Income streaming through investments in financial instruments like dividends and interest offers a diversified approach to generating steady cash flow, contrasting with rental income derived directly from property assets that provide tangible value and potential appreciation. Both income streams have unique tax implications and risk profiles, with rental income often involving property management responsibilities while income streaming relies heavily on market performance. Explore the benefits and trade-offs of income streaming versus rental income to determine the most effective strategy for your financial goals.

Why it is important

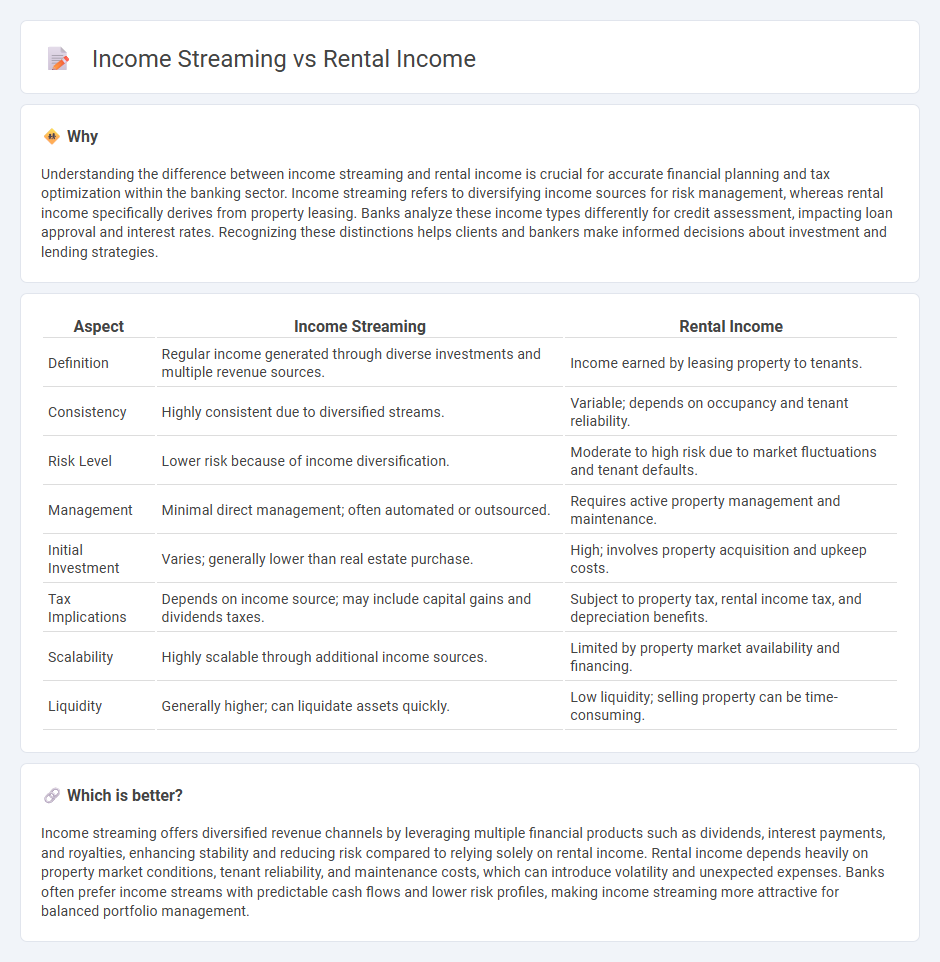

Understanding the difference between income streaming and rental income is crucial for accurate financial planning and tax optimization within the banking sector. Income streaming refers to diversifying income sources for risk management, whereas rental income specifically derives from property leasing. Banks analyze these income types differently for credit assessment, impacting loan approval and interest rates. Recognizing these distinctions helps clients and bankers make informed decisions about investment and lending strategies.

Comparison Table

| Aspect | Income Streaming | Rental Income |

|---|---|---|

| Definition | Regular income generated through diverse investments and multiple revenue sources. | Income earned by leasing property to tenants. |

| Consistency | Highly consistent due to diversified streams. | Variable; depends on occupancy and tenant reliability. |

| Risk Level | Lower risk because of income diversification. | Moderate to high risk due to market fluctuations and tenant defaults. |

| Management | Minimal direct management; often automated or outsourced. | Requires active property management and maintenance. |

| Initial Investment | Varies; generally lower than real estate purchase. | High; involves property acquisition and upkeep costs. |

| Tax Implications | Depends on income source; may include capital gains and dividends taxes. | Subject to property tax, rental income tax, and depreciation benefits. |

| Scalability | Highly scalable through additional income sources. | Limited by property market availability and financing. |

| Liquidity | Generally higher; can liquidate assets quickly. | Low liquidity; selling property can be time-consuming. |

Which is better?

Income streaming offers diversified revenue channels by leveraging multiple financial products such as dividends, interest payments, and royalties, enhancing stability and reducing risk compared to relying solely on rental income. Rental income depends heavily on property market conditions, tenant reliability, and maintenance costs, which can introduce volatility and unexpected expenses. Banks often prefer income streams with predictable cash flows and lower risk profiles, making income streaming more attractive for balanced portfolio management.

Connection

Income streaming and rental income are connected through their role in generating consistent cash flow for investors, with rental income serving as a primary source of steady revenue in income streaming strategies. Banks leverage rental income within income streaming models to assess borrower creditworthiness and enhance portfolio diversification. This connection supports financial planning, enabling property owners and investors to optimize returns while managing risk effectively.

Key Terms

Cash Flow

Rental income provides a consistent cash flow derived from leasing properties, offering a predictable revenue stream for real estate investors. Income streaming diversifies revenue sources by combining rental income with other cash flow channels like dividends, royalties, or business profits, enhancing financial stability. Explore strategies to optimize cash flow and maximize income diversification for robust financial growth.

Passive Income

Rental income generates steady cash flow by leasing properties, providing a reliable source of passive income through monthly tenant payments. Income streaming involves diversifying income sources, such as dividends, royalties, or online businesses, enhancing overall financial stability and growth potential. Explore effective strategies to maximize passive income and build sustainable wealth.

Debt Service Coverage Ratio (DSCR)

Rental income directly impacts the Debt Service Coverage Ratio (DSCR) by providing a steady cash flow to cover debt obligations, making it a crucial metric for lenders assessing property loans. Income streaming, which aggregates various income sources such as rentals, service fees, and ancillary revenue, diversifies income streams and can enhance DSCR by stabilizing cash flow against market fluctuations. Discover how optimizing income streams can improve DSCR and strengthen financial resilience in real estate investments.

Source and External Links

Tips on Rental Real Estate Income, Deductions, and Recordkeeping - Provides guidance on reporting rental income and deducting associated expenses for tax purposes.

Rental Income Taxes Explained - Offers insights into how rental income is taxed, including what constitutes rental income and how to calculate taxable income.

What is Rental Income and How Do I Report It? - Covers the definition of rental income and explains how to report it using Schedule E for Supplemental Income and Loss.

dowidth.com

dowidth.com