Personal finance automation streamlines budgeting, bill payments, and expense tracking using AI-driven tools, while robo-advisory platforms focus on automated investment management by leveraging algorithms to optimize portfolio allocation. Both technologies employ machine learning to enhance financial decision-making and reduce human error, catering to different aspects of wealth management. Explore how these innovations can transform your financial strategy by understanding their distinct benefits and use cases.

Why it is important

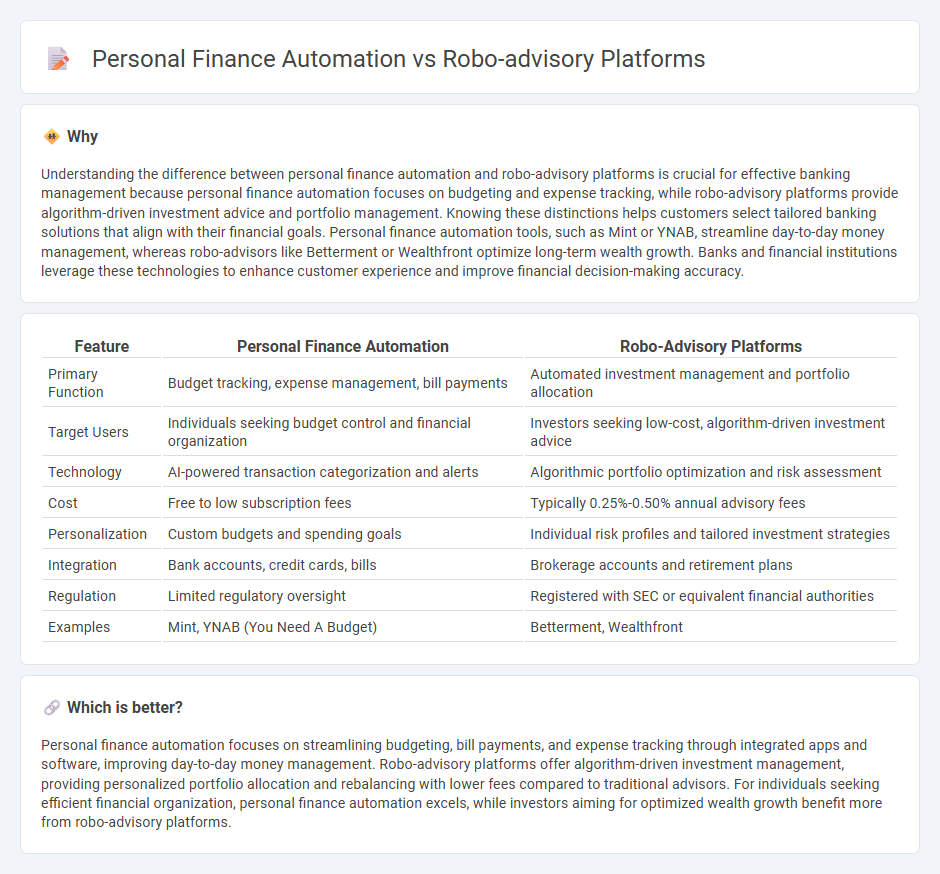

Understanding the difference between personal finance automation and robo-advisory platforms is crucial for effective banking management because personal finance automation focuses on budgeting and expense tracking, while robo-advisory platforms provide algorithm-driven investment advice and portfolio management. Knowing these distinctions helps customers select tailored banking solutions that align with their financial goals. Personal finance automation tools, such as Mint or YNAB, streamline day-to-day money management, whereas robo-advisors like Betterment or Wealthfront optimize long-term wealth growth. Banks and financial institutions leverage these technologies to enhance customer experience and improve financial decision-making accuracy.

Comparison Table

| Feature | Personal Finance Automation | Robo-Advisory Platforms |

|---|---|---|

| Primary Function | Budget tracking, expense management, bill payments | Automated investment management and portfolio allocation |

| Target Users | Individuals seeking budget control and financial organization | Investors seeking low-cost, algorithm-driven investment advice |

| Technology | AI-powered transaction categorization and alerts | Algorithmic portfolio optimization and risk assessment |

| Cost | Free to low subscription fees | Typically 0.25%-0.50% annual advisory fees |

| Personalization | Custom budgets and spending goals | Individual risk profiles and tailored investment strategies |

| Integration | Bank accounts, credit cards, bills | Brokerage accounts and retirement plans |

| Regulation | Limited regulatory oversight | Registered with SEC or equivalent financial authorities |

| Examples | Mint, YNAB (You Need A Budget) | Betterment, Wealthfront |

Which is better?

Personal finance automation focuses on streamlining budgeting, bill payments, and expense tracking through integrated apps and software, improving day-to-day money management. Robo-advisory platforms offer algorithm-driven investment management, providing personalized portfolio allocation and rebalancing with lower fees compared to traditional advisors. For individuals seeking efficient financial organization, personal finance automation excels, while investors aiming for optimized wealth growth benefit more from robo-advisory platforms.

Connection

Personal finance automation and robo-advisory platforms are interconnected through their use of artificial intelligence and machine learning algorithms to optimize financial decision-making and portfolio management. These platforms leverage real-time data analysis, personalized risk assessment, and automated transaction execution to enhance investment strategies and budgeting efficiency. Integration of banking APIs enables seamless synchronization of user financial accounts, promoting comprehensive financial health monitoring and goal optimization.

Key Terms

**Robo-Advisory Platforms:**

Robo-advisory platforms leverage advanced algorithms and artificial intelligence to provide customized investment portfolios with low fees and minimal human intervention, emphasizing automated asset allocation and continuous portfolio rebalancing. These platforms analyze user data, risk tolerance, and financial goals to deliver personalized, data-driven investment advice, making wealth management accessible to a broader audience. Explore more about how robo-advisors can optimize your financial strategy and simplify investment decisions.

Portfolio Management

Robo-advisory platforms leverage automated algorithms to optimize portfolio management by providing personalized investment strategies, risk assessment, and asset allocation tailored to individual goals. Personal finance automation streamlines budgeting, expense tracking, and savings by integrating seamlessly with bank accounts and credit cards but offers limited active portfolio rebalancing. Explore the evolving landscape of portfolio management solutions to determine which approach best aligns with your financial objectives.

Risk Profiling

Robo-advisory platforms utilize advanced algorithms to conduct precise risk profiling by analyzing individual investor data such as age, income, and investment goals, enabling tailored portfolio recommendations. Personal finance automation tools streamline cash flow management, savings, and expense tracking but often lack sophisticated risk assessment capabilities integral to investment decisions. Explore the key differences and benefits of risk profiling in robo-advisors and automation tools to enhance your financial strategy.

Source and External Links

The Best Robo-Advisors of 2025 - Morningstar - Robo-advisors are platforms providing automated, semi-tailored investment portfolios, with top services like Vanguard Digital Advisor offering low fees, customized ETF portfolios, and access to CFPs based on account size.

Best Robo-Advisors In July 2025 - Bankrate - Leading robo-advisors like Betterment and Schwab Intelligent Portfolios provide features such as automatic rebalancing, tax-loss harvesting, fractional shares, and tiered human advisor access, with fees varying by service level and account minimums.

What is a robo advisor? | Robo advisory services - Fidelity Investments - Robo-advisors use automated technology based on investor information to create and maintain portfolios aligned with personal goals and risk tolerance, often at lower fees than traditional management and sometimes with human advisor support.

dowidth.com

dowidth.com