Stablecoin rails provide a decentralized and transparent payment infrastructure enabling fast, low-cost cross-border transactions, contrasting with traditional e-wallets that rely on centralized systems and fiat currency management. The blockchain technology behind stablecoins offers enhanced security, immutability, and real-time settlement compared to the conventional banking networks that e-wallets often utilize. Explore the evolving landscape of digital payments to understand how these innovations reshape global banking.

Why it is important

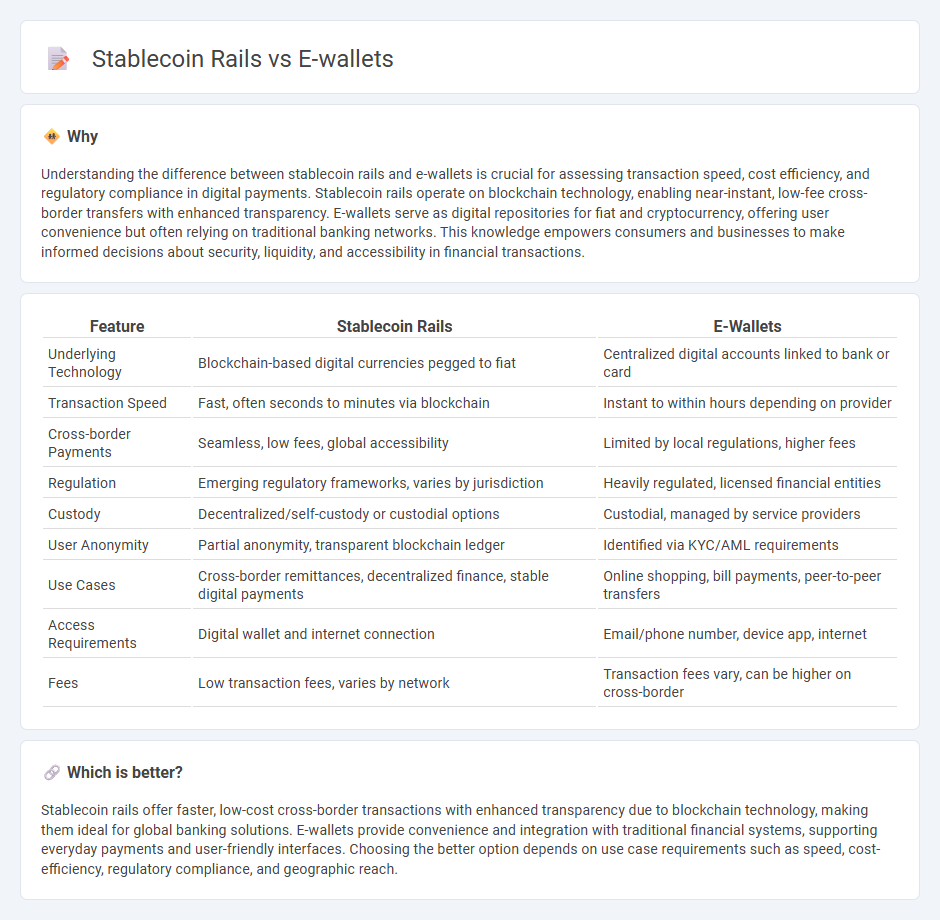

Understanding the difference between stablecoin rails and e-wallets is crucial for assessing transaction speed, cost efficiency, and regulatory compliance in digital payments. Stablecoin rails operate on blockchain technology, enabling near-instant, low-fee cross-border transfers with enhanced transparency. E-wallets serve as digital repositories for fiat and cryptocurrency, offering user convenience but often relying on traditional banking networks. This knowledge empowers consumers and businesses to make informed decisions about security, liquidity, and accessibility in financial transactions.

Comparison Table

| Feature | Stablecoin Rails | E-Wallets |

|---|---|---|

| Underlying Technology | Blockchain-based digital currencies pegged to fiat | Centralized digital accounts linked to bank or card |

| Transaction Speed | Fast, often seconds to minutes via blockchain | Instant to within hours depending on provider |

| Cross-border Payments | Seamless, low fees, global accessibility | Limited by local regulations, higher fees |

| Regulation | Emerging regulatory frameworks, varies by jurisdiction | Heavily regulated, licensed financial entities |

| Custody | Decentralized/self-custody or custodial options | Custodial, managed by service providers |

| User Anonymity | Partial anonymity, transparent blockchain ledger | Identified via KYC/AML requirements |

| Use Cases | Cross-border remittances, decentralized finance, stable digital payments | Online shopping, bill payments, peer-to-peer transfers |

| Access Requirements | Digital wallet and internet connection | Email/phone number, device app, internet |

| Fees | Low transaction fees, varies by network | Transaction fees vary, can be higher on cross-border |

Which is better?

Stablecoin rails offer faster, low-cost cross-border transactions with enhanced transparency due to blockchain technology, making them ideal for global banking solutions. E-wallets provide convenience and integration with traditional financial systems, supporting everyday payments and user-friendly interfaces. Choosing the better option depends on use case requirements such as speed, cost-efficiency, regulatory compliance, and geographic reach.

Connection

Stablecoin rails provide a secure and efficient infrastructure for e-wallets by enabling instant, low-cost digital asset transfers and settlements across borders. E-wallets integrate stablecoin rails to facilitate real-time payments, reduce transaction fees, and enhance accessibility for unbanked populations. This synergy supports seamless digital transactions within decentralized finance (DeFi) ecosystems and traditional banking networks.

Key Terms

Digital Wallet Integration

Digital wallets offer seamless integration with traditional banking systems, enabling users to store, send, and receive fiat currencies securely. Stablecoin rails leverage blockchain technology to provide fast, low-cost cross-border transactions with price stability tied to fiat currencies like the US dollar. Explore the benefits and innovations of digital wallet integration and stablecoin rails to enhance your financial ecosystem.

Fiat-backed Assets

Fiat-backed assets in both e-wallets and stablecoin rails provide secure digital transaction methods with reduced volatility compared to cryptocurrencies like Bitcoin or Ethereum. E-wallets, integrated with traditional banking systems, facilitate seamless fiat currency storage and transfer, while stablecoin rails use blockchain technology to enable faster, transparent, and cross-border payments backed by fiat reserves. Explore the comparative advantages of e-wallets and stablecoin rails in managing fiat-backed assets to optimize your digital payment strategies.

Blockchain Settlement

E-wallets provide digital payment solutions by securely storing fiat currency in centralized platforms, enabling fast and convenient transactions. Stablecoin rails leverage blockchain technology to facilitate transparent, immutable settlements with reduced intermediaries, improving cross-border payment efficiency. Explore the benefits and challenges of blockchain settlement in modern digital payments to understand the evolving landscape.

Source and External Links

10 best digital wallets in 2025 you need to know - Lists leading e-wallets like Apple Pay, Google Pay, PayPal, and Venmo, highlighting their convenience, security, and integration with financial services for streamlined payments, centralized storage, and versatile functionality.

E-Wallet - Apps on Google Play - A personal finance manager app designed to help users budget, track expenses, save money, and manage bills in one place, with flexible budgeting tools and cloud data synchronization for ongoing financial control.

What businesses need to know about accepting a digital wallet - Explains how digital wallets use NFC, MST, and QR codes for contactless payments, allowing users to make fast, secure transactions in-store or online by selecting stored payment methods on their devices.

dowidth.com

dowidth.com