Debt recycling involves strategically converting non-deductible home loan debt into tax-deductible investment loan debt to enhance wealth accumulation. Investment loans are borrowed funds used specifically for investment purposes, typically offering tax advantages on interest repayments. Explore how these financial strategies can optimize your borrowing and investment goals.

Why it is important

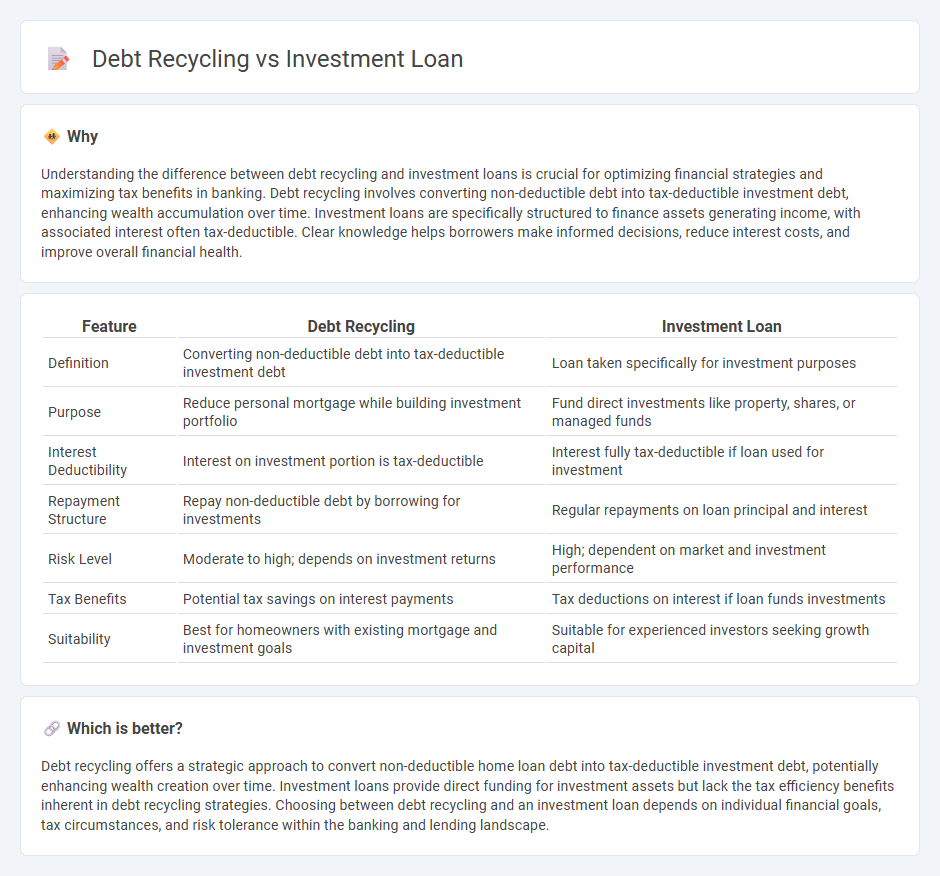

Understanding the difference between debt recycling and investment loans is crucial for optimizing financial strategies and maximizing tax benefits in banking. Debt recycling involves converting non-deductible debt into tax-deductible investment debt, enhancing wealth accumulation over time. Investment loans are specifically structured to finance assets generating income, with associated interest often tax-deductible. Clear knowledge helps borrowers make informed decisions, reduce interest costs, and improve overall financial health.

Comparison Table

| Feature | Debt Recycling | Investment Loan |

|---|---|---|

| Definition | Converting non-deductible debt into tax-deductible investment debt | Loan taken specifically for investment purposes |

| Purpose | Reduce personal mortgage while building investment portfolio | Fund direct investments like property, shares, or managed funds |

| Interest Deductibility | Interest on investment portion is tax-deductible | Interest fully tax-deductible if loan used for investment |

| Repayment Structure | Repay non-deductible debt by borrowing for investments | Regular repayments on loan principal and interest |

| Risk Level | Moderate to high; depends on investment returns | High; dependent on market and investment performance |

| Tax Benefits | Potential tax savings on interest payments | Tax deductions on interest if loan funds investments |

| Suitability | Best for homeowners with existing mortgage and investment goals | Suitable for experienced investors seeking growth capital |

Which is better?

Debt recycling offers a strategic approach to convert non-deductible home loan debt into tax-deductible investment debt, potentially enhancing wealth creation over time. Investment loans provide direct funding for investment assets but lack the tax efficiency benefits inherent in debt recycling strategies. Choosing between debt recycling and an investment loan depends on individual financial goals, tax circumstances, and risk tolerance within the banking and lending landscape.

Connection

Debt recycling involves converting non-deductible mortgage debt into tax-deductible investment loans by systematically using home equity to invest in income-generating assets. Investment loans leverage borrowed funds to acquire assets that generate returns, which can be used to pay down existing mortgage debt, enhancing wealth-building potential. This strategy optimizes cash flow by recycling debt from non-deductible to deductible, maximizing tax benefits and accelerating loan repayment.

Key Terms

Leverage

Investment loans increase leverage by allowing borrowers to access funds specifically for investment purposes, amplifying both potential returns and risks. Debt recycling involves converting non-deductible debt into tax-deductible investment loans, strategically leveraging home equity to optimize tax benefits and grow wealth. Explore detailed comparisons to understand which leverage strategy aligns best with your financial goals.

Interest deductibility

Interest deductibility plays a crucial role in distinguishing investment loans from debt recycling strategies, with investment loans typically allowing full tax deductibility on interest if the borrowed funds are used solely for income-producing purposes. Debt recycling involves converting non-deductible personal debt into tax-deductible investment debt, effectively maximizing interest deductions while building an investment portfolio. Explore more about how leveraging interest deductibility benefits your financial planning and tax strategies.

Cash flow

Investment loans often require regular principal and interest repayments, impacting cash flow by increasing monthly outgoings. Debt recycling leverages existing equity to convert non-deductible debt into tax-deductible investment loans, potentially improving cash flow through tax benefits and accelerated wealth building. Explore how strategic debt recycling can optimize your cash flow and investment portfolio.

Source and External Links

Investment Property Loans - Eligibility, Benefits & Apply - Pennymac - Investment property loans require strong financial standing, a minimum down payment of 15-25%, good credit, cash reserves for six months and proof of steady income to help finance single-family or multi-unit rental properties.

Investment Property Loan Guide | 2025 Guidelines and Process - Main financing options for investment properties include conforming loans, jumbo loans, and government-backed loans (only if you occupy one unit), with alternatives like home equity loans, private loans, and hard money loans also available.

Investment property loans: What are they and what are your options? - Investment property loans finance income-producing properties and come with stricter requirements than owner-occupied homes, including higher down payments, credit scores, and cash reserves, while some investors may live in one unit of a multi-unit property to qualify under primary residence guidelines.

dowidth.com

dowidth.com