Personal financial management tools help individuals budget, track expenses, and optimize savings through user-friendly interfaces and real-time financial data integration. Fraud detection solutions leverage machine learning algorithms and behavioral analytics to identify and prevent unauthorized transactions, minimizing financial risk. Explore how these technologies transform banking security and personal finance management.

Why it is important

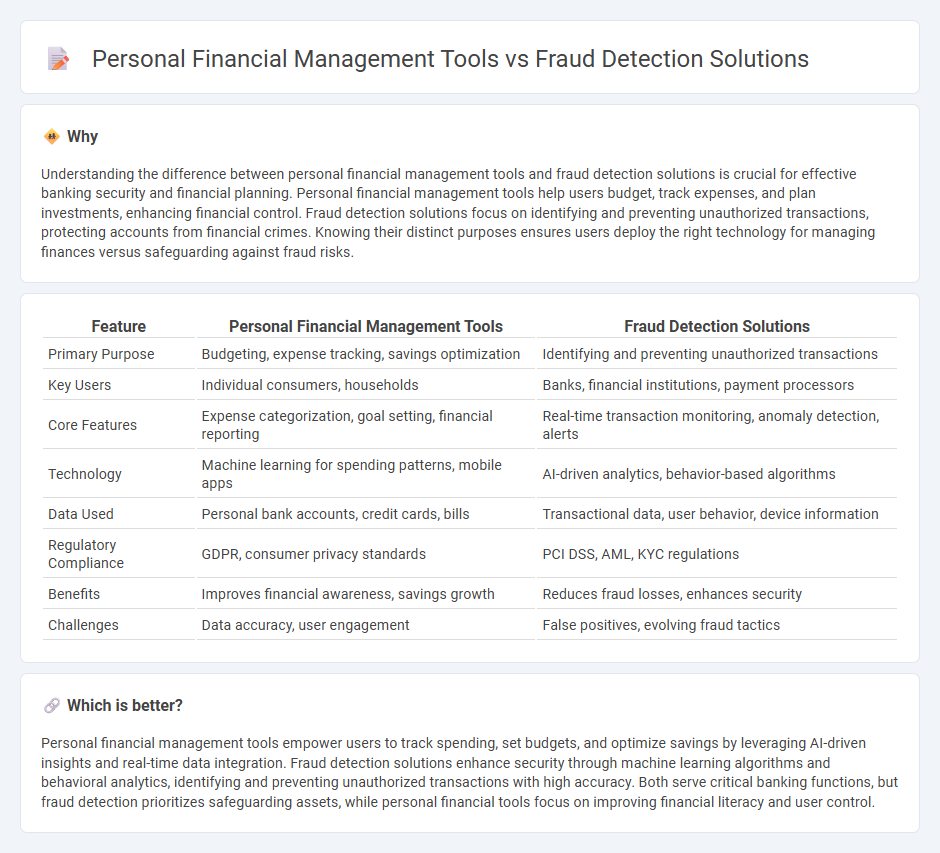

Understanding the difference between personal financial management tools and fraud detection solutions is crucial for effective banking security and financial planning. Personal financial management tools help users budget, track expenses, and plan investments, enhancing financial control. Fraud detection solutions focus on identifying and preventing unauthorized transactions, protecting accounts from financial crimes. Knowing their distinct purposes ensures users deploy the right technology for managing finances versus safeguarding against fraud risks.

Comparison Table

| Feature | Personal Financial Management Tools | Fraud Detection Solutions |

|---|---|---|

| Primary Purpose | Budgeting, expense tracking, savings optimization | Identifying and preventing unauthorized transactions |

| Key Users | Individual consumers, households | Banks, financial institutions, payment processors |

| Core Features | Expense categorization, goal setting, financial reporting | Real-time transaction monitoring, anomaly detection, alerts |

| Technology | Machine learning for spending patterns, mobile apps | AI-driven analytics, behavior-based algorithms |

| Data Used | Personal bank accounts, credit cards, bills | Transactional data, user behavior, device information |

| Regulatory Compliance | GDPR, consumer privacy standards | PCI DSS, AML, KYC regulations |

| Benefits | Improves financial awareness, savings growth | Reduces fraud losses, enhances security |

| Challenges | Data accuracy, user engagement | False positives, evolving fraud tactics |

Which is better?

Personal financial management tools empower users to track spending, set budgets, and optimize savings by leveraging AI-driven insights and real-time data integration. Fraud detection solutions enhance security through machine learning algorithms and behavioral analytics, identifying and preventing unauthorized transactions with high accuracy. Both serve critical banking functions, but fraud detection prioritizes safeguarding assets, while personal financial tools focus on improving financial literacy and user control.

Connection

Personal financial management tools integrate advanced fraud detection solutions by analyzing transaction patterns and alerting users to suspicious activities in real time. These tools leverage machine learning algorithms and behavioral analytics to enhance security while providing users with insights into their spending habits and credit health. The synergy between financial management and fraud detection increases trust and safeguards assets, making banking experiences safer and more efficient.

Key Terms

**Fraud Detection Solutions:**

Fraud detection solutions leverage advanced algorithms, machine learning, and real-time transaction monitoring to identify and prevent suspicious activities, safeguarding financial assets from unauthorized access and cyber threats. These systems utilize behavioral analytics and anomaly detection to provide rapid alerts and reduce fraud-related losses for both consumers and financial institutions. Explore how cutting-edge fraud detection technologies are transforming security in the fintech landscape.

Transaction Monitoring

Fraud detection solutions leverage advanced algorithms and machine learning to analyze transaction patterns and detect anomalies that indicate fraudulent activity, ensuring real-time protection against unauthorized access or suspicious transactions. Personal financial management tools focus on transaction monitoring to provide users with insights into spending habits and budget adherence by categorizing and tracking expenses automatically. Discover how these technologies transform financial security and user experience by exploring their key features and benefits.

Anomaly Detection

Fraud detection solutions leverage advanced anomaly detection algorithms to identify irregular patterns in transaction data, protecting users from unauthorized activities and financial losses. Personal financial management tools also use anomaly detection but focus on highlighting unusual spending behaviors to help users improve budgeting and financial planning. Explore how anomaly detection differentiates these technologies to enhance both security and personal financial insight.

Source and External Links

13 Best fraud detection software solutions in 2024 - Salv - Features top fraud detection platforms like Salv Bridge, which enhances real-time fraud recovery collaboration across institutions, and Mastercard Consumer Fraud Risk that uses AI to identify scams before funds leave accounts.

SAS Fraud Management & Fraud Detection Software - Offers an end-to-end solution integrating machine learning and analytics to detect fraud across multiple channels with fast, scalable real-time transaction scoring and reduced false positives for better customer experience.

How Fraud Detection Works: Common Software and Tools | F5 - Describes AI and machine learning-based fraud detection powered by vast real-time telemetry, behavioral analytics, and adaptive models aimed at high fraud detection accuracy across online and e-commerce environments.

dowidth.com

dowidth.com