Stablecoin rails offer instant settlement, reduced transaction costs, and global accessibility compared to Fedwire's traditional high-value payment network, which relies on centralized clearing and slower processing times. Fedwire provides robust regulatory oversight and real-time gross settlement for large-dollar transactions between financial institutions, ensuring security and compliance. Explore how stablecoin rails and Fedwire transform payment infrastructures and what this means for the future of banking.

Why it is important

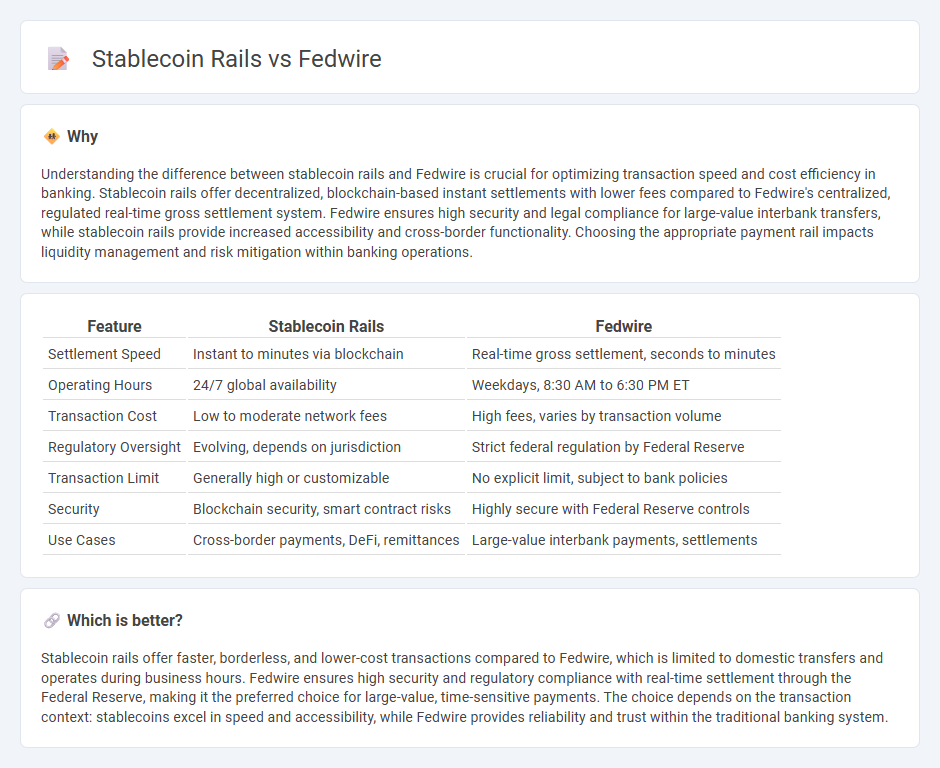

Understanding the difference between stablecoin rails and Fedwire is crucial for optimizing transaction speed and cost efficiency in banking. Stablecoin rails offer decentralized, blockchain-based instant settlements with lower fees compared to Fedwire's centralized, regulated real-time gross settlement system. Fedwire ensures high security and legal compliance for large-value interbank transfers, while stablecoin rails provide increased accessibility and cross-border functionality. Choosing the appropriate payment rail impacts liquidity management and risk mitigation within banking operations.

Comparison Table

| Feature | Stablecoin Rails | Fedwire |

|---|---|---|

| Settlement Speed | Instant to minutes via blockchain | Real-time gross settlement, seconds to minutes |

| Operating Hours | 24/7 global availability | Weekdays, 8:30 AM to 6:30 PM ET |

| Transaction Cost | Low to moderate network fees | High fees, varies by transaction volume |

| Regulatory Oversight | Evolving, depends on jurisdiction | Strict federal regulation by Federal Reserve |

| Transaction Limit | Generally high or customizable | No explicit limit, subject to bank policies |

| Security | Blockchain security, smart contract risks | Highly secure with Federal Reserve controls |

| Use Cases | Cross-border payments, DeFi, remittances | Large-value interbank payments, settlements |

Which is better?

Stablecoin rails offer faster, borderless, and lower-cost transactions compared to Fedwire, which is limited to domestic transfers and operates during business hours. Fedwire ensures high security and regulatory compliance with real-time settlement through the Federal Reserve, making it the preferred choice for large-value, time-sensitive payments. The choice depends on the transaction context: stablecoins excel in speed and accessibility, while Fedwire provides reliability and trust within the traditional banking system.

Connection

Stablecoin rails leverage blockchain technology to facilitate instant, secure digital asset transfers, complementing the Federal Reserve's Fedwire system, which processes high-value interbank payments in real time. Integration between stablecoin networks and Fedwire enhances liquidity and settlement efficiency by enabling seamless tokenized asset exchanges aligned with traditional banking infrastructures. This connectivity supports faster cross-border transactions while maintaining regulatory compliance and reducing reliance on correspondent banking channels.

Key Terms

Real-Time Gross Settlement (RTGS)

Fedwire operates as a Real-Time Gross Settlement (RTGS) system managed by the Federal Reserve, enabling instantaneous fund transfers between banks with finality and irreversibility. Stablecoin rails utilize blockchain technology to facilitate real-time, decentralized transactions with transparency and reduced counterparty risk, often bypassing traditional intermediaries. Explore the nuances and advantages of Fedwire and stablecoin systems to understand their impact on the future of payment infrastructure.

Liquidity

Fedwire's real-time gross settlement system ensures immediate finality and high liquidity for large-value transactions between U.S. financial institutions, leveraging centralized trust and regulatory oversight. Stablecoin rails offer cross-border liquidity with enhanced speed and lower costs by utilizing blockchain protocols and decentralized networks, providing 24/7 access without traditional banking hours constraints. Explore further to understand how liquidity mechanisms in Fedwire and stablecoin systems impact financial efficiency and cross-border payments.

Settlement Finality

Fedwire provides settlement finality through real-time gross settlement (RTGS), ensuring immediate and irrevocable transfer of funds between financial institutions. Stablecoin rails, operating on blockchain networks, offer settlement finality via cryptographic consensus mechanisms, which can introduce latency but enhance transparency and security. Explore the detailed comparison of Fedwire and stablecoin settlement finality to understand their impact on financial transactions.

Source and External Links

Fedwire Funds Services - The Fedwire Funds Service is a real-time gross settlement system operated by the Federal Reserve Banks that allows depository institutions to make immediate, final, and irrevocable large-value transfers between accounts.

Fedwire - Fedwire is used by over 9,000 U.S. financial institutions for same-day, often instantaneous, electronic funds transfers, primarily for large-value or time-critical domestic and international payments.

Fedwire - Established in 1915, Fedwire enables banks to transfer funds quickly and securely, adjusting account balances in real time for both customer and interbank payments, with the average transfer value reaching about $5.4 million in 2022.

dowidth.com

dowidth.com