Open banking revolutionizes financial services by enabling secure data sharing through APIs, fostering innovation and customer-centric solutions. Regtech enhances compliance and risk management via advanced technologies like AI and blockchain, reducing regulatory costs for banks. Explore how open banking and regtech reshape the future of banking security and efficiency.

Why it is important

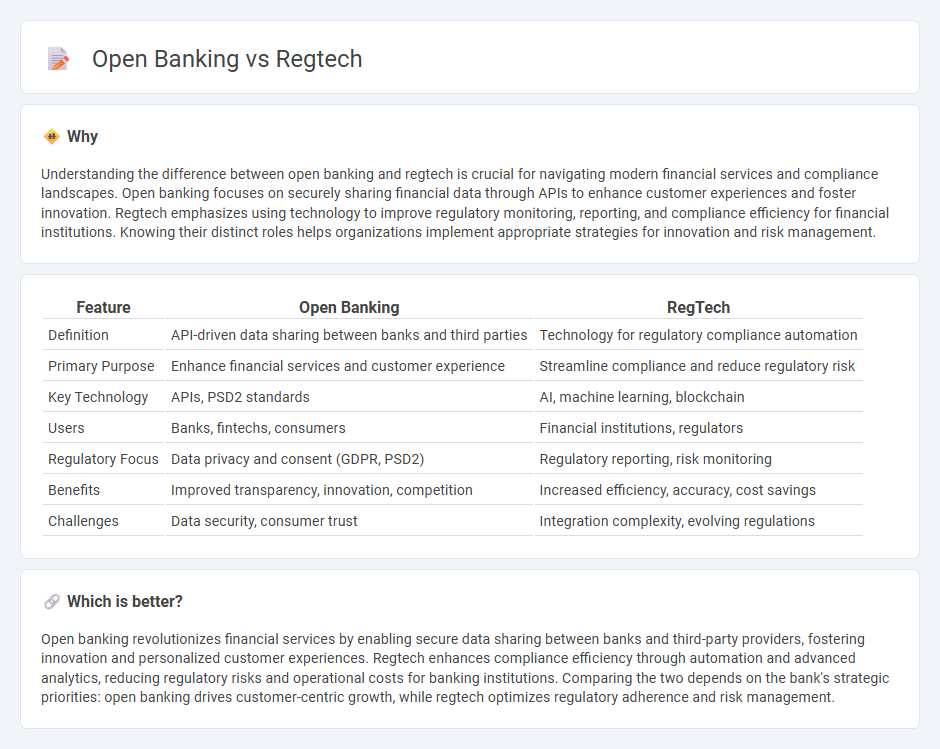

Understanding the difference between open banking and regtech is crucial for navigating modern financial services and compliance landscapes. Open banking focuses on securely sharing financial data through APIs to enhance customer experiences and foster innovation. Regtech emphasizes using technology to improve regulatory monitoring, reporting, and compliance efficiency for financial institutions. Knowing their distinct roles helps organizations implement appropriate strategies for innovation and risk management.

Comparison Table

| Feature | Open Banking | RegTech |

|---|---|---|

| Definition | API-driven data sharing between banks and third parties | Technology for regulatory compliance automation |

| Primary Purpose | Enhance financial services and customer experience | Streamline compliance and reduce regulatory risk |

| Key Technology | APIs, PSD2 standards | AI, machine learning, blockchain |

| Users | Banks, fintechs, consumers | Financial institutions, regulators |

| Regulatory Focus | Data privacy and consent (GDPR, PSD2) | Regulatory reporting, risk monitoring |

| Benefits | Improved transparency, innovation, competition | Increased efficiency, accuracy, cost savings |

| Challenges | Data security, consumer trust | Integration complexity, evolving regulations |

Which is better?

Open banking revolutionizes financial services by enabling secure data sharing between banks and third-party providers, fostering innovation and personalized customer experiences. Regtech enhances compliance efficiency through automation and advanced analytics, reducing regulatory risks and operational costs for banking institutions. Comparing the two depends on the bank's strategic priorities: open banking drives customer-centric growth, while regtech optimizes regulatory adherence and risk management.

Connection

Open banking leverages APIs to enable secure data sharing between banks and third-party providers, fostering innovation and customer-centric services. Regtech employs advanced technologies such as AI and machine learning to ensure compliance with financial regulations in real-time, reducing risks and costs for institutions. The integration of open banking with regtech enhances transparency, streamlines regulatory reporting, and strengthens data security across the banking ecosystem.

Key Terms

Regtech:

Regtech leverages advanced technologies like artificial intelligence, machine learning, and blockchain to enhance regulatory compliance, risk management, and fraud detection within the financial services industry. It offers real-time monitoring and automated reporting, significantly reducing compliance costs and minimizing regulatory penalties. Explore deeper insights into how Regtech transforms compliance frameworks and drives operational efficiency.

Compliance Automation

Regtech leverages advanced technologies like AI and machine learning to streamline compliance automation, reducing manual errors and enhancing regulatory reporting for financial institutions. Open banking, by providing secure API access to financial data, facilitates real-time compliance monitoring and customer consent management. Explore how integrating regtech with open banking drives innovative compliance automation solutions.

Anti-Money Laundering (AML)

Regtech solutions enhance Anti-Money Laundering (AML) efforts by automating compliance processes, real-time transaction monitoring, and risk assessment, significantly reducing the risk of financial crimes. Open banking facilitates AML by providing secure access to customer financial data through APIs, enabling better fraud detection and customer due diligence. Explore how integrating regtech and open banking advances AML strategies for financial institutions.

Source and External Links

What is regtech? - Moody's - Regtech (regulatory technology) is a set of SaaS solutions designed to automate regulatory compliance in industries like financial services, helping to fight financial crime such as money laundering and ensuring efficient compliance with regulations like KYC and AML.

What is RegTech (Regulatory Technology)? - Tipalti - Regtech uses machine learning, big data, and cloud computing to manage compliance risks in real time, monitoring digital financial transactions for irregularities and supporting compliance with regulations such as the FATF recommendations and EU Money Laundering Directives.

Regulatory technology - Wikipedia - RegTech applies information technology to improve regulatory monitoring, reporting, and compliance processes, primarily in heavily regulated industries such as financial services, with goals to increase transparency, reduce costs, and standardize regulatory workflows.

dowidth.com

dowidth.com