automate investing based on an investor's goals, financial situation, and risk tolerance, offering a low-cost alternative to traditional financial advice.

Best Robo-Advisors In July 2025 - Robo-advisors provide automated portfolio construction, ongoing management including rebalancing, and tax-efficient investment moves, typically focusing on diversified ETF portfolios to meet investors' goals at lower fees than traditional advisors.

dowidth.com

dowidth.com