Sustainable finance integrates environmental, social, and governance (ESG) factors into investment decisions, aiming to support long-term economic growth and positive societal impact. Corporate social responsibility (CSR) focuses on companies' ethical obligations and community engagement beyond profit maximization. Explore the distinctions and synergies between sustainable finance and CSR to understand their roles in shaping responsible banking.

Why it is important

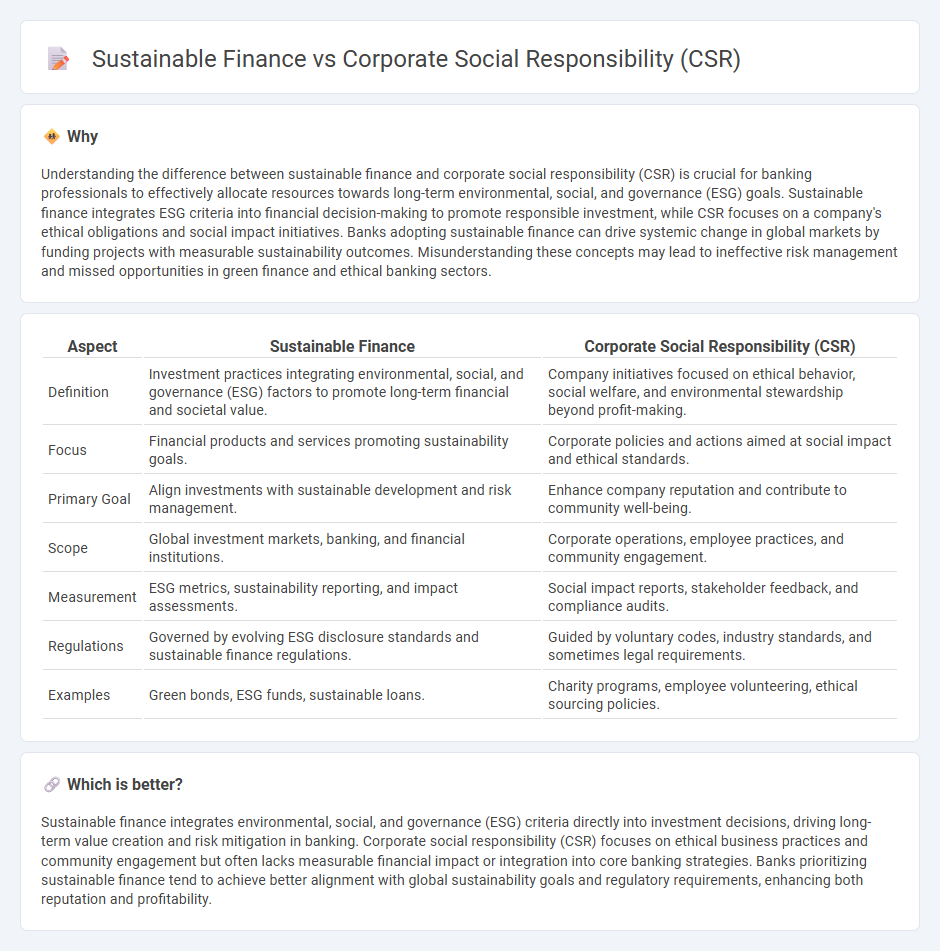

Understanding the difference between sustainable finance and corporate social responsibility (CSR) is crucial for banking professionals to effectively allocate resources towards long-term environmental, social, and governance (ESG) goals. Sustainable finance integrates ESG criteria into financial decision-making to promote responsible investment, while CSR focuses on a company's ethical obligations and social impact initiatives. Banks adopting sustainable finance can drive systemic change in global markets by funding projects with measurable sustainability outcomes. Misunderstanding these concepts may lead to ineffective risk management and missed opportunities in green finance and ethical banking sectors.

