Green financing focuses on funding environmentally sustainable projects such as renewable energy and energy-efficient infrastructure, aiming to reduce carbon footprints and support climate goals. Retail banking provides traditional financial services like savings accounts, loans, and mortgages to individual consumers, prioritizing accessibility and everyday financial needs. Explore how these banking sectors evolve to meet economic and environmental demands.

Why it is important

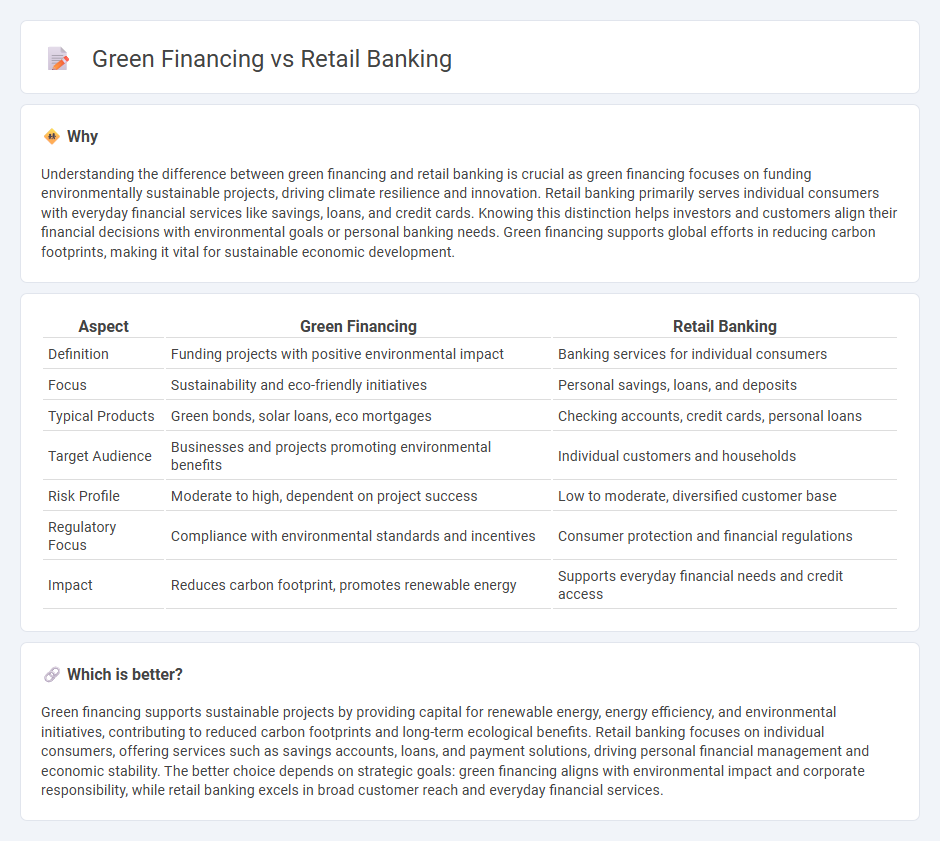

Understanding the difference between green financing and retail banking is crucial as green financing focuses on funding environmentally sustainable projects, driving climate resilience and innovation. Retail banking primarily serves individual consumers with everyday financial services like savings, loans, and credit cards. Knowing this distinction helps investors and customers align their financial decisions with environmental goals or personal banking needs. Green financing supports global efforts in reducing carbon footprints, making it vital for sustainable economic development.

Comparison Table

| Aspect | Green Financing | Retail Banking |

|---|---|---|

| Definition | Funding projects with positive environmental impact | Banking services for individual consumers |

| Focus | Sustainability and eco-friendly initiatives | Personal savings, loans, and deposits |

| Typical Products | Green bonds, solar loans, eco mortgages | Checking accounts, credit cards, personal loans |

| Target Audience | Businesses and projects promoting environmental benefits | Individual customers and households |

| Risk Profile | Moderate to high, dependent on project success | Low to moderate, diversified customer base |

| Regulatory Focus | Compliance with environmental standards and incentives | Consumer protection and financial regulations |

| Impact | Reduces carbon footprint, promotes renewable energy | Supports everyday financial needs and credit access |

Which is better?

Green financing supports sustainable projects by providing capital for renewable energy, energy efficiency, and environmental initiatives, contributing to reduced carbon footprints and long-term ecological benefits. Retail banking focuses on individual consumers, offering services such as savings accounts, loans, and payment solutions, driving personal financial management and economic stability. The better choice depends on strategic goals: green financing aligns with environmental impact and corporate responsibility, while retail banking excels in broad customer reach and everyday financial services.

Connection

Green financing in retail banking promotes sustainable investments by offering eco-friendly loan products and savings accounts targeted at environmentally conscious consumers. Retail banks integrate green financing initiatives to support renewable energy projects and sustainable businesses, enhancing their corporate social responsibility profiles. This connection drives customer engagement while advancing global environmental goals through accessible, green financial services.

Key Terms

**Retail Banking:**

Retail banking primarily serves individual consumers by providing services such as savings accounts, personal loans, mortgages, and credit cards, emphasizing convenience and accessibility. It plays a crucial role in everyday financial transactions and wealth management while focusing on customer relationship and risk assessment. Explore how retail banking innovations are integrating sustainability practices for a more responsible financial future.

Savings Account

Retail banking primarily offers savings accounts that provide secure, accessible deposits with interest earnings for individual customers. Green financing savings accounts often emphasize environmental responsibility by investing deposits in sustainable projects and clean energy initiatives. Explore how choosing green savings accounts can align your finances with eco-friendly values.

Personal Loan

Personal loans in retail banking typically involve fixed amounts borrowed for various personal expenses, with set interest rates and repayment terms, primarily focused on consumer needs rather than environmental impact. Green financing personal loans are designed specifically to encourage sustainable purchases like energy-efficient home improvements or electric vehicles, often featuring lower interest rates, tax incentives, or rebates to promote eco-friendly choices. Discover how shifting to green financing personal loans benefits both your finances and the planet.

Source and External Links

Retail banking - Wikipedia - Retail banking, also known as consumer banking, offers financial services like savings and checking accounts, mortgages, and loans primarily to individuals rather than corporations or other banks.

What Is Retail Banking? - Forage - Retail banking serves individual customers with services such as checking accounts, savings accounts, debit and credit cards, personal loans, and mortgages, focusing on community financial needs and customer service.

The Role of Retail Banking in the U.S. Banking Industry: Risk ... - Retail banking's core involves deposit taking (checking, savings accounts) and consumer credit products (credit cards, mortgages, personal loans), providing a stable funding source and fee income for banks.

dowidth.com

dowidth.com