Synthetic identity fraud manipulates fabricated personal details to create a fake identity for opening bank accounts and securing loans, exploiting gaps in verification systems. Check kiting involves deliberately using checks from accounts with insufficient funds to fraudulently capitalize on the float time between banks to access and inflate balances. Discover more about how these sophisticated financial crimes impact banking security and prevention strategies.

Why it is important

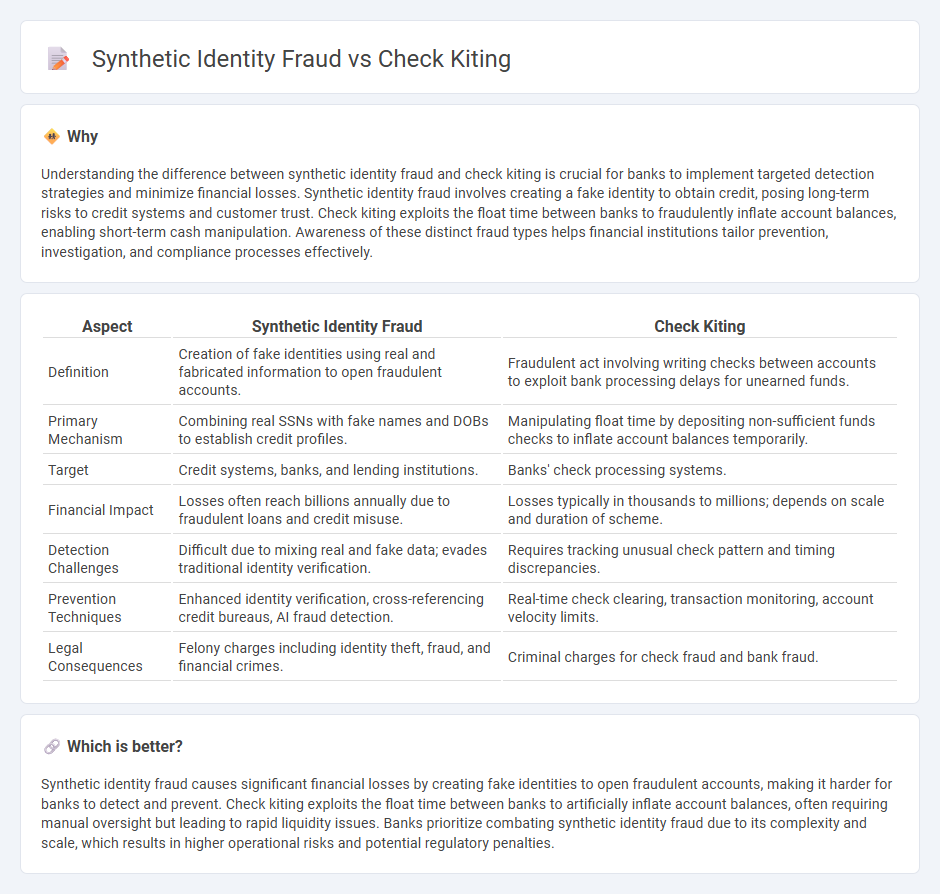

Understanding the difference between synthetic identity fraud and check kiting is crucial for banks to implement targeted detection strategies and minimize financial losses. Synthetic identity fraud involves creating a fake identity to obtain credit, posing long-term risks to credit systems and customer trust. Check kiting exploits the float time between banks to fraudulently inflate account balances, enabling short-term cash manipulation. Awareness of these distinct fraud types helps financial institutions tailor prevention, investigation, and compliance processes effectively.

Comparison Table

| Aspect | Synthetic Identity Fraud | Check Kiting |

|---|---|---|

| Definition | Creation of fake identities using real and fabricated information to open fraudulent accounts. | Fraudulent act involving writing checks between accounts to exploit bank processing delays for unearned funds. |

| Primary Mechanism | Combining real SSNs with fake names and DOBs to establish credit profiles. | Manipulating float time by depositing non-sufficient funds checks to inflate account balances temporarily. |

| Target | Credit systems, banks, and lending institutions. | Banks' check processing systems. |

| Financial Impact | Losses often reach billions annually due to fraudulent loans and credit misuse. | Losses typically in thousands to millions; depends on scale and duration of scheme. |

| Detection Challenges | Difficult due to mixing real and fake data; evades traditional identity verification. | Requires tracking unusual check pattern and timing discrepancies. |

| Prevention Techniques | Enhanced identity verification, cross-referencing credit bureaus, AI fraud detection. | Real-time check clearing, transaction monitoring, account velocity limits. |

| Legal Consequences | Felony charges including identity theft, fraud, and financial crimes. | Criminal charges for check fraud and bank fraud. |

Which is better?

Synthetic identity fraud causes significant financial losses by creating fake identities to open fraudulent accounts, making it harder for banks to detect and prevent. Check kiting exploits the float time between banks to artificially inflate account balances, often requiring manual oversight but leading to rapid liquidity issues. Banks prioritize combating synthetic identity fraud due to its complexity and scale, which results in higher operational risks and potential regulatory penalties.

Connection

Synthetic identity fraud and check kiting both exploit banking systems to illegally obtain funds, with synthetic identity fraud creating fictitious profiles to open accounts and check kiting manipulating the float time between banks to illegally increase balances. Synthetic fraudsters may use multiple synthetic identities to orchestrate check kiting schemes, enhancing the scale and complexity of their operations. This connection intensifies risks for financial institutions by combining identity deception with transactional manipulation, complicating fraud detection and prevention efforts.

Key Terms

Float

Kiting fraud exploits the delay between bank deposits and withdrawals, manipulating the float period to artificially inflate account balances. Synthetic identity fraud combines real and fabricated personal information to create new identities, often resulting in prolonged float periods before detection due to initial legitimate credit activity. Explore detailed techniques and detection strategies for these fraud types to better understand risk management.

Account manipulation

Kiting involves exploiting the float time between bank accounts to create artificial balances through rapid, circular fund transfers, manipulating account balances to access unauthorized credit. Synthetic identity fraud fabricates a new persona by combining real and fictitious information, enabling the fraudster to open accounts and manipulate them over time without detection. Discover more about these techniques to enhance fraud prevention strategies.

Fraudulent identity

Kiting involves exploiting timing differences between bank accounts to create artificial balances, while synthetic identity fraud fabricates entirely new personas using a mix of real and fake information to commit financial crimes. Both methods rely on fraudulent identity manipulation, but synthetic identity fraud typically results in prolonged, large-scale financial damage as perpetrators build credit profiles to exploit. Explore further to understand detection techniques and prevention strategies in combating these complex fraud types.

Source and External Links

What Is Check Kiting? Explained with Examples - Chime - Check kiting is a type of illegal check fraud where someone writes checks for more than their account balance and deposits them into different accounts, exploiting the time it takes for checks to clear to gain unauthorized access to funds or interest.

check-kiting | Wex | US Law | LII - Check kiting is the fraudulent act of tricking two or more banks into inflating account balances by writing checks from insufficiently funded accounts and depositing them into other accounts, effectively creating unauthorized, unsecured loans, and it is punishable under federal and state laws.

Check Kiting in the Digital Age - NICE Actimize - Modern check kiting involves sophisticated fraud schemes that exploit timing gaps in check processing, and financial institutions use advanced analytics and machine learning to detect and prevent this type of fraud.

dowidth.com

dowidth.com