Comparison Table

| Aspect | Sustainable Finance | Corporate Social Responsibility (CSR) |

|---|---|---|

| Definition | Investment practices integrating environmental, social, and governance (ESG) factors to promote long-term financial and societal value. | Company initiatives focused on ethical behavior, social welfare, and environmental stewardship beyond profit-making. |

| Focus | Financial products and services promoting sustainability goals. | Corporate policies and actions aimed at social impact and ethical standards. |

| Primary Goal | Align investments with sustainable development and risk management. | Enhance company reputation and contribute to community well-being. |

| Scope | Global investment markets, banking, and financial institutions. | Corporate operations, employee practices, and community engagement. |

| Measurement | ESG metrics, sustainability reporting, and impact assessments. | Social impact reports, stakeholder feedback, and compliance audits. |

| Regulations | Governed by evolving ESG disclosure standards and sustainable finance regulations. | Guided by voluntary codes, industry standards, and sometimes legal requirements. |

| Examples | Green bonds, ESG funds, sustainable loans. | Charity programs, employee volunteering, ethical sourcing policies. |

Which is better?

Sustainable finance integrates environmental, social, and governance (ESG) criteria directly into investment decisions, driving long-term value creation and risk mitigation in banking. Corporate social responsibility (CSR) focuses on ethical business practices and community engagement but often lacks measurable financial impact or integration into core banking strategies. Banks prioritizing sustainable finance tend to achieve better alignment with global sustainability goals and regulatory requirements, enhancing both reputation and profitability.

Connection

Sustainable finance integrates environmental, social, and governance (ESG) criteria into banking decisions, aligning investment with long-term societal goals. Corporate social responsibility (CSR) in banking focuses on ethical practices, community engagement, and transparency, which foster trust and support sustainable economic growth. Together, they drive banks to prioritize responsible lending, green finance, and social impact initiatives that benefit stakeholders and mitigate risks.

Key Terms

Ethical Investment

Corporate Social Responsibility (CSR) emphasizes a company's commitment to ethical practices, community engagement, and environmental stewardship, enhancing its reputation and stakeholder trust. Sustainable finance prioritizes investment choices that integrate environmental, social, and governance (ESG) criteria to promote long-term value while mitigating risks associated with unethical or unsustainable business practices. Explore how ethical investment strategies intertwine CSR values and sustainable finance to create impactful, responsible financial growth.

Environmental, Social, and Governance (ESG)

Corporate Social Responsibility (CSR) emphasizes voluntary business practices that enhance social and environmental well-being, often focusing on community engagement and ethical labor standards. Sustainable finance integrates Environmental, Social, and Governance (ESG) criteria into investment decisions, aiming to generate long-term economic value while addressing environmental impact, social justice, and corporate governance. Discover how aligning CSR initiatives with sustainable finance strategies can drive impactful ESG outcomes.

Stakeholder Engagement

Corporate Social Responsibility (CSR) centers on a company's commitment to ethical practices, social welfare, and community involvement, actively engaging stakeholders such as employees, customers, and local communities to foster transparency and trust. Sustainable finance emphasizes investment decisions that integrate environmental, social, and governance (ESG) criteria, targeting stakeholders like investors and regulators by promoting long-term financial and societal benefits. Explore deeper insights into how stakeholder engagement bridges CSR and sustainable finance to create resilient, responsible corporate ecosystems.

Source and External Links

Corporate social responsibility - Wikipedia - Corporate social responsibility (CSR) is a form of international private business self-regulation aimed at contributing to societal goals through philanthropy, activism, and ethical business practices, increasingly moving from voluntary to mandatory schemes at various levels.

What Is Corporate Social Responsibility (CSR)? - CSR is a management concept ensuring that a company's daily practices are ethical and beneficial for society, often integrated with environmental, social, and governance (ESG) strategies, influencing both consumer behavior and corporate policies.

What is Corporate Social Responsibility (CSR)? Guide & Examples - CSR represents a company's efforts to improve society through initiatives like donations, volunteer programs, sustainable practices, and diverse hiring, aiming to make a positive social impact while building trust and strengthening brand reputation.

dowidth.com

dowidth.com