Alternative data lending leverages non-traditional information such as utility payments, social media activity, and transaction history to assess creditworthiness, providing access to credit for individuals lacking conventional credit profiles. Collateral-based lending requires borrowers to pledge assets like property or vehicles to secure loans, reducing lender risk but limiting access for those without valuable assets. Explore how these lending methods transform financial inclusion and risk management in lending practices.

Why it is important

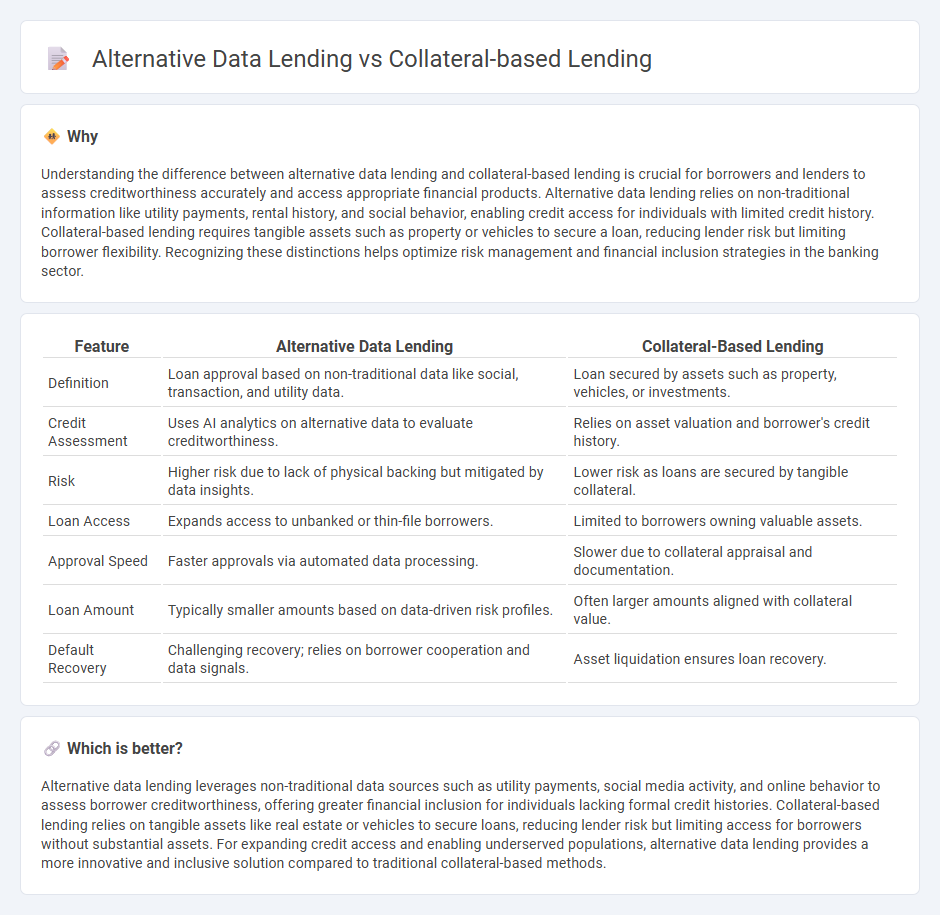

Understanding the difference between alternative data lending and collateral-based lending is crucial for borrowers and lenders to assess creditworthiness accurately and access appropriate financial products. Alternative data lending relies on non-traditional information like utility payments, rental history, and social behavior, enabling credit access for individuals with limited credit history. Collateral-based lending requires tangible assets such as property or vehicles to secure a loan, reducing lender risk but limiting borrower flexibility. Recognizing these distinctions helps optimize risk management and financial inclusion strategies in the banking sector.

Comparison Table

| Feature | Alternative Data Lending | Collateral-Based Lending |

|---|---|---|

| Definition | Loan approval based on non-traditional data like social, transaction, and utility data. | Loan secured by assets such as property, vehicles, or investments. |

| Credit Assessment | Uses AI analytics on alternative data to evaluate creditworthiness. | Relies on asset valuation and borrower's credit history. |

| Risk | Higher risk due to lack of physical backing but mitigated by data insights. | Lower risk as loans are secured by tangible collateral. |

| Loan Access | Expands access to unbanked or thin-file borrowers. | Limited to borrowers owning valuable assets. |

| Approval Speed | Faster approvals via automated data processing. | Slower due to collateral appraisal and documentation. |

| Loan Amount | Typically smaller amounts based on data-driven risk profiles. | Often larger amounts aligned with collateral value. |

| Default Recovery | Challenging recovery; relies on borrower cooperation and data signals. | Asset liquidation ensures loan recovery. |

Which is better?

Alternative data lending leverages non-traditional data sources such as utility payments, social media activity, and online behavior to assess borrower creditworthiness, offering greater financial inclusion for individuals lacking formal credit histories. Collateral-based lending relies on tangible assets like real estate or vehicles to secure loans, reducing lender risk but limiting access for borrowers without substantial assets. For expanding credit access and enabling underserved populations, alternative data lending provides a more innovative and inclusive solution compared to traditional collateral-based methods.

Connection

Alternative data lending and collateral-based lending intersect by enhancing credit risk assessment through diversified data inputs and tangible asset valuation. Lenders utilize alternative data such as utility payments, online behavior, and social media activity to evaluate borrowers lacking traditional credit histories, complementing collateral appraisal methods that secure loans with physical or financial assets. This integrated approach improves loan accessibility and risk management in banking by broadening borrower profiles while ensuring repayment assurance via collateral.

Key Terms

Secured Loan (collateral-based lending)

Secured loans leverage tangible assets such as real estate, vehicles, or equipment as collateral, offering lenders reduced risk and borrowers often lower interest rates compared to unsecured options. Alternative data lending utilizes non-traditional credit information like utility payments and online behavior to assess creditworthiness, expanding access for those with limited credit history. Explore the key differences to determine which lending solution fits your financial needs best.

Credit Scoring Models (alternative data lending)

Collateral-based lending relies primarily on physical assets like real estate or equipment to secure loans, emphasizing asset valuation and liquidation risk in its credit scoring models. Alternative data lending leverages non-traditional data sources such as utility payments, social media activity, and transaction history to assess creditworthiness, offering enhanced predictive accuracy for underserved borrowers. Explore more to understand how alternative data transforms credit scoring and expands lending opportunities.

Asset Valuation (collateral-based lending)

Collateral-based lending prioritizes asset valuation by assessing the market value and liquidity of tangible assets like real estate, machinery, or inventory to secure loans. This traditional approach relies on appraisals and historical data to mitigate lender risk through a clear collateral framework. Explore in-depth comparisons to understand which lending method suits your financial strategy best.

Source and External Links

Collateral (finance) - Wikipedia - In lending agreements, collateral is a borrower's pledge of specific property to a lender to secure repayment of a loan, reducing the lender's risk and often leading to lower interest rates for the borrower.

What Are Collateral Loans and How Do They Work? | LendingTree - A collateral loan is a secured debt backed by a valuable asset, such as a car or home, which the lender can seize if the borrower fails to repay, making these loans accessible even to those with poor or limited credit.

Collateral Loans: A Guide to Asset-Based Lending | Credibly - Collateral loans require borrowers to pledge assets like real estate, equipment, or inventory as security, allowing lenders to seize and sell the collateral if the loan is not repaid, commonly used by businesses to secure financing.

dowidth.com

dowidth.com